Feature

Energy firms use high-tech tools to avert manipulation fines

As regulators tighten their scrutiny of commodities trading and impose costly penalties for market manipulation, energy firms are stepping up investment in trade surveillance. But properly implementing trade surveillance systems in commodity markets is…

Quants: how they shaped the modern energy market

Nowadays, quants are well established in energy trading. But the original introduction of quantitative techniques to the industry was far from straightforward, with a lot of hard work involved in adapting financial market models to the energy arena…

JP Morgan and Mercuria reveal post-transaction plans

Icap Energy chief Newman steps down; PetroChina hires products head; BAML makes commodities hires; E.on recruits Barclays power and gas head; Evolution launches US power desk

European gas hubs stand to benefit from crisis in Ukraine

Escalating tensions between Russia and the West over Ukraine have taken energy market participants by surprise. With the potential for tougher sanctions, industry observers believe one outcome could be an acceleration of Europe's shift away from oil…

Credit fears hold back US solar securitisation deals

In a major breakthrough for renewable energy finance, California-based SolarCity has issued the first securities backed by distributed solar assets. But many hurdles remain before solar securitisation can truly take off, Alexander Osipovich finds

Looking back: Nymex moves into ‘classy’ new headquarters

CME Group’s Nymex trading floor is now sparsely populated, but back in 1997, the exchange was in urgent need of additional capacity, as Energy Risk reported in May that year

Derivatives trading rises in North American regional crudes

As North American crude oil production surges, liquid financial markets are developing around grades such as Louisiana Light Sweet, Western Canadian Select, Mars and Midland, changing the behaviour of both physical hedgers and financial traders…

Carbon emissions trading spreads across the globe

Traders’ enthusiasm for the European Union Emissions Trading System has slumped during recent years. But at the same time, there have been a variety of significant developments in carbon markets elsewhere around the globe. Gillian Carr rounds up some of…

End of an era as Masters leaves JP Morgan

Goldman appoints commodities co-head; CFTC's Chilton joins law firm; energy traders flee Barclays; Alan Koh rejoins Morgan Stanley; head of oil trading quits Citi

Banks tussle to join next generation of commodity dealers

Facing low volatility, a lack of trading opportunities and compliance headaches, major global investment banks are pulling back from commodities. But at the same time, a number of smaller and regional players are actively seeking to increase their…

CFTC upping enforcement effort, warns former chief

David Meister, former director of enforcement at the US Commodity Futures Trading Commission, speaks exclusively to Alexander Osipovich about market manipulation, high-frequency trading and the value of Dodd-Frank reporting rules for financial watchdogs

Looking back: oil market's future is different from its past

By 1994, the oil industry had changed irrevocably due to the increased use of derivatives – a trend that was discussed by Edward Krapels in an article for Energy Risk in June that year

Morgan Stanley crowns King as head of oil liquids

PetroChina hires BAML trader; Freepoint takes on BAML gas duo; Yew moves to GDF Suez; BAML hires FICC trading chief; Goldman metals trader leaves bank

Firms expect power market coupling to have tangible impact

The process of power market coupling is continuing across Europe, with the largest and most ambitious project to date going live in February. But how do market participants feel about market coupling and how it will affect their businesses? Stella…

Applied risk management series: Active VAR management

In this article, Carlos Blanco introduces a set of tools to assist traders and risk managers in actively managing the value-at-risk of energy derivatives portfolios

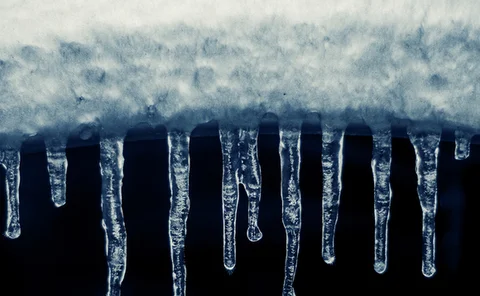

Polar vortex revives interest in gas and power hedging

A brutally cold winter in the eastern US has roiled natural gas and power markets and shocked energy consumers that had grown accustomed to cheap, abundant shale gas. Such firms are now hedging more actively, Alexander Osipovich finds

Energy Risk marks 20 years of covering energy markets

Energy Risk was first published back in February 1994. Since then, its fortunes have risen and fallen with those of the wider energy risk management industry. Mark Pengelly reflects on the highs and lows of the first 20 years

Renewables subsidy shift brings opportunity for energy firms

Germany began encouraging renewable generators to directly market their own production in 2012, reflecting a trend of giving renewables greater exposure to wholesale markets across Europe. That could spell an opportunity for more well-established energy…

FTR underfunding leaves PJM power traders out of pocket

Energy firms in the eastern US are upset about the underfunding of financial transmission rights (FTRs) in the PJM power market, saying it has made FTRs useless as a hedging tool. But even though its price tag has exceeded $1 billion, the problem shows…

Looking back: Post-Enron nerves give way to longer-term fears

By January 2002 – just one month after US energy giant Enron filed for bankruptcy – the more lasting implications were becoming clear in the pages of Energy Risk

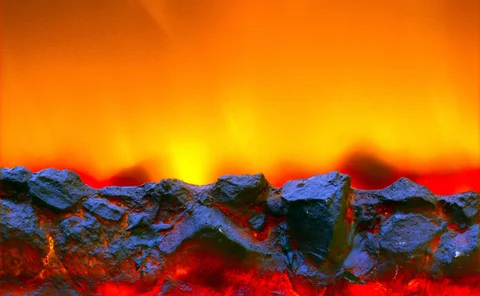

Coal derivatives market fosters burning ambition

Increased attention from both traders and hedgers is providing a boost to the coal derivatives market, say participants, fuelling the success of the API 8 index linked to Chinese coal imports and stimulating further product development efforts elsewhere…

Enforcement director nominated for Ferc chair

Centrica hires Hess market risk director; Vattenfall names trading head; Gazprom recruits BAML power trader; Baltic Exchange names Singapore head; Mitsubishi UFJ in commodity retreat

Fed probes catastrophic risks in bank physical commodity trading

The US Federal Reserve has moved to tighten the rules on physical commodity trading by banks, citing fears they might suffer huge losses as a result of an environmental disaster. How valid are such concerns and what steps is the Fed likely to take?…

Emir reporting date sparks 'mad rush' in energy derivatives market

A requirement to report trades under the European Market Infrastructure Regulation kicked in on February 12, creating a rush to comply among energy derivatives market participants. Some firms have struggled with the rules, and say a lack of support from…