Risk Staff

Follow Risk

Articles by Risk Staff

Rating agencies raise the bar

Confidence in energy traders has never been lower, and the metrics the rating agencies apply to their business are changing. James Ockenden assesses the damage

Building a bridge to Var

Value-at-risk (Var) is a technique often applied to the energy industry. But there are limitations to its use. Here, Leslie McNew aims to bring these limitations to light, and thereby give practitioners confidence in the use of Var

Unleaded prices feel the heat

Data management and analytics specialist FAME Information Services looks at the effect the US driving season is having on US gasoline prices, taking into account various factors – in particular, the big impact of higher crude oil prices this summer

Modelling weather-sensitive electrical loads

Here Véronique Bugnion, Aram Sogomonian and Glen Swindle introduce a new methodology for forecasting and jointly simulating temperature and electrical load

The value of volatility

Brett Humphreys and Tim Essaye seek out the best method for calculating volatility by comparing different measures, and find that complex approaches aren’t necessarily the best ones to use

APB Energy’s winning formula

Kentucky-based APB Energy is one of the leading energy brokerage firms in North America. It has maintained its growth despite Enron fallout, perhaps due to its diverse range of services and locations. Kevin Foster reports

Courses for Californian water resources

No discussion about the state of the energy industry is complete without mentioning the Californian power crisis. Catherine Lacoursière interviews Pete Garris, acting deputy director of the California Energy Resources Scheduling division (CERS) at the…

Pulling in different directions

Can Opec ever achieve harmonised foreign investment rules? Maria Kielmas talks to former Algerian energy minister Nordine Aït Laoussine – who says it will never work – and to harmonisation’s biggest supporter and architect Bernard Mommer, special adviser…

Tools for the trade

Ken Nichols examines the mechanisms available for incorporating credit risk management into an energy company’s portfolio

Finding a solution to the credit problem

Peter Stockman of Accenture outlines what energy companies can do, internally, to manage credit more effectively and addresses the potential benefits of participating in a multilateral netting solution for the industry

Proper procedures

Rajiv Arora examines the processes necessary for effectively measuring, managing and hedging credit risks

Heeding the warning signs

Following the Enron bankruptcy, the use of bond-spread analysis has become increasingly important. Mark Williams looks at how firms can benefit from it

A whole new ball game

Enron’s bankruptcy has changed the playing field for credit risk in the energy sector. Kevin Foster reports on the renewed significance of assessing credit quality

Demystifying credit risk

Satyan Malhotra, Fred Cohen and Rafael Cavestany formulate an analysis for the measurement of credit risk in the energy industry

Higher or lower?

Kevin Foster looks at how credit rating agencies assign a rating to companies in the energy sector and what kind of factors are taken into account

Avoiding over-exposure

Eurof Thomas finds the European energy market is increasing its focus on credit risk mitigation in the wake of Enron’s demise

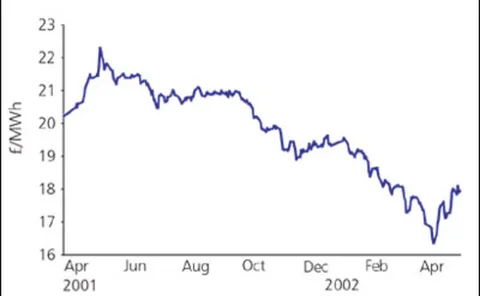

Worth waiting for?

Just over a year on from the delayed launch of the UK’s new electricity trading arrangements, prices have dropped to new lows. But just how low can generators go, asks Joel Hanley