Oil & refined products

Oil price outlook

Despite oil prices staying tightly within range over the past year, Lianna Brinded finds out that most analysts see prices becoming more closely correlated to supply and demand fundamentals and edging higher, with $100/bbl expected for 2012

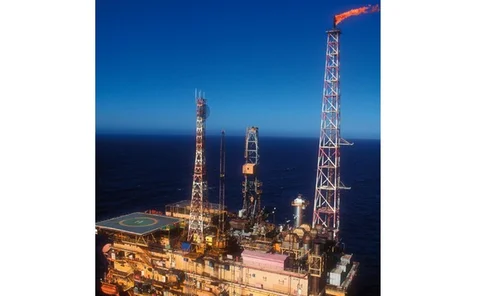

Petrobras raises the stake for unconventional oil

The Petrobras share sale at the end of September set a world record, with $70 billion raised. Alex Davis examines how this is a good omen for risk appetite in deep-water drilling

End-users rush into hedging oil prices

End-users are ploughing into hedging their oil positions, as prices remain in a tight range, says Standard Chartered Bank’s head of energy and environmental research

Goldman Sachs: end-users hedge oil prices now for 2011

Crude will be "the bottleneck in the system, rather than refining" says the investment bank

Low natural gas prices push producers to oil

US producers move to oil plays, 2011 natural gas hedging programmes not expected to support current production levels

Oil & Products House of the Year, Asia – Morgan Stanley

Growing oil demand and the emergence of new commodities markets in Asia have created a new era for the energy and commodities industries

IEA: oil price volatility negated by non-OECD demand

The International Energy Agency (IEA) says that non-Organisation for Economic Co-operation and Development (OECD) countries’ energy demand negates the volatile effects following BP’s Gulf of Mexico oil spill

Ecuador’s hydrocarbons reforms threaten production

Ecuador’s latest reforms for the hydrocarbons industry could stunt investment in the country and lower production levels. Alex Davis investigates

BP’s Gulf of Mexico oil spill will not push fuel switching

Experts quash fears that tighter restrictions following BP’s Gulf of Mexico oil spill will result in oil to gas fuel switching in the US, thus pushing up gas prices

China’s drop in oil demand is "warning sign’"

Alarm bells hit the market after China’s oil demand slump signals a possible unexpected slowdown in energy demand growth

A turning point for crude oil indexes

In the year since major producers in Saudi Arabia and Kuwait adopted the Argus sour crude index (ASCI) as a pricing benchmark for their imports into the US, Alex Davis examines the impact the new benchmark has had on global oil pricing mechanisms

IEA: BP’s oil spill threatens future supply

The International Energy Agency (IEA) expresses major concerns over future oil supply, as new regulations threaten to tighten deepwater drilling, following BP’s Gulf of Mexico oil spill

Energy firms' hedging programmes give mixed results

Hedging programmes for oil & gas companies show widely differing outcomes according to the latest flurry of company results

Nigerian political stability boosts oil production

Nigeria’s crude oil production is on the up, after geopolitical stability hints at consistent growth, says the NNPC

BP oil spill to boost alternative energy - fund manager

The fallout from BP's Gulf of Mexico oil spill will act as a boost for the alternative energy sector, says exchange-traded fund manager ETF Securities.

Time to consider electronic trading for oil markets

The oil markets have stubbornly resisted electronic trading for 10 years. Alex Davis finds out if this is about to change

Nigerian official says oil exports not at risk

Nigeria’s oil minister has dismissed market reports that the country’s oil supply will dramatically tighten following insolvency rumours and major plans for offshore drilling

MF Global fuel oil brokers to move to Spectron

Several fuel oil swaps dealers at brokerage MF Global are reported to be moving to rivals Spectron

HSBC enters energy derivatives market

HSBC and Total Oil Trading expect to offer their first products in a few months' time

BP’s oil spill to tighten global oil supply - report

BP’s Gulf of Mexico oil spill will tighten global oil supply as US oil production is set to wane, following expectations the disaster will lead to stricter regulation and closer scrutiny of drilling operations in the US, say Barclays Capital

Moody’s boosts Petronas rating on Iraq exposure

Rating agency gives a surprise boost to Malaysian oil company Petronas’s credit rating from negative to stable, despite the company’s substantial acquisition of an Iraqi oil field with Royal Dutch Shell

China unveils major oil and gas plan

China’s seemingly insatiable appetite for energy production and consumption reaches new levels as the country unveils plans to increase oil and gas production by a third by 2020

Iraq's oil minister calls for swift action on contracts

Iraq calls on foreign energy companies, such as BP, Eni and China National Petroleum Corporation (CNPC) to move swiftly to implement their recently awarded contracts