Policy risk

Dealing in doubt

Scepticism still surrounds the EU’s National Allocation Plans for theEuropean Emissions Trading Scheme (ETS) starting in January 2005. IvanO’Toole discusses the cost implications of the Kyoto Protocol for the EU power industryand anticipates a few…

EC fails emissions scheme, says E&Y director

The European Commission’s failure to challenge eight EU national allocation plans undermines Europe’s ability to meet its carbon dioxide emissions reduction targets agreed under the Kyoto Protocol according to Ernst & Young’s director of emissions…

Senators lambast CFTC for opposing OTC market regulation

US senators Dianne Feinstein (Democrat, California) and Maria Cantwell (Democrat, Wshnington) have attacked the US Commodity Futures Trading Commission (CFTC) for opposing their legislation that seeks to increase the regulatory oversight of the over-the…

Dutch minister stakes career on energy liberalisation

The Dutch minister for economic affairs, Laurens Jan Brinkhorst is staking his political future on the success of electricity market liberalisation, claiming he will step down if security of electricity supply is threatened.

Europe unprepared for emissions trading

The European Emissions Trading Scheme (ETS) will not begin on time, and will fail to deliver the promised results, according to a survey by Ernst & Young.

CFTC director resigns

Michael Gorham has resigned from his post at the US Commodity Futures Trading Commission (CFTC), effective June 30. Gorham was recruited by CFTC chairman James Newsome to become the first director of the Commission's Division of Market Oversight (DMO) in…

Long wait to market

Plans to create a small natural gas exchange in Russia highlight the complicationsof gas sector reform – arriving at realistic tariffs, finding new reservesand organising transport to name a few. Maria Kielmas reports

Managing manipulation

Sharon Brown-Hruska, commissioner of the Washington, DC-based Commodity FuturesTrading Commission, talks to Paul Lyon about the need for sensible, rather thanover-bearing, energy derivatives regulation

US puts trust in Canadian finance

Canadian income trusts have been trading at all-time highs. Now that the Canadiangovernment is allowing bigger players onto the market, interest from US energyfirms in such vehicles is growing. By Catherine Lacoursiere

Houston happenings

Regulatory pressures, asset valuation and price reporting were just a few of the topic areas covered at Energy Risk’s USA conference in Houstonlast month. Here Paul Lyon rounds up some of the conference highlights

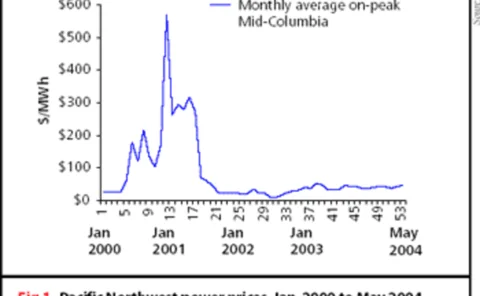

Northwest in excess

The Bonneville Power Administration’s power buyback scheme to tackle electricity shortages in the US Pacific Northwest in 2001 has worked rather too well. The region was left with bankrupt aluminium producers and a surplus of power that is not proving…

Where gas is keener

Fearing its competitiveness is slipping, the Canadian natural gas industry islobbying for pipeline rates of return and tax policies on a par with the US.By Catherine Lacoursière

Pressure group calls for debarment of Reliant’s US Dept of Defense contracts

Public Citizen, the Washington DC-based pressure group, has called for the debarment of Reliant Energy from its newly awarded $35.9 million electricity contract by the US Department of Defense while it is under federal indictment for its role in creating…

FOA close to releasing UK power trading guidelines

The UK Futures and Options Association (FOA) says it is close to releasing final drafts of guidelines on various areas of the UK power market. The problem areas identified by the FOA's Power Trading Forum (PTF) are reference pricing, credit risk…

Liquidity, not regulation, is key to avoid manipulation, says CFTC

Regulators should avoid the temptation to implement over zealous regulation of the energy derivatives market, and instead encourage the development of liquidity, if market manipulation is to be avoided. That was the message delivered by Sharon Brown…

SEC asked to defend Puhca policies

Two US Congressmen have expressed concern about the workings of the Public Utility Holding Company Act (Puhca) and the ability of the US Securities and Exchange Commission (SEC) to police Puhca-regulated energy companies.

De Vitry warns of energy market regulatory pressures

Benoit de Vitry, global head of commodities and emerging markets rates at Barclays Capital in London, today said that regulatory rules could adversely impact the development of a mature energy trading market.

The waiting game

The Italian power market has finally opened to competition, but how long willenergy users have to wait until they can trade on the new electricity exchange? Joe Marsh reports

The cost of optimism

Petroleum engineers and financial regulators have never spoken the same language,as the recent Royal Dutch/Shell debacle has shown. And this has led to confusionover state oil reserves. By Maria Kielmas

Reliably informed

Pat Wood, chairman of US interstate energy regulator the Federal Energy RegulatoryCommission, talks to James Ockenden about reliability, regulation, and wherenext for the competitive market in the US

Isda raises Basel-linked concerns

Bankers have been preparing for the implementation of the Basel II Capital Accordfor a number of years. But Isda says that it is still concerned about the effectthe Accord may have on the commodities markets. By Paul Lyon

Governments face carbon allocation legal action

European governments face legal action from industry if they fail to provide carbon allocation plans by the end of the year, according to Peter Vis of the climate change unit of the European Commission.

European companies outline concerns over emissions trading

Corporates are expressing concern at the ramifications of the European UnionEmissions Trading Scheme – just as EU member states finalise their nationalallocation plans. By Paul Lyon

Deutsche asks SEC to clarify guidelines

Deutsche Bank claims the SEC’s guidelines for estimating oil reserves are outdated. And Shell, unsurprisingly,also believes that the SEC should clarify its reserve rules. By Joe Marsh