Carbon

Spectron brokers first 2012 CO 2 allowance trade

The first 2012 European CO 2 allowances (EUAs) have been traded through energy broker Spectron.

Icecap completes first closing of its carbon portfolio

Icecap, the carbon emissions group, has today reached first closing of its carbon portfolio having raised aggregate commitments to buy 15 million tonnes of carbon credits from the Clean Development Mechanism and Joint Implementation markets.

Survey - Positive feedback

Energy Risk's second annual emissions survey charts the development of emissions trading in Europe since the start of the European Union Emissions Trading Scheme a year ago

CDM reaches out

European firms are now aided in meeting their climate targets by being encouraged to invest in third world emissions reductions. But, as Oliver Holtaway discovers, not everyone is optimistic that the industry will participate

Price drivers - Policy fears in EU ETS

Developments in 2005 have shown that the EU ETS price has been correlated to relative fuel prices and weather. However, there are still remaining policy issues that could greatly influence prices, writes Henrik Hasselknippe and Kjetil Roine from Point…

The windfall dilemma

Free allocations of emission allowances may keep fossil fuel generators happy, but their customers are not smiling. Tobias Hsieh, credit analyst with ratings agency Standard & Poor's, explains who wins and loses under the trading rules

Pioneers

Today's vibrant and dynamic energy markets are a far cry from the illiquid, opaque trading that existed 25 years ago, yet they owe much to the visionary pioneers who started those early markets. Here, Energy Risk honours some of those early pioneers, as…

TFS hires ex-weather broker to emissions desk

Tradition Financial Services (TFS) has hired Frederique Leverett, formerly a weather derivatives broker, for its London-based emissions desk.

Off to a flying start

Aviation is one of the fastest growing sectors in terms of carbon emissions, but a move by the European Commission to include airlines in the EU's Emissions Trading Scheme has alarmed some in the industry

Carbon complexities

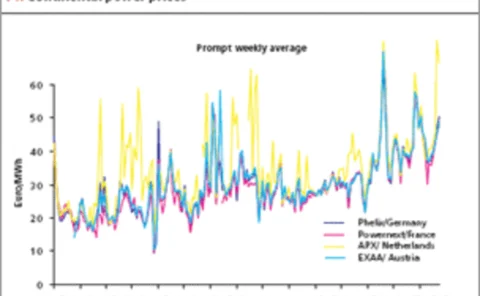

The EU ETS adds price complexity to European energy markets and the trend towards pan-European markets means far more complex models will be needed to model carbon risk, writes Bjorn Brochmann