Risk Staff

Follow Risk

Articles by Risk Staff

Banks take shelter in derivatives

While some banks have found the weather derivatives market a non-starter, others are doing deals worth more than $100 million. Eurof Thomas reports

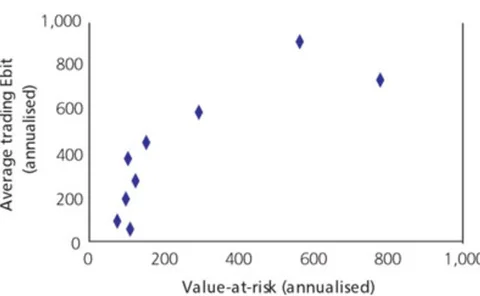

Keeping score

This month Brett Humphreys and Zach Jonasson show how energy trading firms can compare performance using publicly available corporate information

Enron’s online after-effects

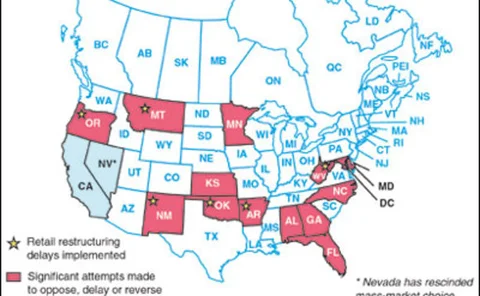

Recent highly visible events in the US, including the Enron failure, the California electricity crisis and market power rulings by the government have all created considerable tumult and uncertainty, which are bound to have repercussions

Green scheme down under

Robin Lancaster reports on Australia’s government-mandated renewable energy certificates market, which – after a slow start – is expected to pick up fast

Many are called, few are chosen

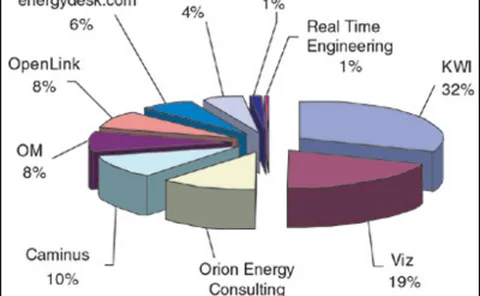

The market for power trading technology in Europe is mirroring the energy industry in the intensity of its competition. Benjamin Tait reports

Pause for thought?

Electricity deregulation in Ontario promises to avoid the price hikes and power shortages seen in some markets. So why are end-users unhappy? Kevin Foster reports

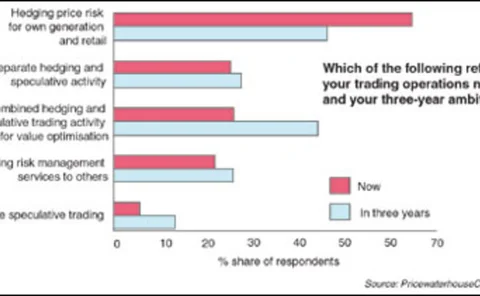

Dealing with price risk

FAME Information Services outlines the main issues currently affecting power prices and looks at how companies should be covering themselves against the risks posed by the continuing process of deregulation

Stand-off over hub plans

German firms Ruhrgas and BEB Erdgas & Erdöl and Norway’s Statoil say they want to work with Gasunie on developing the northwest European natural gas trading hub. Gasunie is making similar noises. So why the separate plans, asks Peter Joy

Counterparty concerns

Following the California crisis and the fall of Enron, energy firms are finally paying more attention to credit risk. Here Fred Cohen, Satyan Malhotra and Rafael Cavestany present some overarching issues senior management must address in implementing an…

Building blocks for complex probability distributions

Brett Humphreys demonstrates how to construct more accurate return distributions and use them to price options