People

CGE Power falls as banks demand cash

CGE Power, the bank consortium formed to acquire distressed UK power assets, has withdrawn offers totalling around £3 billion on 12 plants and ceased trading after proposals to acquire two key power plants were rejected by lenders, according to a…

KWI hires SVP of operations

KWI, the London-based provider of trading and risk management software for the energy industry, today announced the appointment of Alan Somerville as senior vice president (SVP) of operations.

FOA close to releasing UK power trading guidelines

The UK Futures and Options Association (FOA) says it is close to releasing final drafts of guidelines on various areas of the UK power market. The problem areas identified by the FOA's Power Trading Forum (PTF) are reference pricing, credit risk…

Broker Prebon hires Innogy coal trader

London-based broker Prebon may have failed in its bid to lure three coal traders from fellow broker Icap, but it is continuing to build a coal team. In mid-May, Sharon Millar, who previously traded paper and physical coal at UK utility RWE Innogy, joined…

Prebon sets up coal desk

London-based broker Prebon may have failed in its bid to lure three coal traders from fellow broker Icap, but it is continuing to build a coal team. In mid-May, Sharon Millar, who previously traded paper and physical coal at UK utility RWE Innogy, joined…

ESB wins Esso price battle

Esso and Ireland’s Electricity Supply Board entered into a seemingly straightforward15-year contract for the sale and purchase of natural gas in 1999. But the contracthas raised the issue of how to define ‘market price’. By James Ockenden

Icap will not pay Prebon’s £2m damage claim

Icap has no intention of recognising rival broker Prebon’s £2 million claim for damages after a dispute over the employment of three Icap coal brokers, according to its director of corporate affairs Mike Sheard.

ESB wins Esso price battle

A high court judge has rejected claims by Esso it should be allowed to raise the price of gas supplied to Ireland’s Electricity Supply Board (ESB) on the basis of prices reported in the Heren Report .

De Vitry elected to Isda board

Benoit de Vitry, London-based global head of commodities and emerging markets rates at Barclays Capital, has been elected to the board of the International Swaps and Derivatives Association (Isda).

Statoil and Alex Kvaerner swap chief executives

Helge Lund has joined Norwegian energy company Statoil as chief executive, replacing acting CEO Inge Hansen. Hansen replaces Lund as CEO of one of three divisions of newly restructured Norwegian industrial group Aker Kvaerner.

Bank of America settles for $17.85m in weather derivatives lawsuit

For four years, Bank of America has been seeking recompense for a weather derivatives deal written by the now-defunct CWWIA. Finally, the bank has settled its case. By Paul Lyon

Ex-Merrill Lynch energy trader pleads guilty to fraud

At 24, Daniel Gordon headed Merrill Lynch’s energy trading business. He has now pleaded guilty to a $43 million fraud. Paul Lyon reports

Banks grab distressed UK assets

Six European banks intend to buy around 10GW of distressed UK power assets usingfinancial instruments. But their main rival, MMC, says hard cash is needed towin the UK market. By James Ockenden

FirstEnergy to blame for US blackout, say reports

Utilities in Ohio – chiefly FirstEnergy – were at fault for the US blackout in August, conclude separate reports from a US-Canadian task force and Michigan regulators. But the midwest system operator does not escape blame. By Joe Marsh

Creative challenges in customer-driven risk management

Shell Trading’s Ken Gustafson and Jemmina Gualy shed light on the environment in North America for customers and dealers in risk management, and look at the opportunities ahead for the business

Weathering the problems

Weather derivatives can reduce or eliminate the potential economic disastersthat extreme weather can provoke. Ross McIntyre of Deutsche Bank examines thevarious ways in which weather can affect key industries and reviews the benefitsof weather derivatives

Standing out from the crowd

Credit risk management groups can differentiate themselves from their competitors through their different capabilities. Randy Baker and Brett Humphreys explain how

Cross-border conundrums

Analysts at rating agency Standard & Poor’s Lee Munden and Paul Lund look at the future of cross-border trading in Europe, given the credit crises of 2002

Bearing the brunt

Building contractor bankruptcies of have recently stressed the credit profiles of several power projects in the US. Standard & Poor’s Scott Taylor and Tobias Hsieh look at how sponsors and lenders responded and the effects on the various parties

Ahead of the green game

Given the efforts they have already made to reduce emissions, many German firms do not share their environment minister’s enthusiasm for the EU’s new, obligatory cross-border greenhouse gas emissions trading market. Jessica McCallin reports

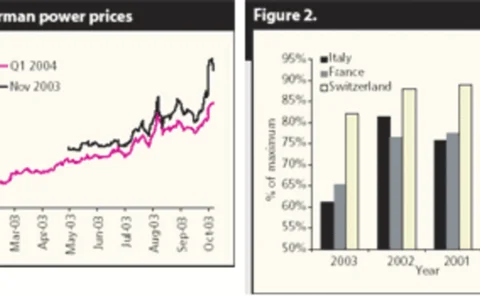

The bigger they come…

The German market is at the heart of the European power business, but it has stuttered since its early promise, and has yet to set the pace for the region as a whole. From a new entrant’s point of view, this is only to be welcomed, argues Ben Tait

Judicial stalemate

German natural gas market liberalisation is stalled between the courts and a corporatist business culture, finds Maria Kielmas

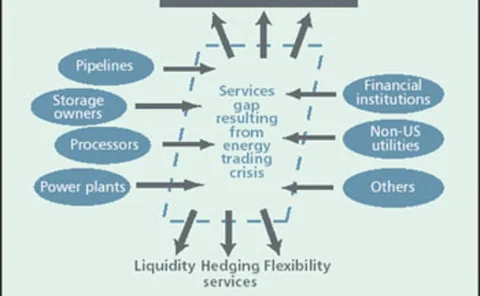

Who is left to manage risk?

The exodus of energy trading companies from the market has created a gap in managing risk. David Johnson and Ross Warriner of Protiviti report