Commodities

The end of an era?

Latin American governments are hiking taxes and forcing changes to contracts with oil and gas investors in a marked departure from the economic liberalisation of the 1990s. But reality may prompt a rethink, writes Maria Kielmas

Coping with setbacks

Most risk managers and employees in energy companies are familiar with the concepts of market risk and credit risk, but operational risk is receiving more attention in corporate boardrooms these days, writes Sandy Fielden

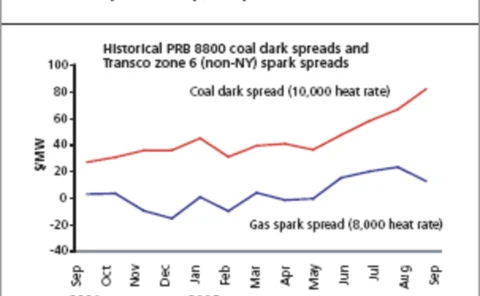

Spectron brokers first UK dark spread

The first brokered UK dark spread has been traded through UK-headquartered brokerage Spectron. The trade, between Sempra and Scottish Power was a Summer ‘06 deal, representing 5,000 tonnes of coal (API#2) versus 15 MW of electricity. It is understood to…

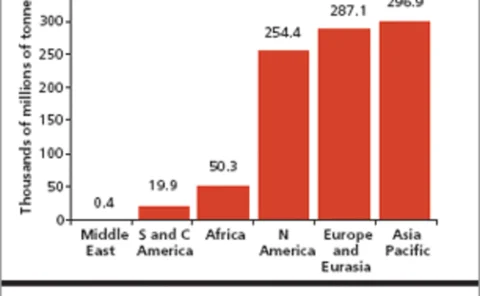

A comeback for coal

With gas prices soaring, it seems inevitable that coal - the Cinderella of energy resources - is bound to return to the forefront. But how long will it last? asks Eric Fishnaut

Commodities Count 2006

The recent swell in energy market participants means the battle for dominance has never been fiercer, but the increased competition means ever-more sophisticated product offerings, finds Stella Farrington

FPL/Constellation merger could be tip of iceberg

High gas prices look set to usher in a wave of fresh consolidation in the utility sector, as companies strive to save costs

What drives natural gas?

Natural gas prices in the US are at an all-time high. The Gulf Coast hurricanes and record summer heat have taken their toll, and business is feeling the effect. Studying and applying seasonality can often protect aganst the volatility of these markets,…

Counting on coal

NRG Energy's move to buy Texas Genco seems a wise one for a company with strong dark-spread exposure, but it has its risks, despite the target company being backed by an active hedging programme. Joe Marsh reports

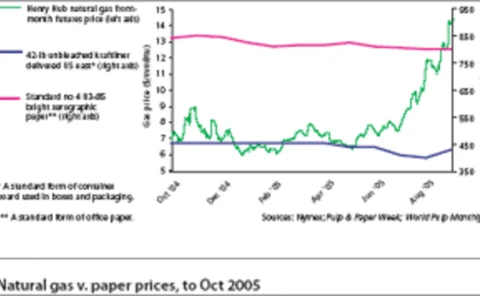

Papering over the cracks

High energy prices are forcing pulp-and-paper makers to take action against falling profits, yet most companies are still shying away from energy price hedging. But that situation may be slowly changing. Joe Marsh reports

King coal still fired up

Despite the soaring cost of emissions reduction credits, the EU emissions trading scheme has yet to dampen utilities’ demand for coal. But, finds Oliver Holtaway, it may affect their long-term investment decisions

No sign of a slowdown

The fundamental outlook for coal looks price supportive for some years to come, but with other fuel prices sky high, coal looks set to retain its market share of electricity generation this decade. Stella Farrington reports

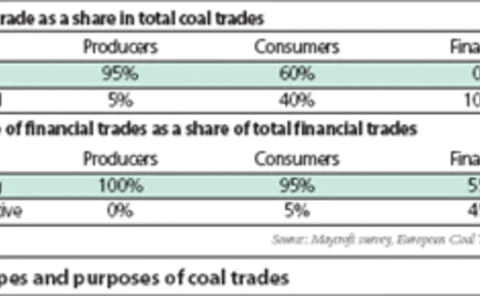

Coal facing changes

Coal derivatives trading is gaining popularity among coal consumers, producers and financial institutions in Europe, according to a recent survey of market players. Cyriel de Jong and Kasper Walet discuss the study’s results

A disciplined approach

E&P companies tend not to strategically hedge in a rising market. But there are good reasons for them to do so, and some are sticking to their hedging strategies, despite suffering losses on their derivatives contracts. By Joe Marsh

Icap to acquire United Fuels International

Interdealer broker Icap is to acquire the majority of the assets of United Fuels International, a leading US-based energy broking business with 2004 turnover of $24 million.

Baiting the hook

End-users such as utilities and industrial companies are not showing the same keenness as hedge funds for trading weather derivatives, despite the efforts of banks, dealers and brokers to lure them in. By Joe Marsh

Pricing the weather

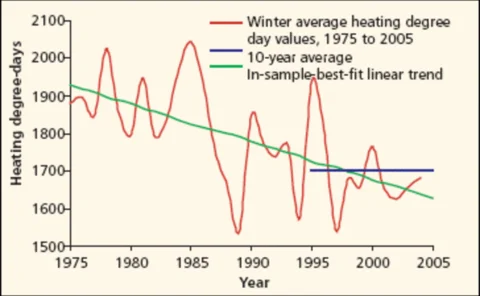

Pricing weather derivatives is different from valuing other derivatives contracts – actuarial methods play a greater role. Steve Jewson looks at the varied approaches available

Strength in numbers

Weather derivatives seem to have a bright future: the market is enjoying record liquidity levels as new players, trading ever more diverse products, flood into the market. Oliver Holtaway reports

Former Swiss Re weather experts launch hedge fund

Weather risk veterans Mark Tawney and Bill Windle, who left global reinsurer Swiss Re on July 7, are starting a hedge fund, named Takara, Energy Risk has learned. Weather trader Bill MacLauchlan departed Swiss Re at the same time, for personal reasons.

BNP Paribas strengthens energy derivatives team

French bank BNP Paribas has strengthened its commodity derivatives team in New York, London and Singapore, particularly on the energy side.

Calpine to sell US oil and gas assets for $1bn

Calpine Corp is to sell all its US oil and gas exploration and production assets for $1.05 billion to Rosetta Resources, a newly formed subsidiary of the California-based energy company.

A growing concern

Despite high natural gas prices, Canadian fertiliser maker Agrium has been posting strong profits, while some rivals have struggled. The company’s risk-management strategy has been a significant factor in its success. By Joe Marsh