Risk management

BNP hires former Deutsche commodities head

Noble Group names new CRO; US commodities reshuffle at Société Générale; CFTC names director of international affairs; Citi sees changes in metals and LNG; Deutsche Bank makes senior hires

The rise of iron ore derivatives

A shift in the way iron ore cargoes are priced has helped give rise to a burgeoning market for iron ore derivatives. Interest in trading the product has come from a wide range of participants, including producers, consumers and investors – making it one…

Cutting edge: Minimising risk when hedging crude oil options

In this paper, Christian-Oliver Ewald, Roy Nawar and Tak Kuen Siu study the performance of locally risk-minimising hedging strategies in the context of futures and options written on crude oil. In contradiction to prior research, the authors show it is…

Energy Risk USA: Energy market participants struggle with reporting

Dodd-Frank rules on swap data reporting creating a headache for energy market participants

Energy Risk USA: New CFTC position limits due in June, O'Malia says

CFTC will soon unveil revised rule on commodity position limits after a court rejected its previous effort, says O'Malia

Exchanges plan futures in response to RIN price surge

CME Group and Ice plan to roll out futures based on biofuel Renewable Identification Numbers

Applied risk management series: Venturing beyond VAR

In this article, Carlos Blanco and José Ramón Aragonés review the historical simulation methodology used to estimate value-at-risk and expected tail loss, while including adjustments to traditional assumptions that can help improve risk forecasts for…

Evolution Markets opens Singapore coal desk

Hiemstra to lead new Asian office; EDF Trading hires power traders; Barclays loses head of commodity research; Vitol enters ag commodities; Davies leaves Trayport

Physical portfolio optimisation – improving margins in a tight market

In this corporate statement, Rashed Haq, vice president, Sapient Global Markets, explains how an analytical market-based approach can improve decision-making and reduce risk for commodity firms.

Turning points: SEB's Torbjörn Iwarson

While many investment banks are having a tough time in commodity markets, Swedish bank SEB is going against the grain by increasing its appetite for risk. Torbjörn Iwarson, the bank’s head of commodities, talks to Jay Maroo

Risk & Energy Risk Commodity Rankings photos

Winners of the 2013 Risk and Energy Risk Commodity Rankings were honoured at a cocktail reception in London on February 12. Here, we present the highlights

CFTC legal counsel to depart

Hetco hires top Tudor quant; Koch swipes LNG expert from BNP; Marex Spectron hires in Asia; DME recruits products and services head; RBC hires metals head

NGL hedging takes off amid shale gas boom

US production of natural gas liquids (NGLs) has surged in recent years, causing NGL derivatives trading to expand as market participants hedge more of their output. But the market for NGL risk management products remains a work in progress, finds…

Financial transaction tax could raise energy company hedging costs

FTT will increase hedging costs for energy companies and deter them from trading with financial counterparties, firms say

Collateral and commodity market dynamics in the new normal

Collateral quality and depth are playing an increasingly important role in a market characterised by systemic risks and high correlations among asset classes, including commodities. That is a trend that should concern energy risk managers, argues Stephen…

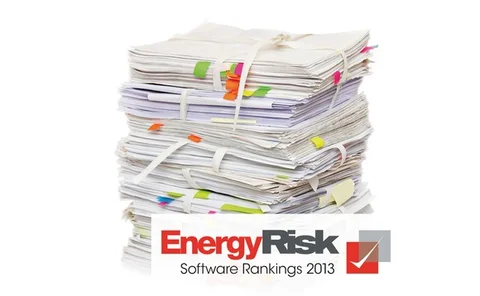

Energy Risk Software Survey and Rankings 2013

Energy trading and risk management (ETRM) software budgets are declining, just as new regulatory requirements are putting more demand on ETRM platforms than in previous years, according to the results of Energy Risk’s 2013 Software Survey and Rankings…

Sommers to leave CFTC

Deutsche Bank appoints commodity co-heads; top analyst leaves Morgan Stanley; Icap Energy appoints in Singapore; Barclays loses energy research head; Huntington Bank launches hedging business

Bank commodity VAR remains muted in Q4

Fourth-quarter results show low risk appetite continues to prevail at banks, reflecting tougher capital requirements and a continuing lack of trading opportunities, writes Jay Maroo

Futurisation worries end-users of OTC energy derivatives

Regulation has caused much of the over-the-counter energy derivatives market to move to exchange-traded futures. While many market participants welcome the shift, derivatives end-users worry that it could harm their ability to hedge. Alexander Osipovich…

Energy firms increasingly using stress tests to cope with regulatory change

Utilities and other energy firms are working hard to refine and enhance the scenarios they use for stress testing. Given recent market events, the impact of regulatory change and large-scale liquidity crises are taking on an increasingly important role…

Applied risk management series: OTC commodity swaps valuation, hedging and trading

In this article, Carlos Blanco and Michael Pierce provide an overview of swap instruments and discuss the pricing, valuation, hedging and risk management of over-the-counter commodity swaps. They also comment on the expected ramifications of new…

Risk & Energy Risk Commodity Rankings 2013 – energy

Muted volatility, sluggish trading activity and regulatory changes have conspired to create a tough environment for energy market participants over the past year. That has fuelled a lot of movement in this year’s Risk and Energy Risk Commodity Rankings,…

Risk & Energy Risk Commodity Rankings 2013 – metals

In a torrid year for metals traders, Société Générale Corporate & Investment Banking retained first place in base metals, with UBS again leading the way in precious metals. By Tom Newton