Operational risk

Deriving storage value

Following an article Energy Risk published in July, TransCanada's Farzan Nathoo looks at how companies can extract value from their natural gas storage assets

Package deals

Banks have been choosing off-the-shelf fully integrated systems for energy trading and risk management. But some feel the available software still falls short

Rights and resources

Doing business in a country with a poor human rights record can be costly, thanks to the changing landscape of corporate liability and human rights. Maria Kielmas reports

OpenLink, Triple Point sign more bank clients

Rival US-based energy trading software suppliers OpenLink and Triple Point Technology (TPT) both signed big new clients this year, increasing their dominance of the energy software market for the banking sector.

Duke Energy to adopt Cinergy trading approach

Following the transfer of its energy derivatives portfolio to Barclays Capital, Duke Energy is targeting a lower-risk trading strategy pioneered by Cinergy, the company it is buying

New GlobalView head makes u-turns on hubs

Contrary to reports in September, new GlobalView chief Steve Gott says he remains committed to the Energy Data Hub and ConfirmHub ventures. Following a management overhaul, it seems it is business as usual

To build or not to build

Europe needs more power. But a lack of clear pricing signals and the unknown impact of new environmental legislation is making risk forecasting difficult, and could hinder new plant construction

BarCap takes on Duke trading book

Barclays Capital will acquire and manage the bulk of Duke Energy North America’s (DENA) power and gas derivatives contracts, as part of parent Duke Energy Corp’s takeover of US utility Cinergy.

Refco raises further concerns

As the Refco bankruptcy case rumbles on, investors are wondering if more could have been done to prevent it, and in future, are likely to seek better assurances over the security of funds in segregated customer accounts

Congestion charges

As the US' premier regional transmission organisation, PJM Interconnection's pricing and transmission congestion models must be foolproof. Sandy Fielden describes how they work and the associated risk management mechanisms available to participants

Francis Van Der Velde

Francis Van Der Velde of Brussels-based Fuel Purchasing & Consulting is more aware than most of the pain airlines are suffering

Marginal improvements

Despite reduced production in the wake of hurricane Katrina, no new US refineries are in the pipeline. Instead, refiners are operating at full tilt as they come under pressure to expand capacity. By Catherine Lacoursiere

Shelter from the storm

Energy companies are showing increased interest in hurricane derivatives, a specialist product that can provide an additional layer of protection on top of insurance. Joe Marsh reports

Finance and faith

Islamic shari’a law may prohibit interest, but far from discouraging investment, shari’a-compliant structured project finance looks set to grow – particularly in the energy arena, as Maria Kielmas reports

Taking the screen test

Screen trading is spreading faster than ever in the energy markets and market dynamics are changing as a result. Do interdealer brokers in the market see this advance as a threat or an opportunity? Stella Farrington finds out

Raising the standard

Growth in energy trading has led to a need for better standardisation of contracts and integration of exchanges and trading hubs. But more needs to be done to simplify and streamline the trading process, says Wolfgang Ferse

LCH.Clearnet launches OTC clearing for freight derivatives

LCH.Clearnet has launched an OTC clearing service for the forward freight agreements (FFAs).

The scandal in Sudan

A fragile peace may at last have come to Sudan after 21years of civil war, but a bitter and unresolved dispute over oil exploration acreage in the south of the country couldendanger that peace. Report by Maria Kielmas

● Accounting standards ● Nordic energy

This month’s Energy Risk debate covers the topical issues of accounting standards, followed by an expert question and answer panel on the influential Nordic energy region

Getting a head-start

North American Energy Credit and Clearing may have gained an advantage by being the first to clear over-the-counter physical electricity contracts. But it still has to prove that it is reliable and efficient. Joe Marsh reports

Evolution expands US west coast emissions brokerage ops

Energy broker Evolution Markets has expanded its environmental market operations for the western US with the hire of Laura Meadors, an expert in environmental market design and analysis. She is based in the San Francisco office, which opened in February…

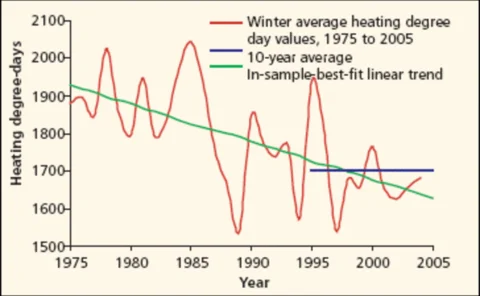

Pricing the weather

Pricing weather derivatives is different from valuing other derivatives contracts – actuarial methods play a greater role. Steve Jewson looks at the varied approaches available

Pipelines and politics

The latest in a long line of disputes over natural gas supplies from Russia is raising concern among utility customers and investors that future supplies to the West may be disrupted. But is this a long-term problem? Oliver Holtaway reports