Risk Staff

Follow Risk

Articles by Risk Staff

Back to basics

Correlation and volatility methods are accepted ways of measuring risk. But areview of the underlying assumptions underlying the statistics used for risk management can identify areas where errors can occur, says Brett Humphreys

Richard Rosen

Richard Rosen of the Tellus Institute in Boston controversially believes thatthere is no need for a wholesale power market. By Paul Lyon

Degreasing palms

The United Nations is likely to ratify extensive anti-corruption legislation in December. But recent scandals at energy giants Elf and Statoil highlight the difficulties in stamping out bribery and corruption. By Joe Marsh

Life without MTBE

The changeover from the use of MTBE as a gasoline blending component, to ethanol,in New York State and Connecticut on January 1, 2004 is likely to lead to pricevolatility in the oil market and make risk management using the Nymex Unleadedcontract far…

Nuclear renaissance

Both Canadian and US governments want to bring more nuclear power capacity online, but will the private investors come? By Catherine Lacoursière

Contract killing

The California Public Utilities Commission wants to renegotiate long-term contractsthe Department of Water Resources entered into during the state’s energycrisis. So far, Ferc has been less than receptive to the request. By Paul Lyon

Open for business

The Russian government has taken the first steps toward the deregulation of its gas and power markets, and despite recent the high-profile Yukos scandal, investors are eyeing up some interesting opportunities. By Paul Lyon

Bouncing back

Business may be sluggish in the energy sector, but energy risk technology companiesare adapting to the tough market environment and proving their resilience, evenif that means partnering with rivals. By Paul Lyon

Weathering the problems

Weather derivatives can reduce or eliminate the potential economic disastersthat extreme weather can provoke. Ross McIntyre of Deutsche Bank examines thevarious ways in which weather can affect key industries and reviews the benefitsof weather derivatives

Creative challenges in customer-driven risk management

Shell Trading’s Ken Gustafson and Jemmina Gualy shed light on the environment in North America for customers and dealers in risk management, and look at the opportunities ahead for the business

The future of ETRM

As generation, trading and retailing companies come out from under the dark cloud to prepare for what looks to be a brighter future, one issue has become critical – the need to upgrade outdated ETRM systems with 21st century architecture, portfolio…

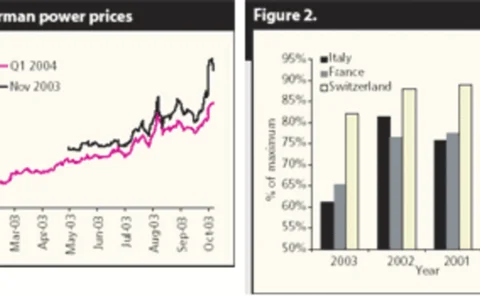

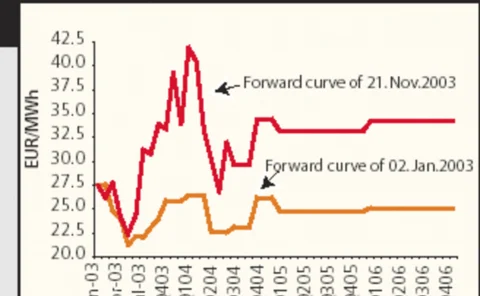

Searching for sellers in 2003

High volatility and rising prices in 2003 clearly above fundamental levels signal the need for improved guidelines from legislative institutions andeasily accessible information

Koch smooths volatile waters

Koch has marketed the first energy volatility swap in a deal with hedge fund Centaurus, a move the oil trader hopes will increase its share in options marketsand attract more hedge funds to the energy business. JamesOckenden reports

A discrete affair

Abstract: Dario Villani, Raffaele Ghigliazza and René Carmona extract the frequency content of a noisy signal using discrete Fouriertransform. After calculating the deterministic component, we show the relevanceof the method in removing spurious…

A dark futurefor clearing

Clearing was the energy buzz word of early 2003. But as Clearing Bank Hannover goes into liquidation and the future of EnergyClear’s business remains uncertain, it seems energy clearing has lost its appeal. By Paul Lyon