Feature

Q&A: Marina Surzhenko, head of LNG export directorate at Gazprom Export

In this exclusive interview with Energy Risk, Gazprom sets out its views on the future of the gas markets in Asia and Europe, the rise of LNG and its recent deals with China. Alex Davis talks with Gazprom Export’s Marina Surzhenko and to the Gazprom…

Q&A: Tony Hall at Duet Commodities Fund

After turning one of the highest proprietary trading profits in the history of Credit Suisse Commodities in 2009, Tony Hall launched hedge fund Duet Commodities Fund last year. He will be delivering the keynote talk at Energy Risk’s Commodities and…

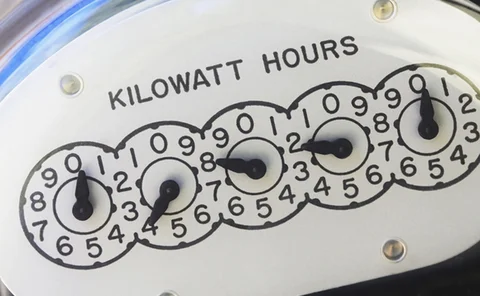

Estimating the impact of US energy efficiency programmes

Increased interest in energy efficiency and demand response programmes in the US power markets has led to the birth of the negawatt – a tradable resource now gaining prominence in the industry. But estimating the impact of these programmes is not easy,…

Can electricity demand response replace hedging?

How will greater use of demand response affect risk managers in the power sector? Pauline McCallion asks the experts

Q&A: Derren Geiger, chief operating officer of Caritas Royalty Funds

Derren Geiger, chief operating officer of the energy-focused Caritas Royalty Funds, speaks to Pauline McCallion about managing risks in a rising oil and gas price environment

Incentivising CDM private sector investment

The Clean Development Mechanism plays a pivotal role in emissions reduction by incentivising investment in developing nations. Much effort has been put into CDM project development, but more should be done to generate additional demand for CDM…

Valuing non-standard load profile products

Load profile products in the European OTC power markets are attracting increasing attention. However, valuations for these non-standard products can be difficult, as Cregor Janssen and Jan Lueddeke discuss

Coal prices rise on back of Japanese disaster and Queensland flooding

Coal prices rise as Latin America and South Africa prepare to export to Asia following the Fukushima disaster and disruptions in supplies from Australia as a result of the Queensland flooding

Special report – Weighing up Dodd-Frank

What will impending regulation under the Dodd-Frank Act mean for the energy sector? Our US editor, Pauline McCallion puts the question to leading industry participants

Slow recovery likely for freight derivatives amid low market rates

An overabundance of dry-bulk vessels ordered before the financial crisis now coming on line is weighing on the freight market and freight rates. Alex Davis looks at how freight derivatives demand will cope during what many expect will be a sustained…

Energy Risk - Rankings reception

Photo highlights from Energy Risk’s Software and Commodity Rankings cocktail reception, held in London on February 24, 2011

Hedge funds see potential in European carbon markets

There is growing interest by hedge funds in carbon trading. Traders are diversifying their funds and business risk by combining carbon investments with allocations to related asset classes. By David Walker

Collateral management: Firms face up to regulatory challenge

Collateral management has become an increasingly complex and vital component of credit risk management for the energy sector. With the EU considering reforming commodity derivative regulation, Alex Davis looks at the latest developments and examines…

Q&A: Kaha Kiknavelidze, managing partner at hedge fund Rioni Capital

With the oil & gas industry going through major changes from pricing to regulation, Lianna Brinded talks to Kaha Kiknavelidze of Rioni Capital about oil & gas opportunities

US: New shale gas options bring market changes and challenges

The shale production boom has changed the dynamics of the North American natural gas infrastructure grid. Pauline McCallion looks at the potential implications for hedging strategies

Algorithmic trading in energy

Algorithmic trading has made slow progress in energy markets. Ned Molloy looks at the reasons for the limited uptake and at the market’s prospects

Q&A: Gary Germeroth, chief risk officer at Calpine

Gary Germeroth, chief risk officer at US independent power producer Calpine, speaks to Pauline McCallion about the company, Dodd-Frank regulation and managing the risks related to renewable energy generation

Turning Points: Larry Kellerman, CEO Quantum Utility Generation

A career so far spent pushing the boundaries of the US power market has lead Larry Kellerman of Quantum Utility Generation to the world of private equity. Pauline McCallion finds out more

Turning Points: Nicholas O’Kane, global head of Macquarie Group’s Energy Markets Division

Macquarie Energy continues to expand its activities in the global energy markets. Pauline McCallion speaks to Nicholas O’Kane about developing the business and his career

Q&A: Craig Donohue, Chief Executive Officer, CME Group

As energy and commodities markets attempt to adapt to a raft of regulation changes from 2010 and lack of liquidity from 2009, Lianna Brinded speaks to the CME Group’s CEO about how risk appetite and derivative trading trends are shifting

Iraq oil: promises and challenges

Despite Iraq being tipped as the next new hub for European oil supply security, the country has faced a series of infrastructural setbacks. Lianna Brinded investigates how much progress has been made and whether the high level of risks is holding back…

US renewable energy: A carrot and stick approach

Pauline McCallion examines current risks surrounding the development of renewable energy resources in the US