Credit risk

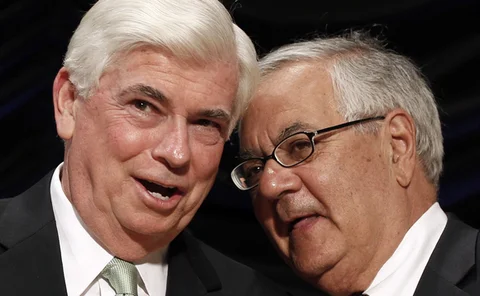

Dodd-Frank: Summary of rule-making progress so far

As regulators approach the end of the Dodd-Frank rule-making period, Energy Risk details the proposals so far and considers what lies ahead for the new regulatory regime. By Peter Madigan with additional reporting by Pauline McCallion

Trend towards in-house clearing could increase fees and admin

The LME is the latest exchange considering whether to build its own clearing business. If the trend continues, banks could face more fees and administration

Will ruling create agreement on regulatory jurisdiction?

The FERC’s $30m fine for former a Amaranth trader has set a strong precedent for market manipulation cases, but regulatory overall jurisdiction remains unclear. Pauline McCallion reports

Profile: Diana Higgins, Director Crediten

Assessing counterparty credit can require the skills of a private detective, says Diana Higgins, talking to Stella Farrington about her credit risk career and the changing role of the credit function

Q&A: Tony Hall at Duet Commodities Fund

After turning one of the highest proprietary trading profits in the history of Credit Suisse Commodities in 2009, Tony Hall launched hedge fund Duet Commodities Fund last year. He will be delivering the keynote talk at Energy Risk’s Commodities and…

Commodity prices seen as greatest threat to recovery: poll

Rising commodity prices pose the biggest risk to recovery after the 2008 global financial crisis, according to a risk.net poll

CFTC regulators favour extending Dodd-Frank comment period

CFTC cost and timing concerns continue; FTRs and commodity forwards exempted from swaps definition

Experts question North American LNG exports

Price differentials make LNG exports viable but price future risk could hamper projects; credit-worthy partner is key

Widespread unease over planned position limits rules

Reservations remain among firms involved in commodity trading about a new position limits regime that could be implemented under the Dodd-Frank Wall Street Reform Act, while support continues from anti-speculation campaigners

Special report – Weighing up Dodd-Frank

What will impending regulation under the Dodd-Frank Act mean for the energy sector? Our US editor, Pauline McCallion puts the question to leading industry participants

Collateral management: Firms face up to regulatory challenge

Collateral management has become an increasingly complex and vital component of credit risk management for the energy sector. With the EU considering reforming commodity derivative regulation, Alex Davis looks at the latest developments and examines…

Q&A: Gary Germeroth, chief risk officer at Calpine

Gary Germeroth, chief risk officer at US independent power producer Calpine, speaks to Pauline McCallion about the company, Dodd-Frank regulation and managing the risks related to renewable energy generation

Planning for bankruptcy of a major counterparty

Paul Turner and Mark Sherrill discuss how to minimise exposure to the bankruptcy of a major energy counterparty

Energy investment delays raise operational risks

After infrastructure investment in the energy and commodities industry dropped to record lows following the credit crunch, Lianna Brinded takes a look at whether the new uptick in spending is too little, too late for staving off operational risk

US regulation update

The Dodd-Frank Act rule-making process has continued apace since enactment of the legislation in July 2010. However, in spite of the regulators’ progress in several major areas, significant concerns remain for energy market players. Pauline McCallion…

EU financial rules consultation raises industry concerns

The European Commission has recently distributed its industry consultation on the expected changes to Mifid’s legislation. Alex Davis asks if the energy sector should be alarmed

Chilton to support comments on position limits

Commissioner supports publishing position limits proposals for public comment; continues to call for interim position "points" system to collect data

South Korean export markets won’t slow

South Korean freight derivatives growth will not slow, despite the financial regulator’s institutional warning to Barclays and a caution to an individual at JP Morgan for breaking local banking rules by selling inappropriate currency derivatives that are…

CFTC wants power market input on Dodd-Frank rule-makings

CFTC commissioners are concerned about the breadth of the Dodd-Frank swap dealer definition; staff call for electricity sector comments

Commissioner presses to speed up Dodd-Frank rule-making

CFTC continues derivatives reform rule-making, staff and commissioners concerned about timetable and resources

Nuclear industry weighs short-term pain for long-term gains

With increased use of nuclear energy currently the EU’s most likely route to ensuing both security of supply and low carbon emissions, Alex Davis examines the impact such a policy could have for energy risk managers