Value-at-risk (VAR)

Cutting Edge: Measuring the risk of Financial Transmission Rights

In this month’s article, Ning Zhang proposes a semi-parametric approach to calculate the risk of FTRs/TCCs portfolios whose risk is hard to capture by using standard VaR methods. The major specialties of FTRs/TCCs – such as non-normality and seasonality …

Valid Assumptions Required: an analysis of VaR for energy markets

In this 10-part series, Brett Humphreys takes a fresh look at the widely used risk measure value-at-risk (VaR), urging risk managers to be more aware of the many assumptions that go into the calculation to produce the VaR number.

Pass the microphone: Humphreys to Strickland

In this new column, an industry professional interviews a market expert of their choice. Next month the interviewee becomes the interviewer and chooses who to interview. The series is kicked off by Brett Humphreys putting his questions to Lacima Group’s…

Consultants’ outlook: 2010 Expert views

Energy Risk convened representatives from Ernst & Young, MRE Consulting, Sapient, The Structure Group and SunGard Consulting Services to discuss a number of topics on the outlook for 2010, including new regulation, future market developments, credit and…

Cutting edge: Visualising value-at-risk

Risk transparency is an important yet elusive goal of any risk management process. One challenge is to understand the diversification effects of the portfolio elements. Wentao Zhao and Kevin Kindall introduce a graphical technique based on value-at-risk…

Hard times for VaR

The Basel Committee's ambitious plan to overhaul VaR models is coming in for fierce criticism. By John Ferry

The three flavours of VaR

Each of the three methods of calculating value-at-risk has its pros and cons. Brian Shydlo of Sirius Solutions examines them

Valid Assumptions Required: backtesting

Given the large number of assumptions made in calculating a value-at-risk, how can we have confidence in the quality of the resulting calculation? Brett Humphreys looks at using backtesting to evaluate quality.

Valid Assumptions Required: Monte Carlo VaR

Brett Humphreys discusses the many decisions associated with the calculation of a Monte Carlo value-at-risk.

Valid Assumptions Required: delta-normal VaR

A delta-normal value-at-risk is one of the basic tools of risk management. Brett Humphreys discusses the assumptions associated with this calculation.

Valid Assumptions Required: calculating correlations

Correlation measures are major drivers of value-at-risk. Brett Humphreys and Eric Raleigh review assumptions associated with calculating correlation.

Valid Assumptions Required: advanced volatility measures

In the next article of his VAR series, Brett Humphreys discusses more advanced methods for estimating volatility.

Valid Assumptions Required: Volatility

Brett Humphreys reviews the assumptions associated with calculating volatility based on historical data.

Valid Assumptions Required: Historical Simulation VaR

Brett Humphreys discusses the assumptions underlying the calculation of a VAR using the historical simulation methodology.

Valid Assumptions Required: examining forward curve assumptions

Brett Humphreys and Eric Raleigh review assumptions about the forward curve and the difference between relative and absolute dates.

Valid Assumptions Required: confidence level and holding period

In the second article of his series, Brett Humphreys examines the assumptions associated with selecting a confidence level and a holding period for a VaR calculation

Valid Assumptions Required: aggregation

In the first article of this series, in which Brett Humphreys questions some of the assumptions and decisions that go into the calculation of value-at-risk, he focuses on portfolio aggregation.

Operational and market risks of a regulated power utility

Victor Dvortsov and Ken Dragoon present an analytical method for including market and operational risks when estimating utility portfolio value-at-risk

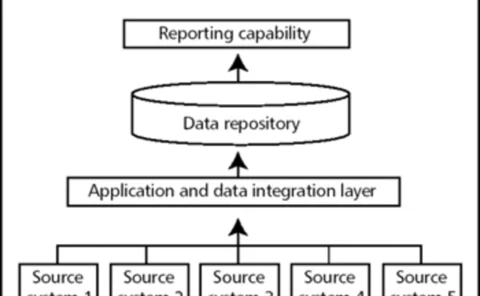

Getting it together

Data consolidation is now a vital foundation to any successful risk management implementation, as Dave Rose and Stuart Cook of The Structure Group report

A true test for value-at-risk

The three classic approaches for measuring portfolio value-at-risk do not compare like with like, argues Richard Sage. Here he presents a test portfolio to highlight the differences between calculation methods

How to run a market

Former-derivatives-trader-turned-author Frank Partnoy wants to see tougher accounting standards and risk disclosures to deter corporate crooks. But are the regulators listening? Maria Kielmas reports

How to spot a VaR cheat

Traders can use weaknesses in VaR measurement to make it appear that they are not taking any risks. Brett Humphreys exposes how easily this can be done

Project risk: improving Monte Carlo value-at-risk

Cashflows from projects and other structured deals can be as complicated as we are willing to allow, but the complexities of Monte Carlo project modelling need not complicate value-at-risk calculation. Here, Andrew Klinger imports least-squares valuation…

Margin notes

Brett Humphreys explains how to measure and manage margin risk, an often-overlooked – yet often-significant – risk exposure