Oil & refined products

Kupe light crude oil ready to ship

Origin Energy New Zealand has revealed that the Kupe gas project will be making the first shipment of light crude oil from Taranaki port on January 17.

Upstream deals boost oil and gas companies’ outlooks

The value of oil and gas deals announced last year increased by 10% from 2008 to $198 billion, although the total number of deals fell from 1,152 to 837, according to Ernst & Young’s third annual global oil and gas transactions review.

Moody’s: Oil will average $75 in 2010

Oil prices will average $75 per barrel (bbl) in 2010, following rising growth in global oil consumption, fuelled by buoyant demand in developing economies, led by China, says rating agency Moody’s.

EIA: World will be more dependent on Opec oil

The world will become more dependent on Organization of the Petroleum Exporting Countries (Opec) oil by the start of 2011, following sustained surplus production capacity and a forecasted decline in growth from countries outside the producer group, says…

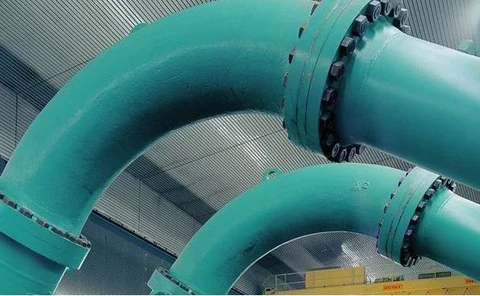

Can pipeline system support Canada oill sands growth?

With Canadian oil sands production set to grow, albeit at a reduced rate, will the current and planned pipeline infrastructure in North America be fit for purpose? Pauline McCallion finds out

Saxo Bank: Oil to fall to $40 in 2010

Oil prices are set to tumble to $40 per barrel (bbl) by the end of 2010, following spare capacity “sloshing around” in the world energy system and despite physical oil nearing peak production, says trading and investment house Saxo Bank. However, longer…

Total takes $2.25bn stake in US shale

The joint venture agreed by Total and Chesapeake in December could lead to further North American shale deals and signals Total’s desire to develop its unconventional resources worldwide.

Russia/Belarus crisis not expected to affect oil market in the longer term

Russia’s halt in crude oil supplies to Belarus, which is providing some support to the oil complex today (January 4), is not expected to have a big impact on the global market, say analysts.

Oil price outlook 2010

Oil prices – which have been rangebound between $65–75 per barrel for most of the second half of the year, averaging just under $61/bbl for 2009 – are forecast to average more than $15 higher next year on expectations of a steady recovery in the global…

Ice to launch ASCI contracts

IntercontinentalExchange (Ice) has introduced more than 40 new over-the-counter cleared energy contracts for North American natural gas, power, natural gas liquids and global oil products, including two contracts based on the Argus Sour Crude Index (ASCI…

Canada's oil sands growth seen steady

It’s been a rollercoaster 18 months for Canada’s oil sands – higher oil prices are now supporting the complex, but credit remains constrained. Pauline McCallion talks to experts about their outlook for the industry

UPDATED: Nymex follows Saudi sour crude endorsement with new contracts

Nymex is to launch two sour crude oil contracts after Saudi Aramco’s announcement this week that it will use the Argus Sour Crude Index (ASCI) as a benchmark for US sales from January 2010.

Saudi Aramco switches to Argus Sour Crude Index

Saudi Arabia’s national oil company Saudi Aramco is to use the Argus Sour Crude Index (ASCI) published by Argus Media as the benchmark price for all grades of crude oil sold to US customers from January 2010.

Industry experts bearish on IEA oil demand

Industry experts at the annual Oil & Money Conference in London this week challenged International Energy Agency (IEA) forecasts for demand growth.

Citi sells Phibro to Occidental

Citi has announced the sale of commodities trading unit Phibro to Occidental Petroleum.

PetroChina acquires oil sands stake

PetroChina has paid C$1.9 billion for a 60% interest in two projects in the Athabasca Oils Sands in Alberta, Canada.

NGX offers physical clearing for US crude oil

Calgary-based Natural Gas Exchange (NGX) today announced the availability of physical clearing capabilities for the United States crude oil market, effective this week.

TAQA to operate Brent system

TAQA Bratani, the UK arm of the Abu Dhabi National Energy Company (TAQA) is the new operator of the North Sea Brent System pipeline and facilities. TAQA acquired the assets from oil major Shell UK, which has owned and operated them since the mid 1970s.

Market uncertain over oil price direction

Analysts at investment banks are divided in their views over the average price of crude oil for the rest of 2009 and into 2010.