News

Refco raises further concerns

As the Refco bankruptcy case rumbles on, investors are wondering if more could have been done to prevent it, and in future, are likely to seek better assurances over the security of funds in segregated customer accounts

Energy trading helps JP Morgan post record results

Energy-trading revenues played a big role in bringing JP Morgan a 2005 third-quarter net profit of $2.5 billion, up from $1.4 billion in 2004. This was on the back of third-quarter net revenues of $15.6 billion, up from $13.6 billion in the same period…

Endex lists Belgian power forwards

Dutch electricity exchange Endex started listing Belgian power forwards today. Belgian utility Electrabel and German utility Essent did the first trade today, a November baseload contract.

US physical clearing firm gets credit support from CSFB

Investment bank Credit Suisse First Boston is to provide credit support for North American Energy Credit and Clearing’s (NECC’s) services in physical energy markets.

Standard Bank invests in biodiesel

South Africa-based Standard Bank has entered the biodiesel sector with an $8 million equity investment in Biodiesel Energy Trading (BET).

BP Singapore chooses Oilspace’s Oilwatch

Global energy major BP’s Singapore division is implementing Oilspace’s Oilwatch, a web-based portal for real-time, aggregated energy prices, news and analytics. BP Singapore is rolling out the service across the Asia-Pacific region.

HSBC is first major bank to go ‘carbon neutral’.

HSBC has reduced its net CO2 emissions to zero by reducing energy use, buying ‘green’ electricity and then offsetting the remaining CO2 emissions by investing in carbon projects.

Tullett Prebon forms wet freight derivatives venture

Tullett Prebon, part of Collins Stewart Tullett, is the latest interdealer broker to partner with a shipping broker to offer forward freight agreements (FFAs). It has started a venture with three international shipping brokers with the aim of…

EEX to launch carbon derivatives contract

The European Energy Exchange (EEX) plans to launch a futures contract for carbon emissions allowances in October, pending regulatory approval.

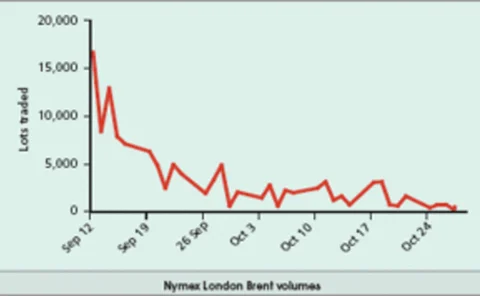

Nymex plans to sell 10% stake to private equity firm

The New York Mercantile Exchange (Nymex) has signalled its intention to sell a 10% equity stake to General Atlantic, a US-based private equity firm, for $135 million.

Amerex's Prokop joins Energy Data Hub board

The Energy Data Hub has appointed Mike Prokop, senior vice president at energy brokerage Amerex, to its board of directors.