Operational risk

China Aviation Oil chief arrested

Chen Jiulin, the suspended chief executive of China Aviation Oil, has been arrested on his return to Singapore early Wednesday as investigations begin into the company’s huge trading losses.

Mirant settles price-reporting charges

A subsidiary of Atlanta-based energy company Mirant has settled charges with the US Commodity Futures Trading Commission (CFTC) of false reporting of natural gas prices. The commission found that Mirant Americas Energy Marketing (MAEM) traders made false…

Ten years of trading

As an analyst and software designer who has spent the past ten years working closely with energy markets, Sandy Fielden had no problem identifying what had the most impact on his world in that time – technology. A regular Energy Risk contributor for some…

The famous fifty

To celebrate Energy Risk’s 10th birthday, we have created the Energy Risk Hall of Fame: a group of individuals whose commitment and contribution to energy markets makes them a foundation of this business. Introduced by James Ockenden

Trading techniques

Merchant generators make daily decisions on how to get the most from their assets.How much capacity should be sold in the day-ahead market and how much shouldbe set aside for the hourly market are seldom-studied but thorny questions. ShulangChen looks at…

Trading techniques

A majority of merchant power plants built during the last few years in the US are combined-cycle units fired by natural gas. This article discusses asset-backed trading strategies for a merchant single-block power plant, showing how unit dispatches can…

Changing of the guard

Changes to the European gas market may further attract financial players, and tighten the rules in case of physical supply disruptions. Meanwhile changes in the UK gas market may lead to clearing at the hub. By James Ockenden

Getting physical

Asset-backed trading strategies usually employ a combination of physicalpositions, which are subject to physical risk; and financial hedgingintruments, which are not. Here, Steve Leppard shows how value-at-risk,applied to this combined risk scenario, can…

China Aviation Oil hid US$390m derivative loss in struggle to survive

China Aviation Oil’s trading unit, China Aviation Oil (Singapore) Corp (CAOSCO) hid an initial US$390 million loss while its directors sought “white knights” to save it from liquidation, it emerged yesterday as the company announced an estimated US$550…

Calpine trades up

US power company Calpine installed a new trading floor this year due both to its own growth and its aim to provide more companies with energy services. Joe Marsh reports

Volatility conspiracy

The concept of volatility is universally used by quantitative analysts. But is it a concrete idea or a false friend? And does it even exist? Energy quant Neil Palmer takes a look at its mysteries

Oiling the wheels

Bribery and corruption is a hot topic, not least in the energy sector. Energy Risk this month looks at recent high-profile cases and what governments are doing to combat the problem. By Daren Allen and Kelly Williams

Saudi to up oil output to 12.5 million b/d

Saudi Arabia’s total oil production capacity is now at 11 million barrels a day (b/d) and plans are in place to increase it to 12.5 million b/d, Saudi Arabia’s Minister of Petroleum and Mineral Resources, Mr Ali Al-Naimi, said Monday.

IPE members approved to trade on Ice OTC markets

The International Petroleum Exchange’s (IPE) registered brokers and local traders can now trade on IntercontinentalExchange’s (Ice) over-the-counter markets for their own accounts.

BP pays $100,000 to settle wash trading charges

The energy round-trip trading scandal continues to rumble on, as BP America today paid $100,000 to the US Commodity Futures Trading Commission (CFTC) to settle charges of illegal wash trading. A wash or round-trip trade is one that produces neither a…

California ISO gets tough on generators with new software

Power suppliers in California will face financial penalties if they deviate from pre-specified generation levels as of December 1. This is one of the main changes brought in by a new software system implemented by the California independent system…

Taking cover

US energy companies are increasingly taking out terrorism cover, even though none has yet made a claim. This is partly because the cost of policy premiums is falling. But this trend may be under threat. Joe Marsh reports

Kinder Morgan to buy more refined products terminals

US pipeline operator Kinder Morgan Energy Partners is to buy nine refined-products terminals from Georgia-based Charter Terminal Company and Charter-Triad Terminals for $75 million in cash and assumed liabilities. The deal is expected to close later this…

Nymex ends open-outcry trading of PJM monthly power futures

The New York Mercantile Exchange (Nymex) will move daytime trading of the PJM monthly electricity futures contract to ClearPort, its internet-based system, from the open-outcry trading floor on November 1.

Pemex signs up to OpenLink’s Endur

Mexican state-owned petroleum company Petroleos Mexicanos (Pemex) has licensed OpenLink’s Endur energy trading and risk management system for its natural gas division.

Pemex signs for OpenLink’s Endur

Mexican state-owned petroleum company Petroleos Mexicanos (Pemex) has licensed OpenLink’s Endur energy trading and risk management system for its natural gas division.

Atmos Energy gets go-ahead to buy TXU gas ops for $1.9bn

Texas-based natural gas company Atmos Energy is set to buy the gas distribution and pipeline operations of TXU Gas, the largest gas utility in Texas, on October 1. TXU Gas will still exist as part of TXU Corp, a non-regulated retail electricity provider …

DTE Energy Trading opts for Amerex STP solution

DTE Energy Trading, a subsidiary of Detroit-based DTE Energy, has implemented Amerex Energy’s straight-through processing (STP) product, Xcheck - a web-based trade confirmation system that replaces the manual process of generating, transmitting and…

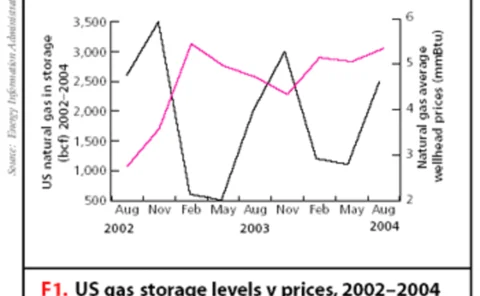

Storing up trouble

Utilities have become active hedgers against today’s high natural gas prices.In recent years, there has been a notable increase in both physical and financialhedging. Catherine Lacoursiere looks at whether storage is still a viable hedge