European Union (EU)

Uncertainty over phase III EU carbon plans a ‘nightmare’

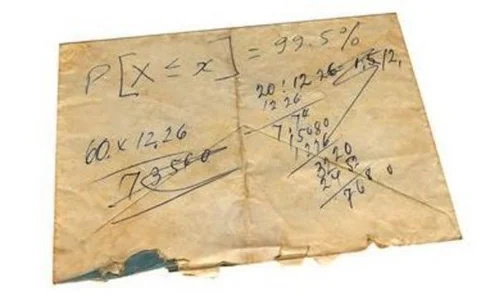

Risk managers face a CDM ‘nightmare’ when managing their carbon portfolios in the face of post-2012 uncertainties, according to carbon market experts, as Katie Holliday reports

Special video report: regulatory strategies from chief risk officers

With regulatory changes and new markets impacting the energy and commodities markets, Lianna Brinded files this exclusive special video report showcasing the views of leading risk managers and quantitative analysts on how to tackle these challenges

EU rules changes may cause power market liquidity risk

Power market risk managers face a new set of liquidity and market risks if the European Union (EU) enforces proposed regulation changes, says RWE chief

Regulation, liquidity and risk management strategies

US derivatives regulation is likely to have far-reaching consequences for energy companies, but how will it affect the liquidity risk management strategies developed in the wake of collateral management events of the past decade? Pauline McCallion reports

Uncertainties over Europe's long-term gas supplies

Major exploration and infrastructure projects designed to ensure security of supply of natural gas to Europe have been delayed by political wrangling and investment uncertainty in recent years. If gas demand recovers from the impacts of the recession,…

EDHEC-Risk slams France on commodity derivatives regulation

Influential risk management and analytics business school, the EDHEC-Risk Institute, has criticised France for its hardline approach to commodity derivatives market regulation on lack of evidence

France to tighten commodity derivatives regulation

France has warned the European Commission that it will tighten its commodities derivatives regulation to prevent the risk of big swings in commodities prices

China CDMs plummet by 30% on legality risk

The number of approved Clean Development Mechanism (CDM) projects in China tumbles by 30% after investors voice concerns that the generated credits will not be legal under future emissions' regulation

Brokers establish own carbon trading risk tests

Carbon brokers establish their own checks for assessing counterparty risk, following European market authorities’ failure to react to a spate of carbon market fraud.

Credit rating agencies: A question of trust

For companies involved in the production and trade of energy, credit ratings agencies have played an important risk function, but confidence plummeted after their perceived failure to signal the financial crisis

Turkey power market set for expansion

Disputes with Russia have prompted Turkey to strive for energy independence, and its government has fast-tracked the liberalisation of its power markets, but there is still a long way to go before Turkey can step up and compete with other liquid European…

Symbolic first 2020 EU carbon futures trade between JP Morgan and Gunvor

JP Morgan and Gunvor completed the first European Union 2020 over-the-counter European Union Allowance carbon contract on August 6, signalling their confidence in the European carbon markets

Delay of aviation EU ETS inclusion ‘unlikely’

Experts doubtful over a delay to aviation's entrance into the EU ETS due to the volcanic ash cloud, after Lufthansa CEO calls for delay until 2013

FOA: Details of new infrastructure derivatives rules expected shortly

European Union regulators to clarify controversial new derivatives and central clearing rules in a new regulation rather than previously intended directive, avoiding lengthy and politically sensitive procedure

Kyoto suspension will disadvantage Bulgarian compliance companies

Bulgaria's emissions trading suspension set to impact companies trading on EU ETS

New regulation could open up French power market

A slow response to the EU’s liberalisation directive has left the French power market lagging behind some European markets in terms of liquidity, but recent regulatory proposals are set to open up the market and may spell the end of regulated tariffs…

New approaches to energy credit risk management

The aftermath of the financial crisis led to some innovative approaches to tackling energy credit risk. Pauline McCallion looks at developments and asks whether proposed US and European regulation will help or hinder innovation in this space

CBI: Quarter of UK power plants face closure

Independent business lobby group the Confederation of British Industry (CBI) has warned the latest draft of the European Union Directive for Industrial Emissions could force at least a quarter of the UK’s power plants to close, which would raise a major…

Power market must act on clearing to avoid mandatory limits, says EEX CEO

Individual participants in the European power markets need to be proactive on clearing if they are to avoid enforced mandatory limits, according to chief executive officer of the European Energy Exchange (EEX) Hans-Bernd Menzel.

EC’s Nabucco pipeline payout a small step in right direction

The European Commission’s announcement of a €200 million payout to the Nabucco pipeline has been welcomed by European utilities, but some experts point out it is only a tiny fraction of the estimated total cost of €7.9 billion.

Romania bans OTC emissions trading to combat fraud

Romanian authorities have banned European Union carbon emissions allowances (EUA) in the over-the-counter derivatives market to prevent EUA tax fraud, after ruling that these contracts are now classed as equity securities and therefore can only be bought…

Market fears two-tier EU ETS post-2012

Following a lack of collective will to determine a binding agreement at the Climate Change conference in Copenhagen (Cop15), analysts say the West may take steps to either ban or restrict most Chinese certified emissions reduction (CER) credits in the…