Policy risk

The derivatives burden

Former International Petroleum Exchange official Chris Cook looks at the issues raised at a debate on the future of the European energy markets at the end of London’s Derivatives Week event. The regulatory burden on firms took centre stage

From a gas crunch to a crisis

In this month’s Market Focus, GlobalView Software takes a look at the factors contributing to the current US natural gas crunch, which is drawing the attention of major political and financial figures

Emerging adequacy

The Committee of Chief Risk Officers’ capital adequacy ‘emerging practice’ guidelines will, says the capital adequacy committee chair, evolve into a new regulatory body within a year. James Ockenden reports

The trouble with normalisation

Weather derivatives practitioners say normalisation agreements between regulators and utilities in the US are posing a threat to their industry. Kevin Foster investigates

Ferc’s California clean-up

Sixty energy firms and utilities will have to justify their activities during the California energy crisis, the Federal Energy Regulatory Commission (Ferc) said in its regular bi-weekly meeting on June 25.

Ferc executes already dead Enron

Enron became the first company to face the Federal Energy Regulatory Commission’s (Ferc) “death penalty” in June when the US energy regulator revoked the bankrupt firm’s authority to sell electricity at market-based rates.

Teething problems in Texas

Advocates of retail electricity deregulation cite Texas as evidence that competitioncan succeed. But big risks remain for power marketers, finds Kevin Foster

End of the road for California?

A bill aiming to re-regulate the California energy sector is progressing through the state’s legislature. Does this spell the end for California’s troubled experiment with deregulation? Kevin Foster finds market participants split over the issue

The cost of deregulation

US electricity deregulation does not necessarily make prices more competitive, as is shown in this study of New England power prices by Logical Information Machines

How to run a market

Former-derivatives-trader-turned-author Frank Partnoy wants to see tougher accounting standards and risk disclosures to deter corporate crooks. But are the regulators listening? Maria Kielmas reports

A Spanish power struggle

A takeover bid by gas distributor Gas Natural for power utility Iberdrola may provide the impetus for much-needed competition in the Spanish energy market. But the bid has upset many traditional links in politics, finance and business. By Maria Kielmas

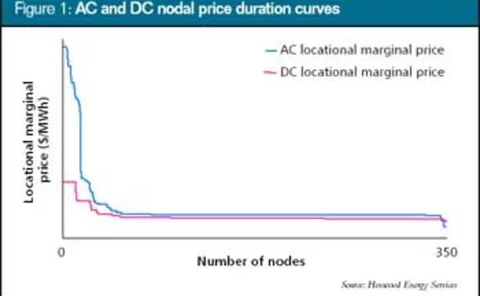

The LMP supermodel

With Ferc’s standard market design (SMD) seeking a shift from zonal power pricing to nodal pricing, the concept of locational marginal pricing (LMP) has become a key policy issue. Henwood Energy’s Vikram Janardhan proposes 10 key modelling features to…

Carbon across Europe

Pan-European emissions trading is a step closer after agreement of an EU directive. Atle Christiansen and Kristian Tangen of Point Carbon look at the consequences

Tough talk on derivatives

The Commodity Futures Trading Commission and Ferc are getting tough in throwing fines around. Is this a ploy to avoid being lumbered with further over-the-counter regulatory responsibilities? Some market participants certainly think so. By Paul Lyon

Seeking a boost for crude

Venezuela’s internal conflict and the intended removal of Saddam Hussein from Iraq have meant both countries are seeking deals with international investors to boost oil production. But are the potential legal problems worth the trouble? By Maria Kielmas

The return of Russian crude

Russia has reclaimed its position as the world’s biggest oil producer for the first time in a decade – but uncertainty is still preventing some foreign oil firms from making the investments the country needs to fulfil its potential. Kevin Foster reports

Rethinking European power

European energy firms are seeking to reposition their products and strategies in advance of European Union market deregulation. FAME Energy reports

Pointing the index finger

Concerns over manipulative energy price reporting has led to a call for price index reform. But many market participants are apprehensive about disclosing detailed confidential data to a third party. James Ockenden looks at developments