Carbon compliance markets

Off to a flying start

Aviation is one of the fastest growing sectors in terms of carbon emissions, but a move by the European Commission to include airlines in the EU's Emissions Trading Scheme has alarmed some in the industry

Carbon complexities

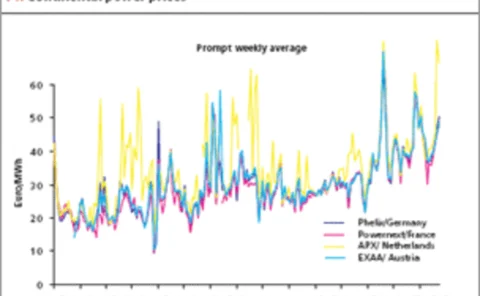

The EU ETS adds price complexity to European energy markets and the trend towards pan-European markets means far more complex models will be needed to model carbon risk, writes Bjorn Brochmann

UKPX to launch carbon spot contract on Climex

London-based energy exchange UKPX will co-operate with Dutch emissions exchange New Values to launch a UKPX spot contract for carbon emissions certificates.

EEX to launch carbon derivatives contract

The European Energy Exchange (EEX) plans to launch a futures contract for carbon emissions allowances in October, pending regulatory approval.

TFS starts brokering CDM and JI emissions credits

TFS, a New York-based inter-dealer broker, has started brokering emissions credits under the Kyoto Protocol’s Clean Development Mechanism (CDM) and Joint Implementation (JI) schemes.

King coal still fired up

Despite the soaring cost of emissions reduction credits, the EU emissions trading scheme has yet to dampen utilities’ demand for coal. But, finds Oliver Holtaway, it may affect their long-term investment decisions

The cost of power

The market in European Union emissions allowances is taking off, largely thanks to Nord Pool

TFS brokers first Nymex emissions contract

Global broker Tradition Financial Services (TFS) has brokered the first transaction on the New York Mercantile Exchange (Nymex) emissions futures contract.

Emissions education

As the European carbon market continues to grow, so too do some unique challenges: not least the gap between retail and wholesale players and the problem of counterparty credit risk. Oliver Holtaway reports

A calculated gamble

After a promising start, Canadian carbon trading has slowed. The country has much work to do if it wants to get a domestic greenhouse-gas trading market running ahead of the 2008 Kyoto deadline. By Catherine Lacoursiere

Austrian Energy Exchange launches emissions trading

The Austrian Energy Exchange, EXAA, joined the ranks of European exchanges trading emissions yesterday with its first spot auction of European Union CO 2 allowances (EUAs).

ECX and Powernext team up on carbon trading

French electricity exchange Powernext and the Amsterdam-based European Climate Exchange (ECX) have agreed to jointly offer carbon futures and spot contracts. The partnership is complimentary, because ECX lists a futures contract and Powernext offers a CO…

Nymex to launch emissions futures on ClearPort

The New York Mercantile Exchange (Nymex) is to introduce sulphur dioxide (SO 2 ) and nitrogen oxide (NOx) futures contracts on Nymex ClearPort on June 19 for the June 20 trading session, the exchange said today.

New carbon brokerage targets non-power-sector SMEs

Three senior players in the European emissions trading market have launched Carbon Capital Markets, a broker-dealer service that targets small to medium-sized companies (SMEs) outside the power sector.

Powernext to launch spot carbon contract in late June

French electricity exchange Powernext will launch its delayed CO 2 emissions spot market on June 24, barring any technical or administrative difficulties among market members.

Barclays Capital in first Leba carbon index trade

Barclays Capital has completed the first financial carbon trade using the new Leba Carbon Index for "a significant volume" of EU emissions allowances.

TFS continues expansion with Arc Oil purchase

Connecticut-based broker TFS is in fierce expansion mode: yesterday it announced its purchase of oil broker Arc Oil, an oil broker headquartered in Houston. This follows TFS’s recent opening of a Houston office and re-entering US coal and emissions…

Point Carbon buys Natsource Scandinavia’s analysis unit

Carbon emissions consultancy Point Carbon has bought Natsource-Tullett Scandinavia, Europe’s largest power and gas analysis firm, but will disband Natsource’s Oslo brokerage operations. The move adds power and natural gas market analysis to Point Carbon…

Carbon copycats

The EU emissions trading scheme, which started in January this year, is already attracting the attention of hedge funds, who see opportunities in this developing and less crowded market, finds Solomon Teague

Clearer signals ahead

Estimating CO2 prices in the first Kyoto budget period of 2008–2012 is now a key risk-management challenge for utility analysts. Abyd Karmali, Sebastian Foot and Nazim Osmancik look at what is likely to drive prices in this period

Vying for top spot

Emissions traders will soon be looking beyond simple forward trades towards options, swaps and exotic derivatives. But for these markets to develop, a tried and trusted index or daily assessment must emerge. Several firms are now vying to become the…

Signs of the times

A comprehensive Energy Risk survey into emissions trading finds there is widespread confidence in the development of the market, but less conviction that the scheme will tackle global warming. Stella Farrington reports