Gas/LNG

What drives natural gas?

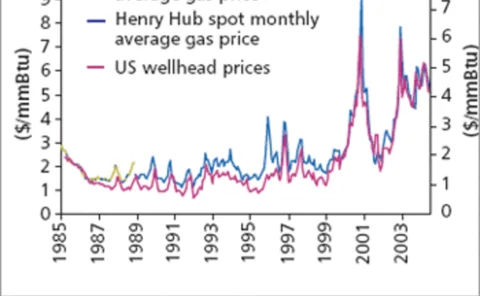

Natural gas prices in the US are at an all-time high. The Gulf Coast hurricanes and record summer heat have taken their toll, and business is feeling the effect. Studying and applying seasonality can often protect aganst the volatility of these markets,…

Options - A plan for all seasons

Selling natural gas options on a market that is adhering closely to a seasonal tendency can be a powerful strategy for an option seller, write James Cordier and Michael Gross

Industrial users - Taming the flame

Industrial users of natural gas in North America are investing in physical hedges while gradually returning to the financial markets

Europe - An uncertain future

European natural gas demand is expected to rise in the next three decades. But, as Anouk Honore finds, the overall picture is not easy to predict, and depends on what happens in individual countries - particularly Italy and Spain

Buyer and seller beware

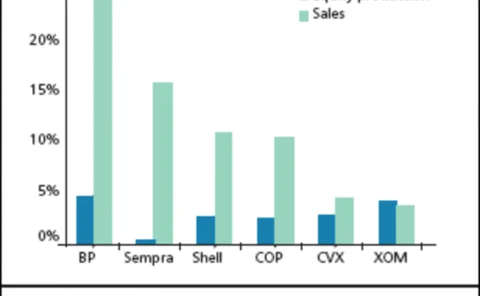

As a busy M&A period looms in the US utility sector, a wave of power plant sales seems likely. But those looking to hedge the fuel supply to these assets will find it tricky, given the current volatile gas prices. By Joe Marsh

Bear Stearns and Calpine form energy marketing and trading company

Investment bank Bear Stearns and California-based power company Calpine Corp have formed an energy marketing and trading venture focused on physical natural gas and power trading and related structured transactions.

Pipelines and politics

The latest in a long line of disputes over natural gas supplies from Russia is raising concern among utility customers and investors that future supplies to the West may be disrupted. But is this a long-term problem? Oliver Holtaway reports

Storage strategies

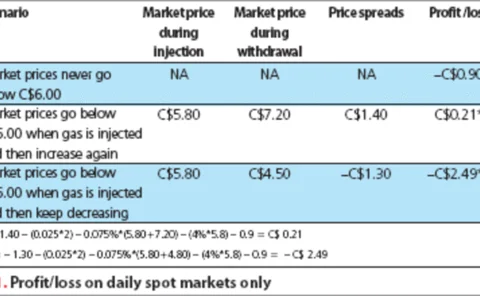

Companies are increasingly realising they can use natural gas storage to add value to their bottom line. TransCanada’s Farzan Nathoo weighs up the strategies available for optimising value through storage

Just a seasonal swing?

US natural gas market volatility is keeping trading volume high. But is this just a seasonal phenomenon or part of a long-term trend? Catherine Lacoursiere reports

Getting it together

The US Committee of Chief Risk Officers is proposing an energy data hub to improve price transparency in the natural gas market, but index publisher Platts is concerned over some aspects of the initiative. Joe Marsh reports

Shell:powering up

Shell Trading’s core values of honesty, integrity and respect for people define thecompany and how it does business

Strategies for success

To succeed in the fast-changing US gas market requires an effective hedging and risk-management strategy. Accenture’s Alexander Landia , Paul Equale and Julie Adams look at what firms need to do to win in this key market

LNG makes headway

The market for liquefied natural gas is ripe for expansion, given the scarcity of oil and LNG’s cleaner burning properties, and a short-term market is emerging for the first time. Eric Fishhaut looks at the evolving structure of this international market

Germany’s closed shop

Despite six years of liberalisation, Germany’s gas market is still virtually closed to outside competition. Writing from Germany, Stella Farrington looks at whether new regulation is finally about to bring change

Spectron to launch LPG web-trading platform

UK energy broker Spectron will launch an online trading platform for liquefied petroleum gas (LPG) on Tuesday (February 22). Spectron said the screen will be the first to allow the trading of LPG in both the east and west, as outrights or spreads, and…

The basics of basis

Basis plays an important role for trading in the very complex US natural gas markets: spot will differ from the benchmark Henry Hub New York Mercantile Exchange price on the same day. Eric Fishhaut describes how the basis works and demonstrates the…

Evolution expands gas and power desk

US broker Evolution Markets has hired two brokers for the North American natural gas and power desk it launched in October. Corey Geraghty and Trenton Davis now broker gas and electricity options from the company headquarters in White Plains, New York.

Bridging the gas gap

Volatility in the natural gas markets shows no sign of any let-up, which means that managing basis risk at Henry Hub continues to spur demand for increasingly innovative derivatives products. Catherine Lacoursiere reports

Balanced buying

Yijun Du and Xiaorui Hu present a general framework for applyingmodern portfolio theory to optimal natural gas procurements.They showthat successful natural gas procurement involves determining the optimalallocation between fixed-price and floating-price…

UK traded gas market: What with liquidity?

The last two months have been a difficult time for UK gas traders; but Philippe Vedrenne and Marc Lansonneur from Gaselys say conditions will improve, leaving a market that may be stronger than ever