Volatility

High risk and volatility require new risk management approaches

Energy leaders warn fast-rising geopolitical, market and infrastructure risks demand new strategies, AI adoption and stronger risk culture

US-China trade war becomes focus again for commodities

As the end of the 90-day truce in US-China trade hostilities looms, commodity markets brace for uncertainty

Energy Risk Asia Awards 2018: The winners

BNP Paribas takes Derivatives house, BP wins Oil & products and BOCI and Engie scoop two awards each

Watch out for commodity vol products

Commodity traders shouldn't ignore the recent meltdown in CBOE’s Vix derivatives, writes energy consultant

Falling margins force energy firms to expand data use

Verification and model challenges arise as volatility and margins dry up

A pairs trading strategy based on switching-regime volatility for commodity futures

A pairs trading strategy on energy, agricultural and index futures uses different parameters according to a volatility regime that is detected using a threshold evaluated in two ways, namely by means of a mixture of two Gaussian densities and a Markov…

Commodity volatility, skew and inverse leverage effect

Two observations have consequences for commodity risk management and stochastic volatility modelling: the first is that the standard leverage effects in commodities are due to a misspecification and are inefficient proxies for the forward slope effect;…

Commodity volatility increases need for risk management

Energy Risk discusses market volatility and risk management with representatives from US commodities index publisher Platts

Quant Ideas: market-making, risk and information in commodities

Persistent low liquidity in commodity markets is the result of the fundamental interaction of high volatility and noisy data sets. This fact has profound implications for the theory and practice of risk management in commodity markets

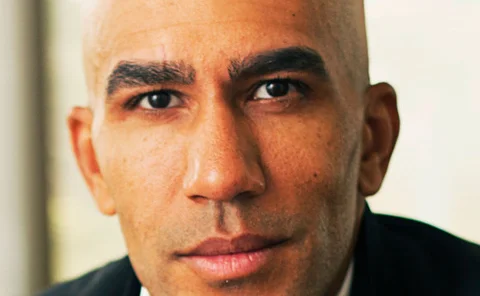

Video: Jean-Marc Bonnefous, Tellurian Capital Management

Bonnefous defends investment in commodities amid market turbulence

Practitioners must take risk measures with a pinch of salt

While useful, it is possible to rely too heavily on conventional risk measures such as volatility and value-at-risk – a point made recently by billionaire US investor Warren Buffett. Every aspiring practitioner should know about their drawbacks, writes…

Oil, weather and Ukraine boost European gas volumes

2014 saw rising activity in Europe's exchange-traded and OTC gas markets

Commodity leveraged ETFs: Tracking errors, volatility decay and trading strategies

Commodity exchange-traded funds (ETFs) and their leveraged counterparts are a significant part of the growing ETF market. Kevin Guo and Tim Leung examine their tracking performance, with a focus on the phenomena of volatility decay and realised effective…

Oil price fall spurs interest in trading, says panel

Financial traders such as banks are likely to benefit from a marked drop in oil prices and a rise in volatility, according to market participants speaking at a London conference

Cutting edge: Incorporating forex volatility into commodity spread option pricing

In this article, Joseph Yechong Chen extends Kirk’s formula to spread option pricing when forex is a stochastic factor and is multiplied to one leg in the payoff formula. The article illustrates the importance of forex risk factors and the need to…

Cutting edge: Modelling dependence of price spikes in Australian electricity markets

The deregulation of Australian electricity markets has brought several challenges, including the possibility of price spikes, which expose market participants to significant risks. As Adebayo Aderounmu and Rodney Wolff outline, these spikes are hard to…

Critics assail industry-sponsored study on HFT

Critics say industry-sponsored study into impact of high-frequency trading in futures markets is flawed

Skylar’s Perkins sees potential for volatility in US natural gas

Bill Perkins believes rising demand and reduced risk warehousing will create opportunities for natural gas traders: video

Low crude volatility to bolster spread trades, say analysts

Market participants expected to shy away from outright bets on crude oil as low volatility persists

White House seeks tools to fight ‘excessive’ oil speculation

On Tuesday, US President Barack Obama launched a new initiative aimed at curbing speculation in energy markets, arguing that it would help ease the pain of high gasoline prices. He urged Congress to give the US Commodities Futures Trading Commission …

Gas users lock in low long-term prices

Long-term price risk management deals are becoming more popular with utilities and regulators as a way to lock in low natural gas prices