Market risk

The value of volatility

Brett Humphreys and Tim Essaye seek out the best method for calculating volatility by comparing different measures, and find that complex approaches aren’t necessarily the best ones to use

Unleaded prices feel the heat

Data management and analytics specialist FAME Information Services looks at the effect the US driving season is having on US gasoline prices, taking into account various factors – in particular, the big impact of higher crude oil prices this summer

Building a bridge to Var

Value-at-risk (Var) is a technique often applied to the energy industry. But there are limitations to its use. Here, Leslie McNew aims to bring these limitations to light, and thereby give practitioners confidence in the use of Var

Rating agencies raise the bar

Confidence in energy traders has never been lower, and the metrics the rating agencies apply to their business are changing. James Ockenden assesses the damage

Natural gas storage: a market driver changes horses

Given the importance of natural gas storage figures to energy market traders and analysts, a change in the provider and timing of the data release is an event of some significance. Software provider Logical Information Machines reports

Discovering new frontiers

Joerg Engels and Volker Linde report on the changes Germany’s deregulated energy market will have to make as a result of the country’s banking act

Mean-reverting smiles

Commodity markets such as crude oil exhibit mean reversion as well as option smiles. David Beaglehole and Alain Chebanier meet this challenge, constructing a model suitable for pricing exotic options in these markets

Utilities renegotiate to survive

For the past 10 years, Argentina’s privatised utilities have been icons of successful energy sector reform. But with the country’s deepening crisis, they face increased difficulties. What can investors do to mitigate such risks, asks Maria Kielmas

Mixed signals from the east

Flaws in Poland’s electricity regime have crippled Warsaw’s two-year-old power exchange. But Slovenia’s power exchange is faring rather better. Peter Joy reports

A cure for Enron flu

Brett Humphreys discusses recent events in the energy sector and the role risk managers can play in improving the industry

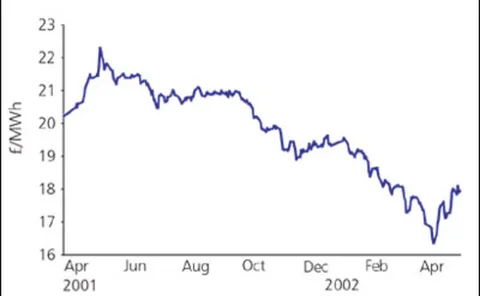

Worth waiting for?

Just over a year on from the delayed launch of the UK’s new electricity trading arrangements, prices have dropped to new lows. But just how low can generators go, asks Joel Hanley

Storing up the gains?

Natural gas prices are climbing again, and energy companies are reacting by putting in place new hedges, as Kevin Foster discovers