Oil

IEA slashes Gulf of Mexico supply forecasts

Repercussions from the BP oil spill force the International Energy Agency (IEA) to slash supply forecasts.

Oil market recovery hinges on China

Oil market recovery will rest mainly on China for the next 15 years, says the International Energy Agency (IEA)

Sponsored Q&A: Standard Bank

With African roots and a presence in 17 African countries and 33 countries worldwide, Standard Bank has been working with commodities clients since 1994. In 2006, the bank hired Janelle Matharoo as managing director, global head of energy sales & trading…

London conference report

Energy risk managers met in London in October for Energy Risk’s Europe 2010 conference to discuss the latest developments and prospects for the energy and commodities markets as the economic recovery takes root amid sweeping regulatory changes. Katie…

Europe – Threat to long term oil supplies

European domestic reserves of crude oil are declining at a rapid pace and with European energy demand set to pick up, the region could be exposed to additional security of supply risks, reports Katie Holliday

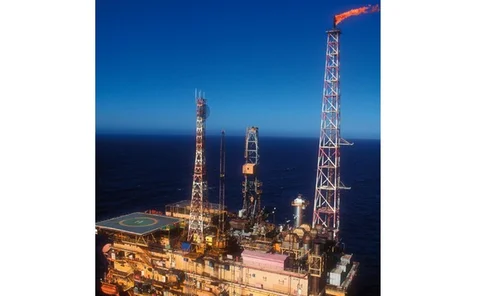

Oil report: US toughens up after BP oil spill

Pauline McCallion speaks to industry experts about the outlook for US offshore E&P and how risk management strategies are changing in the wake of the BP spill last April

Oil price outlook

Despite oil prices staying tightly within range over the past year, Lianna Brinded finds out that most analysts see prices becoming more closely correlated to supply and demand fundamentals and edging higher, with $100/bbl expected for 2012

Petrobras raises the stake for unconventional oil

The Petrobras share sale at the end of September set a world record, with $70 billion raised. Alex Davis examines how this is a good omen for risk appetite in deep-water drilling

Energy giants: IOC, NOC tie-ups mean better risk management

International oil companies (IOC) and national oil companies (NOC) need to contractually work more together to enhance energy risk management, say energy chiefs

Qantas’s head of risk: hedging programme is too conservative

Qantas Airways’ head of risk believes the company could take more risks within its hedging programme

End-users rush into hedging oil prices

End-users are ploughing into hedging their oil positions, as prices remain in a tight range, says Standard Chartered Bank’s head of energy and environmental research

Goldman Sachs: end-users hedge oil prices now for 2011

Crude will be "the bottleneck in the system, rather than refining" says the investment bank

IEA: oil price volatility negated by non-OECD demand

The International Energy Agency (IEA) says that non-Organisation for Economic Co-operation and Development (OECD) countries’ energy demand negates the volatile effects following BP’s Gulf of Mexico oil spill

Russian / CIS exchanges to launch more derivatives contracts

Chiefs at Russia’s RTS Stock Exchange, the Ukrainian Exchange and Kazakhstan’s Regional Financial Centre (RFCA) reveal that they are looking into launching more exchange-traded funds (ETF), indexes and other derivatives contracts across commodities and…

Mexico’s Pemex looks to shale gas development

Mexico’s main energy company Pemex says it is looking to replicate the US’s success in shale gas by entering the lucrative industry in its own country

France to tighten commodity derivatives regulation

France has warned the European Commission that it will tighten its commodities derivatives regulation to prevent the risk of big swings in commodities prices

“New price on risk” for Gulf of Mexico producers

Government and regulators are urged to act quickly to create a stable regulatory regime in the wake of the Macondo oil spill or risk stifling domestic production

China's Sinopec: gas production up 40% as demand grows

China’s state-owned energy giant Sinopec reveals natural gas production soars by 40%, as proven reserves ebb lower, suggesting heightened imports are on the horizon

BP’s Gulf of Mexico oil spill will not push fuel switching

Experts quash fears that tighter restrictions following BP’s Gulf of Mexico oil spill will result in oil to gas fuel switching in the US, thus pushing up gas prices

China’s drop in oil demand is "warning sign’"

Alarm bells hit the market after China’s oil demand slump signals a possible unexpected slowdown in energy demand growth

Trading group fined $12 million for inflating oil price

CFTC fines ConAgra Trade Group for artificially pushing crude to $100 per barrel in January 2008, the year prices hit all-time peak of $147 per barrel

Singapore’s commodities derivatives exchange to go live

Singapore’s central bank Monetary Authority of Singapore (MAS) gives the green light for new commodity and currency derivatives bourse