Risk management

Regulation, liquidity and risk management strategies

US derivatives regulation is likely to have far-reaching consequences for energy companies, but how will it affect the liquidity risk management strategies developed in the wake of collateral management events of the past decade? Pauline McCallion reports

Total eyes growing Asia and China energy market

French energy giant Total takes a large stake in an Australian liquefied natural gas (LNG) project with an eye to growing energy demand from Asia and China

BNP Paribas reshuffles global equities and commodities derivatives business

French bank BNP Paribas has reshuffled its global equity and commodity derivatives (GECD) business units and says there are no job losses

EDHEC-Risk slams France on commodity derivatives regulation

Influential risk management and analytics business school, the EDHEC-Risk Institute, has criticised France for its hardline approach to commodity derivatives market regulation on lack of evidence

Trading positions - September 2010

Energy Risk catches up with the latest appointments, promotions and departures in global commodity markets

Brokers establish own carbon trading risk tests

Carbon brokers establish their own checks for assessing counterparty risk, following European market authorities’ failure to react to a spate of carbon market fraud.

BP’s Gulf of Mexico oil spill will not push fuel switching

Experts quash fears that tighter restrictions following BP’s Gulf of Mexico oil spill will result in oil to gas fuel switching in the US, thus pushing up gas prices

End-users adopt more complex hedging tools and methods

End-users’ energy and commodities hedging strategies are growing in sophistication as they adopt more complex products and non-traditional tools, says the head of RWE npower’s optimisation desk

Forward planning at M&S

As a high profile global retail chain, Marks & Spencer faces regular public scrutiny over its energy use and is well known for championing its ‘green’ image. Katie Holliday talks to Mervyn Bowden, head of energy management, about how M&S manages its…

Nigerian political stability boosts oil production

Nigeria’s crude oil production is on the up, after geopolitical stability hints at consistent growth, says the NNPC

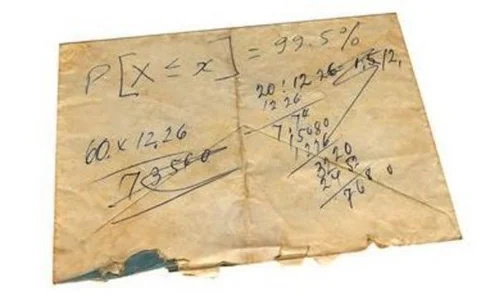

NATS saves £1.7 million in hedging programme

Major end-user NATS saved £1.7 million after installing a new hedging strategy and energy risk management programme

BP’s oil spill to double energy companies’ IT spend

The aftermath of BP’s Gulf of Mexico oil spill could double the amount energy companies will spend on information technology (IT) as they look to adhere to new regulatory requirements in offshore drilling pursuits

Effective monitoring for energy trading behaviours of interest

The webinar discusses perspectives, ideas and actionable steps to help optimise firms' approaches to energy trade surveillance, assess and respond to new compliance demands driven by regulators or internal policies.

Challenges for energy & commodities technology

Trayport chief speaks to Lianna Brinded about how energy and commodities trading risk management systems will cope with changes in regulation

Q&A: Shell Gas Direct’s Mike Hogg

With major industrial and commercial end users bearing the brunt of global regulatory changes and more stringent carbon emissions requirements, Shell Gas Direct’s Mike Hogg speaks to Lianna Brinded how he sees the future and what companies can do to…

Q&A: Wayne Mitchell, head of corporate sales, npower

End users have increasingly wised up to the range of financial products and methods available to manage their energy risk. Wayne Mitchell, head of corporate sales at UK energy company npower, tells Lianna Brinded about changing end user risk management…

Statoil stung by hedging derivatives losses

Norwegian oil and gas giant Statoil's results are hit by major losses on hedging derivatives in spite of a rise in profits and production

BP oil spill to boost alternative energy - fund manager

The fallout from BP's Gulf of Mexico oil spill will act as a boost for the alternative energy sector, says exchange-traded fund manager ETF Securities.

Commodities ‘financialisation’ worries end-users

With recent statistics showing an increasing number of financial institutions jumping into commodities, Lianna Brinded investigates whether this will cause more risks to end-users

Trading positions – August 2010

Energy Risk catches up with the latest appointments, promotions and departures in global commodity markets

Getting more control with bespoke technology

Playing a role in the development of a bespoke technology solution gives energy traders and risk managers more control over how they perform their daily duties, according to experts. Pauline McCallion finds out more

The pressure builds for more market standardisation

With the market standardisation of energy and commodities contracts still falling behind more traditional asset classes, Lianna Brinded asks if this is a crucial step for the energy sector