Risk management

Centrica hires ex-Hess market risk director

John Wengler joins Centrica Energy as UK-based midstream risk director

Risk & Energy Risk Commodity Rankings 2014 – energy

The past 12 months proved tough for energy dealers, with low volatility, poor liquidity and sluggish levels of client activity. Given this, some banks decided to scale back their commitment to the market – a trend that is reflected in this year’s results…

Risk & Energy Risk Commodity Rankings 2014 – metals

For metals, the past 12 months were marked by plummeting gold prices, directionless markets in base metals and heated rows over the London Metal Exchange’s warehousing system. Despite this, the top dealers and brokers in this year’s rankings are largely…

Deutsche Bank makes commodities cuts

Goldman names new commodities heads; BAML exits European power and gas; GDF Suez promotes Moorooven; Newedge names commodity heads; JP Morgan hires EDF power trader

The 10 biggest energy risk management disasters of the past 20 years

The history of energy trading is littered with losses, bankruptcies and other misfortunes that now serve as cautionary tales. Alexander Osipovich looks back at the biggest energy risk management disasters of the past two decades and how they reshaped the…

American Airlines to stop fuel hedging after merger

US Airways policy of not hedging jet fuel will now extend to American Airlines, says chief executive

EEX seeks Asia commodity derivatives boost

Cleartrade Exchange acquisition based on greater prospects for growth in Asian commodity markets

Commodity position limits may make hedgers think twice

Dodd-Frank and Mifid II position limits could cause firms to withdraw from commodity derivatives

Lynton Jones laments IPE's hesitation over electronic trading

Lynton Jones, the IPE’s former chief executive, tried hard to promote electronic trading in Brent futures. But those efforts met with strong resistance, he tells Mark Pengelly

Energy Risk Europe & North America awards open for entries

Enter now to win one of Energy Risk's coveted Europe and North America awards

Looking back: Are banks coming back into OTC energy derivatives?

Banks have often stepped in and out of the OTC energy derivatives market. In this article from August 2001, Energy Risk reports on banks upping their activity

Market coupling: Energy Risk & Baringa Partners launch survey

Energy Risk & Baringa Partners invite you to participate in a landmark survey on European market coupling

Resist the rise of the risk management machines

Overreliance on modern risk management systems, and metrics such as value-at-risk, can blind firms to tectonic structural market shifts. To help alleviate this problem, the use of human judgement and intervention is required, argues Vincent Kaminski

Trading OTC may be costlier than you think

Debate continues to rage about the merits of clearing, with some market observers arguing that the benefits of using central counterparties are outweighed by the precipitous costs involved. But such criticisms fail to take the full burden of over-the…

Liquidity flows back into freight derivatives

Rising prices and volatility spur renewed interest in dry bulk FFAs

Energy Risk Software Survey & Rankings open for voting

Make sure your vote is counted in Energy Risk's annual ETRM software rankings

CFTC chair nominated as Chilton exits

Goldman's Shenouda and O'Hagan retire; BNP Paribas takes Flax; ABN Amro appoints global head of energy; Hederman joins DoE; JP Morgan lures origination head

Sovereign hedging picks up as developing countries end fuel subsidies

A push to eliminate fuel subsidies across much of Africa, the Middle East and Asia is raising interest in the use of commodity hedging by governments as a way of containing social unrest. But it remains a challenge to get sovereign commodity hedging…

Energy trading firms must be whiter than white

Allegations of manipulation are particularly bad for energy trading firms, which should respond by holding themselves to higher standards

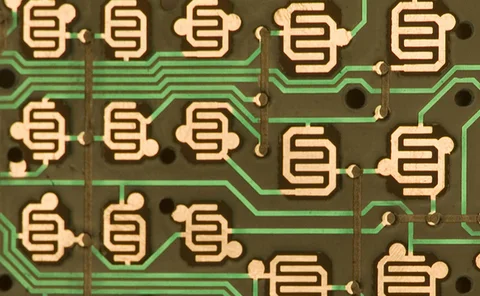

Risk management should be more than just a decoration

Despite massive investment in human capital and technical resources, risk managers failed to warn about the dangers of toxic assets and excessive leverage in the run-up to the global financial crisis. Their lack of authority is partly to blame, writes…

CFTC proposes 'unassailable' position limits rule

CFTC puts forward another Dodd-Frank position limits rule, generating concerns among commodity derivatives end-users

Commodity investment goes back to fundamentals

The past year has not been a good one for commodity investment. Passive commodity indexes have delivered disappointing returns, while a number of high-profile commodity hedge funds have been forced to close. What is the outlook for investor interest in…

Risk & Energy Risk Commodity Rankings open for voting

Vote now in the 2014 Risk & Energy Risk Commodity Rankings

Correlation suggests ‘return to normal’ for commodities

Commodities are being increasingly driven by market fundamentals, say analysts, forcing investors to search harder for returns