Hedge funds

Correlation suggests ‘return to normal’ for commodities

Commodities are being increasingly driven by market fundamentals, say analysts, forcing investors to search harder for returns

Skylar’s Perkins sees potential for volatility in US natural gas

Bill Perkins believes rising demand and reduced risk warehousing will create opportunities for natural gas traders: video

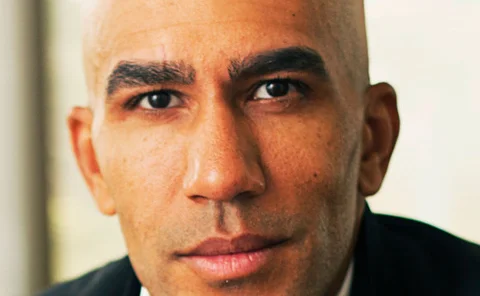

Turning Points: Bill Perkins, Skylar Capital Management

Bill Perkins, founder of Skylar Capital Management, sees opportunities in US natural gas markets, even as depressed prices and low volatility prompt other traders to pull back. Alexander Osipovich reports

Turning points: Frédéric Lasserre, Belaco Capital

Recent years have seen an outflow of commodity derivatives talent from banks towards hedge funds and independent traders. This is the path trodden by Frédéric Lasserre, former head of Société Générale Corporate & Investment Banking’s commodity research…

Q&A: Derren Geiger, chief operating officer of Caritas Royalty Funds

Derren Geiger, chief operating officer of the energy-focused Caritas Royalty Funds, speaks to Pauline McCallion about managing risks in a rising oil and gas price environment

Concerns over Egypt & inflation push oil derivatives trading volumes to record levels

Oil prices will continue to rise to triple-digit highs over 2011 on long-term Egypt risk premiums and continual unrelated underlying issues, say market experts

Energy players expect further market fragmentation

Energy market fragmentation is likely to continue as larger players scale back their activities under Dodd-Frank

Commodities remain an attractive asset for hedge funds

Despite volatile markets, commodities trading remains a popular strategy for hedge fund managers and investors as regulators target speculation. Joanne Harris reports

Positive outlook for 2011 commodity inflows: survey

Commodity investment to strengthen and become more active in 2011 as natural gas producers look to hedge low price expectations

Proprietary trading conundrum

With implementation of the Dodd-Frank Act due to start next year, Alex Davis examines how the commodities markets stand to be affected by the Volcker rule

Nat gas hedging hit by regulation and fundamentals

Experts link drop in natural gas trading activity and liquidity to fundamentals and regulatory uncertainty

Commodities ‘financialisation’ worries end-users

With recent statistics showing an increasing number of financial institutions jumping into commodities, Lianna Brinded investigates whether this will cause more risks to end-users

European power: Iberian market slow to develop

Market analysts have pinpointed the Iberian power market as one to watch due to recent increased participation from banks, hedge funds and utilities. However, some European energy companies are still highly critical of the market’s structure and…

BNP Paribas’ commodity research to triple

French investment bank BNP Paribas is set to more than triple its commodity research team, across metals, soft commodities and carbon emissions, in order to bolster its trading side as it goes on an aggressive drive to gather more hedge funds and…

What next for hedge funds in energy?

Hedge funds, which fled the energy markets post-financial crisis, began returning steadily in the second half of 2009. However the influx stopped abruptly at the start of this year. Rachel Morison looks at what’s next for energy hedge funds in the short…

Hedge funds will return to energy markets in H2

Energy hedge fund investors will return to the market in the second half of the year, as these investment managers see prices rise towards the end of 2010, say analysts.

Transmission holds US wind power back despite 2009 record

Wind power is now the joint leading source of new electricity generation in the US, tying with natural gas, due to record levels of new capacity last year, according to the American Wind Energy Association (AWEA).

Heroes or cowboys?

Banks and energy companies alike are sceptical about the role that hedge fundsplay in energy markets. Are they really an aid to market stability, or is theirpresence compounding market volatility? Paul Lyon reports