Markets

ICE proposes $10 billion merger with CBOT

The IntercontinentalExchange (ICE) has made a proposal to the Chicago Board of Trade to combine the two companies in a stock-for-stock transaction that would create the world’s most comprehensive derivatives exchange, ICE announced today.

El Paso expands 2007 hedge program

El Paso Corporation, one of North America’s largest independent natural gas producers, has announced that it has restructured and expanded the hedge program that supports its natural gas production for 2007.

SG, Rhodia launch emissions company

Société Générale and Rhodia Energy Services, a global specialty chemicals company, have formed a joint venture company to trade carbon.

Jaime Roman, risk managing director, Endesa, Spain

Jaime Roman is chief financial officer and risk managing director at Spanish utility Endesa. Holding a PhD in Electrical Engineering, he was in academia before being approached to join Endesa in 1997

Nymex's death knell to floor?

The New York Mercantile Exchange's decision to introduce side-by-side electronic and open-outcry trading heralds the beginning of the end for its floor trade, many market participants believe

Utilities shift towards longer-term hedging

US and Canadian regulated utilities are increasingly looking to put on longer-term hedges, even more than three years out in some cases. Such was one of the findings of an informal survey of the audience at a utility risk-management conference in Chicago…

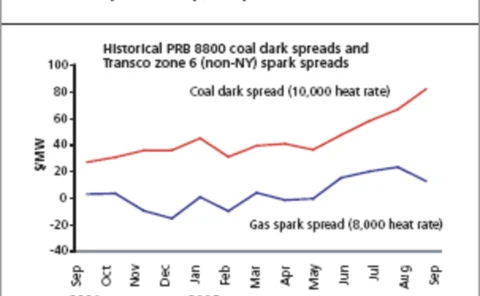

Counting on coal

NRG Energy's move to buy Texas Genco seems a wise one for a company with strong dark-spread exposure, but it has its risks, despite the target company being backed by an active hedging programme. Joe Marsh reports

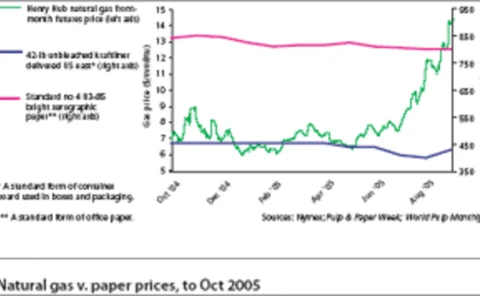

Papering over the cracks

High energy prices are forcing pulp-and-paper makers to take action against falling profits, yet most companies are still shying away from energy price hedging. But that situation may be slowly changing. Joe Marsh reports

A disciplined approach

E&P companies tend not to strategically hedge in a rising market. But there are good reasons for them to do so, and some are sticking to their hedging strategies, despite suffering losses on their derivatives contracts. By Joe Marsh

A growing concern

Despite high natural gas prices, Canadian fertiliser maker Agrium has been posting strong profits, while some rivals have struggled. The company’s risk-management strategy has been a significant factor in its success. By Joe Marsh

Just a seasonal swing?

US natural gas market volatility is keeping trading volume high. But is this just a seasonal phenomenon or part of a long-term trend? Catherine Lacoursiere reports

Hanging on at the top

This year’s User Choice Awards demonstrate that quality counts. In a fast-changing market, the top vendors and packages have managed to stay ahead of the pack. But the winners cannot rest easy. With IT budgets deflated, it’s a competitive market, and…

Nymex confirms plans to launch in London

The New York Mercantile Exchange (Nymex) today announced plans to open an open-outcry Brent futures floor in London. "It's our intention to move to London as soon as possible," Nymex president James Newsome told reporters in London.

Caught short

Given the difficulty China Aviation Oil is having closing its remaining illiquid positions, its derivative trading losses may be greater than first thought. James Ockenden and Stella Farrington report

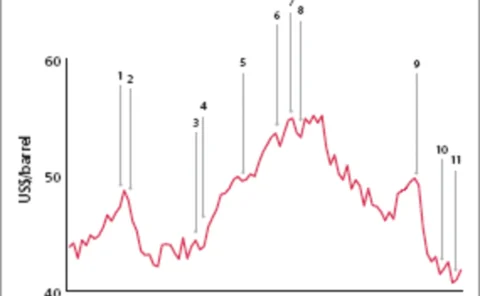

Sovereign solutions

As we saw last month, most governments prefer stabilisation funds over hedging to protect against oil price risks. But multilateral institutions such as the World Bank advise otherwise. By Maria Kielmas

AsiaRisk Awards

Here we feature two outstanding winners from our sister publication AsiaRisk’s Annual Awards, published in October. Thanks largely to Macquarie Bank, alternative investments are gaining a real foothold in Australia, while Westpac has been instumental in…

Weather wisdom with risk management

Mark Tawney from Swiss Re spells out the implications of not keeping an eye to the weather

Teething troubles

Following decades of cloistered state control and the exit of a number of largeUS players, the Australian power market is going through a period of hiccups. Paul Lyon reports on the outlook for the country’s electricity sector

The troubleshooter

After struggling for a year with a difficult Triple Point installation, US energycompany Cinergy brought in energy IT veteran Joel McKnight. Nine months on, implementationand integration is complete. By Joe Marsh

Faith in the figures

There are signs that price reporting will remain voluntary, despite the drop-offin reporting levels, but proposals are still being made on all sides. EricFishhaut looks at the progress being made to achieve greater price transparency

The waiting game

The Italian power market has finally opened to competition, but how long willenergy users have to wait until they can trade on the new electricity exchange? Joe Marsh reports