Risk Staff

Follow Risk

Articles by Risk Staff

Goldman Sachs buys 3,300MW of power generation capacity

Godman Sachs has agreed to buy US power producer Cogentrix, in a deal that willmore than quadruple the bank’s generation capacity. JoeMarsh reports

Arnie’s energy plan faces opposition

Californian governor-elect Arnold Schwarzenegger is facing stiff opposition and awkward questions over his energy deregulation plans. In particular, one consumer group is concerned about the implications of his meeting with formerEnron chairman Ken Lay…

JP Morgan Chase plans electricity trading foray

JP Morgan Chase is planning to enter power trading, just as the US energy regulator overturns its onerous stock-holding limit rule. PaulLyon reports

Gas prices hit fertiliser industry

North American fertiliser producers are struggling for survival, thanks to the high cost of natural gas. Some have turned to hedging and pre-purchasing their gas, but such measures may not be sufficient. Paul Lyon reports

Running late

Compliance with the new International Financial Reporting Standards is likely to have a big effect on the volatility of oil, natural gas and utility companies’ reported earnings. Yet the sector has been slow to implement the IASB standards, finds James…

Tech for gas turmoil

An adaptable straight-through processing system is crucial if natural gas marketparticipants are to stay profitable despite continuing price volatility, saysOpenLink International’s Jean-Claude Riss

A slow recovery

Recent research carried out by Fitch Ratings says the energy merchant sector has made great strides towards solving its near-term liquidity woes. But there is much work still to be done, finds Paul Lyon

The credit charge

Brett Humphreys describes a simple method for charging traders for the credit risk embedded in a contract, using an example based on an oil purchase agreement. Such a charge creates proper incentives for traders with regard to credit risk

Phillip Fletcher

Phillip fletcher , a partner at Milbank, Tweed, Hadley & McCloy, has seen nothing but change in his 15 years with the law firm, he tellsJames Ockenden

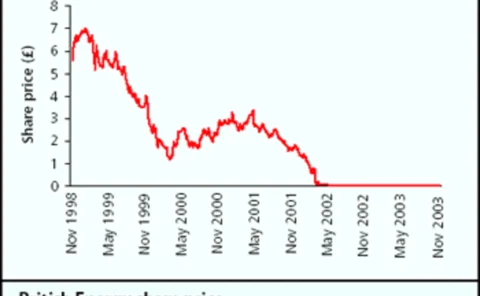

Radioactiveliabilities

Creditors have agreed nuclear generator British Energy’s restructuring package. But without European Union agreement over the UK government’s £4 billion in subsidy, these creditor agreements could be meaningless. James Ockenden reports

Blackouts spark supply debate

The world’s energy regulators met in Rome last month, days after the Italian blackout on September 28. Perfect timing, it would seem – but what are the regulators going to do about Europe’s bottlenecked grid? Paul Lyon reports

Enterprise-wide risk management

Market and regulatory requirements mean EWRM is fast becoming essential. Now is the time for implementation www.kpmg.com

Competing at the highest level

BP is fast becoming as well known for its risk management services as it is as a global energy company.

Russian roulette

European and US oil companies are tipped to be big investors in Russia’s oil market. But while rewards could be great, any decision to invest in thecountry will be fraught with difficulties. Paul Lyon reports

Refining systems for oil trading

The increasing complexity of the crude oil business – on both the physical and financial side – means companies in the sector need fast-changingand flexible software to manage their operations. CliveDavidson reports

Trading crude blows

Banks and oil majors alike are building up their oil derivatives operations, vying to attract the same corporate client base. But the oil companies do notseem unduly concerned about the competition, finds Paul Lyon

Upstream sector gets flexible

The oil exploration and production sector is transforming its thinking and trying to become more flexible by using portfolio management models, finds Maria Kielmas

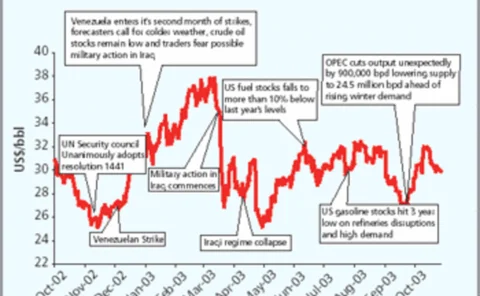

Opec keeps a tight grip

The latest production quota cut by the Organisation of Petroleum Exporting Countries has forced prices up, but will crude oil producers in Europe and elsewhere co-operate to help them stay up? EricFishhaut examines the situation

Lands of confusion

Oil production uncertainties in Iraq and political doubts in Russia and Venezuelaare keeping crude prices well above historical averages. MariaKielmas reports

Measuring the value of clearing

Central clearing houses offer major advantages to the electricity trading industry, says UK Power Exchange’s Paul Danielsen. He sets out a practical example to demonstrate how UK power firms can benefit from clearing

Operational and market risks of a regulated power utility

Victor Dvortsov and Ken Dragoon present an analytical method for including market and operational risks when estimating utility portfolio value-at-risk

Rothschild enters oil risk sector

Heading the senior team is Martin Fraenkel, previously managing director of JPMorgan Chase's global commodities group in London. Fraenkel has recruited hissenior team from outside Rothschild. KamalInvestment bank Rothschild has entered the oil risk…

People swaps

Buchanan appointed Ofgem chief executive UK energy regulator the Office of Gas and Electricity Markets (Ofgem) has appointed Alistair Buchanan as chief executive. Previously head of European utilities research at Dutch bank ABN Amro, Buchanan (pictured)…