Commodities

Teething troubles

Following decades of cloistered state control and the exit of a number of largeUS players, the Australian power market is going through a period of hiccups. Paul Lyon reports on the outlook for the country’s electricity sector

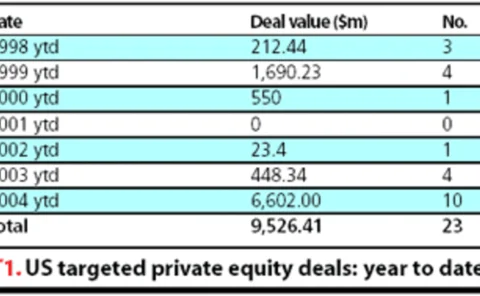

Buyouts are back

Private equity funds have been making bold inroads into energy markets in the past year – the number of deals has doubled since 2003, and the acquisitions are getting bigger. CatherineLacoursiere reports

Dominion agrees price for USGen assets

Virginia-based energy producer Dominion looks set to acquire three power plants from Maryland-based USGen New England for $656 million. However, an auction process is due to take place before the deal closes to ensure no other bidders are willing to top…

Merrill Lynch snaps up Entergy-Koch Trading

Investment bank Merrill Lynch is set to acquire the energy trading businesses of Entergy-Koch Trading (EKT), a joint venture between New Orleans-based Entergy Corp and Koch Industries in Kansas. Energy Risk reported in June that the bank was a top…

Energi E2 chooses KWI for multi-commodity trading

Danish energy production and trading company Energi E2 today signed up for K2, the integrated energy trading and risk management system from London-based KWI. Energi E2 will use the software for multi-commodity trading, with the aim of reducing its…

Banc of America Securities hires senior oil analyst

Banc of America Securities (BAS) yesterday hired Daniel Barcelo as a senior equity research analyst covering the global integrated oil sector. He joins the Bank of America subsidiary from rival bank Lehman Brothers and will be based in New York. He will…

Edison Mission sells off foreign power assets, posts Q2 loss

California-based Edison Mission Energy is to sell its remaining foreign generation assets to London-based generator International Power and Japanese trader Mitsui & Co for $2.3 billion. International Power will take a 70% stake and Mitsui a 30% stake of…

BNZ enters energy trading

The Bank of New Zealand (BNZ) has launched an energy risk management desk. The plan is to target the bank’s corporate client base who need hedging solutions for their energy, base metals and agricultural commodities exposures, said Wayne Jolly, BNZ’s…

Power financing up one third to $20 billion

Power was the best performing project finance sector in the first six months of 2004, up by a third compared with the same period last year, according to research by London based global banking analyst Dealogic. Power projects accounted for 39% of total…

The troubleshooter

After struggling for a year with a difficult Triple Point installation, US energycompany Cinergy brought in energy IT veteran Joel McKnight. Nine months on, implementationand integration is complete. By Joe Marsh

Faith in the figures

There are signs that price reporting will remain voluntary, despite the drop-offin reporting levels, but proposals are still being made on all sides. EricFishhaut looks at the progress being made to achieve greater price transparency

Nordic volumes heading south

Nordic region electricity trading volumes are falling fast, which is damagingprofits at Oslo-based power exchange Nord Pool. The company may face postinga loss for 2004 if it cannot reverse this trend. Joe Marsh reports

Tepco hedges weather

The Tokyo Electric Power Company (Tepko) has entered into weather derivatives contracts with both Tokyo Gas Company and Osaka Gas Company. The deals have been finalised in a bid to limit the effect on Tepco’s earnings from summer temperature conditions,…

Merrill Lynch tipped to bid for EKT

Rumours are circulating that Merrill Lynch may snap up Entergy-Koch Trading (EKT) following last week’s news that New Orleans-based Entergy Corporation and Wichita’s Koch Industries are considering selling their Houston-based energy trading business.

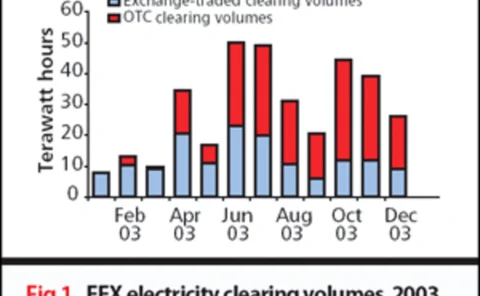

Taking the slow road

Recent developments suggest that clearing is likely to gain widespread acceptance in the European energy market. Market participants feel it is a question of how and when – not if – robust, liquid solutions will emerge. By Joe Marsh

LNG drive gears up

The global push for LNG has reached a new level – particularly in the US. Big players had projects rubber-stamped or proposed further terminals, and the inaugural LNG summit took place. Joe Marsh reports

Risk at the margin

Competition and deregulation has led to new ways of running utilities, and the commodity-trading model has emerged as the leading approach. But the challenge lies in how it is applied, argues Lawrence Haar

Banks grab distressed UK assets

Six European banks intend to buy around 10GW of distressed UK power assets usingfinancial instruments. But their main rival, MMC, says hard cash is needed towin the UK market. By James Ockenden

The future of freight

The Baltic Exchange has recently shelved plans to offer freight derivatives,yet rising freight rates should aid the development of the embryonic forwardfreight agreement market. By Paul Lyon

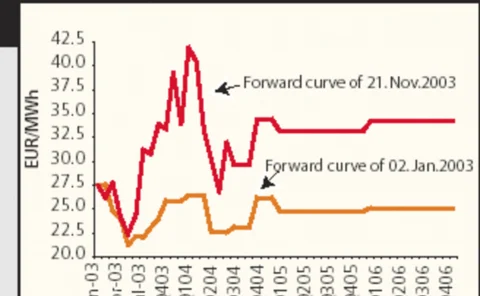

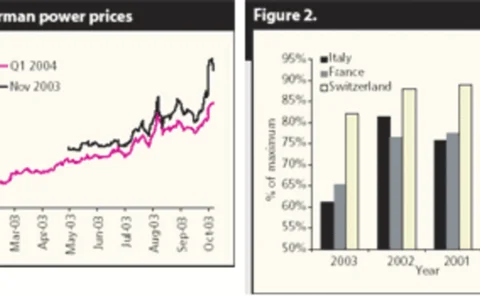

Searching for sellers in 2003

High volatility and rising prices in 2003 clearly above fundamental levels signal the need for improved guidelines from legislative institutions andeasily accessible information

The future of ETRM

As generation, trading and retailing companies come out from under the dark cloud to prepare for what looks to be a brighter future, one issue has become critical – the need to upgrade outdated ETRM systems with 21st century architecture, portfolio…

Creative challenges in customer-driven risk management

Shell Trading’s Ken Gustafson and Jemmina Gualy shed light on the environment in North America for customers and dealers in risk management, and look at the opportunities ahead for the business

Weathering the problems

Weather derivatives can reduce or eliminate the potential economic disastersthat extreme weather can provoke. Ross McIntyre of Deutsche Bank examines thevarious ways in which weather can affect key industries and reviews the benefitsof weather derivatives

Farms weather power shortages

Farmers in both hemispheres are struggling to cope with heat waves and droughts while pondering the prospect of future power supply disruptions, finds Maria Kielmas