Power

Power market design leads traders to take advantage

The design of modern power pools is highly complex, creating plenty of opportunities for clever traders to profit by circumventing the rules, writes Vincent Kaminski

Uncertainty rules in Australian electricity derivatives market

Australia's electricity derivatives market had been picking up since the global financial crisis, but volumes have declined in recent years. Firms blame the slowdown on a combination of slim trading opportunities and uncertainty over plans to curb…

US power hedging suffers from low prices

Low power prices have dented the need for electricity producers and consumers to hedge with derivatives, while regulatory reform is also making life difficult for market-makers. But market participants are optimistic the trend could be reversed. Pauline…

US power traders expect rebound in hedging activity

Power hedging activity could increase with rising prices and greater regional variation across the US

Turning points: Torsten Amelung, Statkraft

As the proportion of power generated from renewables goes up, the business model of traditional utilities is increasingly under threat, says Torsten Amelung, Statkraft’s senior vice-president of trading, origination and business development. He speaks to…

Renewables push proves challenging for Germany

An abundance of renewables capacity in Germany has caused extreme price movements, pushing volatility and trading activity increasingly towards short-term markets – forcing physical and financial market players to rethink their approach to electricity…

South Korean power outage fears loom high on agenda

A lack of investment in generation capacity and safety-related nuclear shutdowns left South Korea facing warnings of severe power shortages over the past year. That is putting investment in energy infrastructure and security of supply high on the…

NWE power market coupling struck by delays

The European Union’s biggest power market coupling project to date has been beset by delays and will not now be be completed before the end of 2013. What is behind the setbacks and what do they mean for continuing efforts to forge a pan-European…

Hunter ruling may slow Ferc’s anti-manipulation push

A court decides the US Federal Energy Regulatory Commission overstepped its authority in trying to prosecute manipulation in natural gas futures - a ruling with implications for other cases

'Uneconomic trading' at issue in Barclays power dispute

Barclays seeks to defend itself against power market manipulation allegations by contesting regulator’s pursuit of uneconomic trading

Firms shy away from public utilities despite CFTC relief

No-action letter not enough to convince counterparties to trade with public utilities

Influx into Italian electricity

Interest in Italian power trading has picked up lately, according to market participants. Nonetheless, the market remains dogged by challenges, including a lack of exchange liquidity and excess supply in the midst of an economic slump. Gillian Carr…

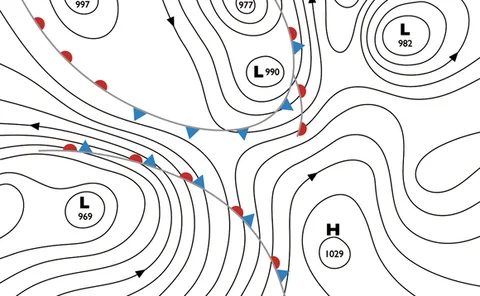

Energy firms tune in to weather forecasts

As weather forecasting becomes more accurate, utilities and banks are increasingly turning to it – not only to predict power and gas demand – but also to find arbitrage opportunities, writes Gillian Carr

Is risk modelling keeping up with the energy market?

Lean times in energy and commodity derivatives trading have caused a cutback in the amount of time and resources spent on energy risk modelling – a worrying trend that could leave firms unprepared for future market challenges, argue some experts. Mark…

Energy Risk Europe 2012: EU power market integration faces next set of hurdles

The next stages of creating an integrated European electricity market should focus on the intra-day market, direct current cables and preparing trading strategies post-2014, say panellists at Energy Risk Europe

Power and utilities M&A declines in volume but grows in value: Ernst & Young

Slow global economic recovery led to weak M&A activity in the global power and utilities sector in the first quarter of 2012, but deal value increased almost 20% from the previous quarter

Energy Risk USA: Storms, warm winter, fuel interest in weather derivatives

The extreme weather that hit North America recently has spurred interest in tools designed to hedge weather risk, according to participants speaking at Energy Risk USA

Research report outlines scope for Saarc power trading

Power trading across the Indian subcontinent is set to grow in size and interconnectivity, according to a GBI Research report

European power market series: Iberia

Liquidity in the Iberian power market has been on the rise thanks to market coupling and a move away from fixed tariffs, but uncertainty around government intervention and a lack of interconnection with the rest of Europe remain huge obstacles to…

German power market outlook

This month marks the one-year anniversary of Germany announcing its intention to abandon nuclear power. Since then a number of fundamental shifts have occurred in the German power market, which are expected to impact prices during the year. Jay Maroo…

Sponsored statement: APX-ENDEX

With more than 15 years of experience in energy trading in the UK, Derek Abernethy was appointed commercial director UK of APX-ENDEX in February this year. He discusses the developments of the UK power market and how APX-ENDEX is responding to these…