Operational risk

Gazprom and EDF announce transatlantic gas swap

Gazprom Marketing & Trading and EDF Trading have announced details of an agreement to swap natural gas between the US and European markets.

Parity Energy introduces WhenTech valuations

Electronic trading platform Parity Energy has launched real-time option pricing through a collaboration with WhenTech Markets, a risk management and pricing software programme.

International energy regulator launched

The creation of the International Confederation of Energy Regulators (ICER), a group of 12 regional energy regulatory associations, was announced by John Mogg, president of the Council of European Energy Regulators (CEER), at the fourth World Forum of…

BlueNext launches outright spread contract

BlueNext has introduced an outright spread contract that will allow members to price the difference between spot European emission allowances (EUAs) and certified emission reduction (CER) contracts.

StanChart signs $500m risk-sharing deal with Ofid

A $500 million trade-finance agreement has been signed between global bank Standard Chartered and the Organisation of Petroleum Exporting Countries Fund for International Development (Ofid), which aims to boost world trade flows for emerging market banks.

Record high sugar prices hit ethanol market

Ethanol prices in Brazil have recently risen due to a decrease in production. According to experts, record high sugar prices in the region are encouraging mills to refine sugar over ethanol, which is giving a 50% better return.

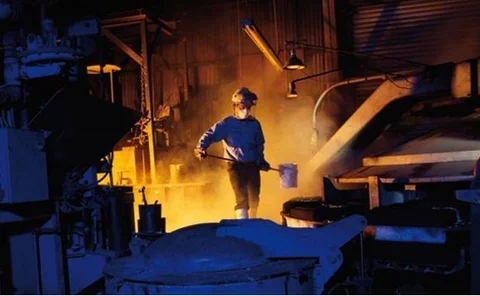

Sponsored statement: Perilous markets demand enterprise-wide risk management

Rampant volatility, illiquidity, dramatically shifting relationships between physical products and financial instruments and the scarcity of credit are stressing energy and commodity markets like never before. Against this backdrop of uncertainty, says…

Corporate profile: VTB Capital: A new entrant in the commodities market

Sergei Timokhovitch, Global Head of Commodities, discusses VTB Capital’s ambitious plans to develop its commodity business in these risky operating environments

Commodity focus: Eurex is Entering the Commodities Space

Ralf Huesmann, Product Strategy, discusses Eurex’s increased activity in alternative asset classes as market trends change and appetites increase

Corporate statement: Are you re-evaluating your energy risk management provider?

Many energy-price-dependent organisations, such as utilities, independent power producers and oil and gas producers, saw their hedges at risk with the crumbling balance sheets of several key hedge providers. The global credit crisis has forced many…

Nord Pool Spot expands into Estonia

Nordic power exchange, Nord Pool Spot, has announced plans to incorporate Estonia into its pricing area for physical power from April 2010.

Cutting edge: Visualising value-at-risk

Risk transparency is an important yet elusive goal of any risk management process. One challenge is to understand the diversification effects of the portfolio elements. Wentao Zhao and Kevin Kindall introduce a graphical technique based on value-at-risk…

RWE acquires Essent

The sale of the largest energy generator in the Netherlands, Essent, to German utility RWE was completed on September 30 in a €7.3 billion deal.

Market focus: derivatives - Risky business

Companies that are heavy consumers of energy are particularly susceptible to market volatility. For such end-users, proper use of risk management techniques can mean make or break, says Eric Fishhaut of GlobalView

Evaluating credit & market exposure

Today’s volatile energy prices and the lower creditworthiness of some energy intensive users means energy providers have to assess counterparty risk thoroughly. David Coffman of GDF SUEZ Energy Resources provides some tips for assessing risk in the non…

Taking a health check

When global economic recovery eventually takes place, it is essential energy trading organisations are in a position to capitalise on market changes. Julie Shochat and Ryan Rogers of Enite set out some guidelines

Power adaptor

Alpiq Group was created at the beginning of 2009 as a result of the merger of Swiss utilities Atel and EOS. Peter Heydecker, head of trading and services, talks to Rachel Morison about Alpiq’s culture and presence in European power markets

Too much of a good thing

The price of US natural gas has hit record lows, but with storage fit to burst and demand in the doldrums, any hope of a price pick-up may remain a pipe dream for now, writes Pauline McCallion

Get ready for the revolution

Global events and climate change have fundamentally changed the face of energy procurement. Chris Bowden of Utilyx looks at the issues facing energy-intensive businesses in the UK

Buying smart

Guy Newsam, general manager at Muntons, a UK-based energy-intensive corporation, talks to Katie Holliday about how the company is addressing its exposure to volatile energy costs and carbon risk