Trading systems

Compliance solutions

Compliance with regulations such as Sarbanes-Oxley and Mifid is putting an increasing burden on energy-trading firms. Roderick Bruce looks at ways of overcoming the latest regulatory hurdles

OpenLink acquires IRM

OpenLink, a provider of cross-asset trading and risk management software solutions, has purchased IRM, an Austrian-based energy solution provider focused on energy asset optimisation and strategic planning.

OpenLink, Triple Point sign more bank clients

Rival US-based energy trading software suppliers OpenLink and Triple Point Technology (TPT) both signed big new clients this year, increasing their dominance of the energy software market for the banking sector.

Making a connection

Addressing both sophisticated multi-asset trading and physical asset optimisation – while complying with stringent new regulation – are challenges few software firms claim to have the entire solution to. Oliver Holtaway reports

Hanging on at the top

This year’s User Choice Awards demonstrate that quality counts. In a fast-changing market, the top vendors and packages have managed to stay ahead of the pack. But the winners cannot rest easy. With IT budgets deflated, it’s a competitive market, and…

OpenLink may launch web-based version of Endur

OpenLink may launch a web-based version of Endur, its energy trading and risk management system, according to Matt Frye, Houston-based managing director of the software company.

Caught short

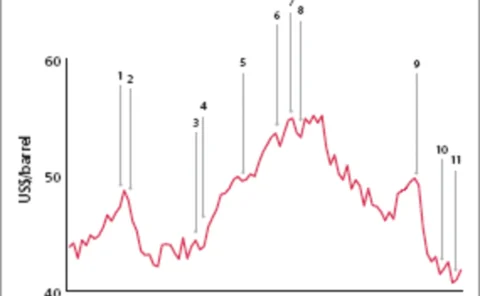

Given the difficulty China Aviation Oil is having closing its remaining illiquid positions, its derivative trading losses may be greater than first thought. James Ockenden and Stella Farrington report

Calpine trades up

US power company Calpine installed a new trading floor this year due both to its own growth and its aim to provide more companies with energy services. Joe Marsh reports

Pemex signs up to OpenLink’s Endur

Mexican state-owned petroleum company Petroleos Mexicanos (Pemex) has licensed OpenLink’s Endur energy trading and risk management system for its natural gas division.

Pemex signs for OpenLink’s Endur

Mexican state-owned petroleum company Petroleos Mexicanos (Pemex) has licensed OpenLink’s Endur energy trading and risk management system for its natural gas division.

SunGard acquires ASP pioneer Kiodex

SunGard has acquired New York based Kiodex, a supplier of web-based risk management, financial reporting, FAS 133 compliance and market data solutions for companies exposed to commodity price risk.

Wachovia expands Calypso use to energy

US financial group Wachovia Corp is to expand its use of the Calypso system to include energy derivatives. Wachovia began trading oil and gas in February.

Energi E2 chooses KWI for multi-commodity trading

Danish energy production and trading company Energi E2 today signed up for K2, the integrated energy trading and risk management system from London-based KWI. Energi E2 will use the software for multi-commodity trading, with the aim of reducing its…

Iberdrola moves to spread its influence in Europe

Spanish utility Iberdrola is taking steps to expand its trading and supply activities in Europe, particularly in Portugal, given that the joint Iberian power market is scheduled to open in March 2005.

User Choice winners revealed

Energy Risk's first User Choice Awards have been a tremendous success, with over 450 valid votes showing which vendors and data providers are the preferred suppliers to the energy industry in 2004.

Technology upload

There has been a recent upswing in the fortunes of energy risk software industry. And that is reflected in this year’s expanded technology vendor guide, making it the definitive guide to energy software and technology available

The troubleshooter

After struggling for a year with a difficult Triple Point installation, US energycompany Cinergy brought in energy IT veteran Joel McKnight. Nine months on, implementationand integration is complete. By Joe Marsh

King of convenience

The need for Sarbanes-Oxley certification has boosted sales of internet servicerisk systems, says web pioneer Martin Chavez of Kiodex. By James Ockenden

Bucking the trend

Openlink’s founder Coleman Fung talks to James Ockenden about the decisionsthat have promoted his company to one of the leading risk management solutionproviders

KWI allies with Toshiba to tap Japanese market

KWI, the London-based risk technology company, has created the first Japanese-language energy trading and risk management (ETRM) application in conjunction with Toshiba Corporation, the Japanese developer and manufacturer of power generation systems.

KWI hires SVP of operations

KWI, the London-based provider of trading and risk management software for the energy industry, today announced the appointment of Alan Somerville as senior vice president (SVP) of operations.

Bayer signs up for SunGard Adaptiv

Bayer, the Leverkusen-based pharmaceuticals and chemicals company, has chosen Sungard’s Adaptiv trading and risk management product to support its commodity, foreign exchange and fixed-income trading operations.