Operational risk

Delivering the goods

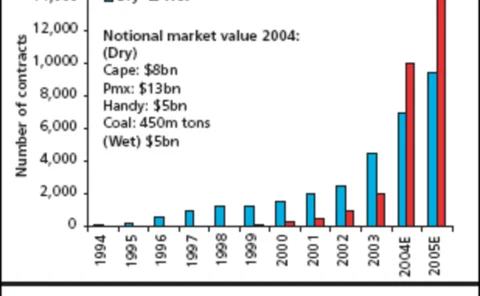

There’s huge scope for growth in the freight derivatives market, but to attract more players, existing participants need to adopt more innovative and sophisticated trading practices, participants say. Stella Farrington reports

In pole position

Sakonnet’s Thurstan Bannister says a sound footing in risk management and a customer-facing approach is the secret of his company’s success. By Stella Farrington

Francois-Xavier Saint Macary

It can’t be easy hauling a whole commodities division overseas, but SG CIB veteran Francois-Xavier Saint Macary has big ambitions. By Oliver Holtaway

Keep it simple, stupid

Do you prefer sophistication or simplicity? Neil Palmer takes a look at optimisation methods in energy modelling and asks if energy quants aren’t sometimes being a little too heavy-handed

Belgian power exchange to launch early 2006

The Belgian day-ahead electricity market is due to start in early 2006 on the Belgian power exchange (Belpex) in a link-up with Dutch power exchange APX and French energy exchange Powernext. This is the first time three power exchanges will be linked…

Some brokers taking wrong approach to freight, says senior broker

Inter-dealer brokers could be taking the wrong approach by entering the freight derivatives market through joint ventures with physical shipping brokers rather than directly broking physical freight, says a senior energy broker.

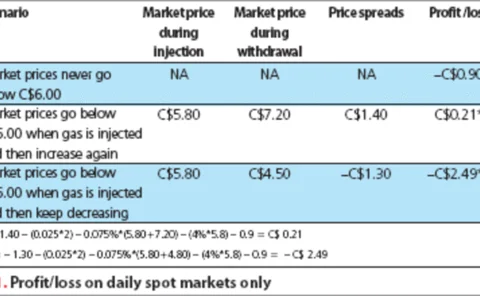

Storage strategies

Companies are increasingly realising they can use natural gas storage to add value to their bottom line. TransCanada’s Farzan Nathoo weighs up the strategies available for optimising value through storage

The technology trap

Large banks are increasingly looking to energy trading to improve liquidity and develop relationships with large institutional and industrial clients. James Kemp looks at some of the technological challenges they face

Checking outside the box

Companies often use checklists to evaluate their IT buying requirements. But these rarely address what the firm actually needs. Brett Humphreys discusses how over-reliance on checklists may lead to poor software buying decisions

Making a connection

Addressing both sophisticated multi-asset trading and physical asset optimisation – while complying with stringent new regulation – are challenges few software firms claim to have the entire solution to. Oliver Holtaway reports

Risk-adjusted planning

An energy firm’s economic performance can be highly affected by incorrect valuation of implied economic risk. For this reason it is essential to provide management with the correct risk assessment tools. Here we propose a way of introducing risk…

Editor

"With oil prices at record highs, energy is set to remain key in strategic decision making"

The best of all worlds

Thanks to their varying scale, structure and diversity, European organisations often have very different solutions to risk management. But which system is the most effective? In an exclusive to Energy Risk, the European Energy Risk Forum offers a route…

Training the tiger

Derivatives are finally beginning to gain wider acceptance in Taiwan, but senior executives remain wary, associating them with the collapse of Barings and, more recently, China Aviation Oil’s huge trading losses, finds David Hayes

Clearing service launches for physical power in US

North American Energy Credit and Clearing (NECC), the Clearing Corporation (CCorp) and Atlanta-based commodity-trading platform IntercontinentalExchange (Ice) have launched a physical clearing service for the US energy markets.

The clearing challenge

Growing over-the-counter trade in the energy markets, much of it from hedge funds, coupled with exceptional price volatility, could test the current clearing system to the limit, warns independent consultant Chris Cook

The dragon’s revenge

In the second article on the pitfalls of hedging, Neil Palmer considers one of the risks of managing options: dynamic hedging. He shows there is an awful lot that can go wrong in the quest for perfect risk elimination

Valuing interruptus

Managing wholesale spot power price volatility by turning off supply offers a way of reducing price spikes, but measuring the value of such interruptibility involves costly modelling techniques. JK Winsen suggests a simpler alternative

The ABC of PCA

Often, the costs associated with implementing advanced statistical models can outweigh the potential benefits. Brett Humphreys shows how to smooth and speed up choppy simulations using principal components analysis

UK business paying £1bn/year too much for energy

UK businesses are failing to manage energy buying efficiently and as a result are exposed to volatile prices, losing up to £1 billion ($1.81 billion) a year, a new survey has found.

GlobalView technology to support ConfirmHub

US-based GlobalView Software has been chosen as the exclusive technology provider to ConfirmHub, a joint venture by brokers Icap, Amerex Energy and Prebon Energy. ConfirmHub is a post-execution, straight-through processing (STP) trade-confirmation…

Awards

Welcome to the annual Energy Risk awards, celebratingthe talent,innovation and enthusiasm that forms thebackbone of this industry.

Standard challenges

Early signs suggest European energy companies may, like their US counterparts,have problems complying with a new derivatives-accounting standard. But theydo have newguidelines to help interpret the rules. By Joe Marsh

Contract killers

Hidden risks can lurk in unexpected areas – such as the contracting process. Brett Humphreys and Brett Friedman discuss how risk managers must look beyondsimple value-at-risk measures and find other potentially hidden exposures