Physical climate risk

Weather fund Pyrenees closes, traders set up weather desk at Sempra

Weather hedge fund Pyrenees Capital Management closed at the end of October, a year after its launch, and two of the company’s three staff have moved to energy trader Sempra Commodities to set up a new weather desk.

Marginal improvements

Despite reduced production in the wake of hurricane Katrina, no new US refineries are in the pipeline. Instead, refiners are operating at full tilt as they come under pressure to expand capacity. By Catherine Lacoursiere

Shelter from the storm

Energy companies are showing increased interest in hurricane derivatives, a specialist product that can provide an additional layer of protection on top of insurance. Joe Marsh reports

Baiting the hook

End-users such as utilities and industrial companies are not showing the same keenness as hedge funds for trading weather derivatives, despite the efforts of banks, dealers and brokers to lure them in. By Joe Marsh

Growing up fast

Weather trading is seeing strong volume growth in the US, largely due to the influx of hedge funds into the market. Why such a big increase in interest, and what sort of strategies are the funds adopting? By Joe Marsh

Pricing the weather

Pricing weather derivatives is different from valuing other derivatives contracts – actuarial methods play a greater role. Steve Jewson looks at the varied approaches available

Strength in numbers

Weather derivatives seem to have a bright future: the market is enjoying record liquidity levels as new players, trading ever more diverse products, flood into the market. Oliver Holtaway reports

Making an impact

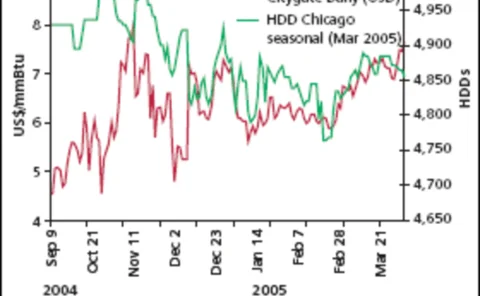

It can affect as much as 20% of the US economy, and nearly every industry worldwide is affected by it. But blaming poor results on the weather is no longer an excuse: weather derivatives are on the rise. Eric Fishhaut reports from Chicago on the growth…

Weatherproofing the VAR

The weather derivatives market shares some similarities with other markets, but applying existing models can sometimes have disastrous results. Brett Humphreys and Eric Raleigh discuss how weather derivatives differ from financial derivatives and how we…

Growing up fast

Weather trading is seeing strong volume growth in the US, largely due to the influx of hedge funds into the market. Why such a big increase in interest, and what sort of strategies are the funds adopting? By Joe Marsh

Former Swiss Re weather experts launch hedge fund

Weather risk veterans Mark Tawney and Bill Windle, who left global reinsurer Swiss Re on July 7, are starting a hedge fund, named Takara, Energy Risk has learned. Weather trader Bill MacLauchlan departed Swiss Re at the same time, for personal reasons.

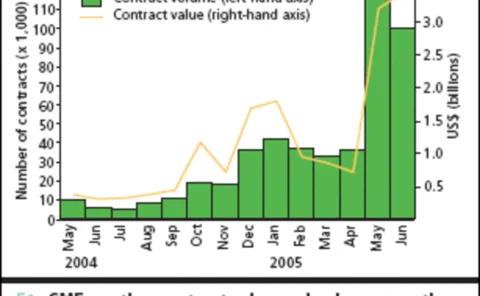

CME to launch more weather contracts

The Chicago Mercantile Exchange (CME) is set to list weather derivatives contracts for more cities in the US and Europe and to introduce two new types of weather contracts - probably by early July. Demand for CME weather contracts is fast increasing: as…

Peaking patterns

Weather is increasingly affecting power market dynamics, with prices as variableas the temperatures. But the volatility has spawned a growing variety of methodsofmanaging peak load demand. By Catherine Lacoursiere

Weather wisdom with risk management

Mark Tawney from Swiss Re spells out the implications of not keeping an eye to the weather

Bright future for weather derivatives, finds survey

Energy Risk has completed its inaugural weather derivatives survey and the results show that traders appear to be confident about the state of their business, despite high profile exits from the industry in recent years.

Singing in the rain

Melbourne-based Southern Hydro Partnership signed its first precipitation hedgelast year – a landmark deal that paved the way for a number of other contractsto protect itself from the risk of low rainfall. Paul Lyon reports

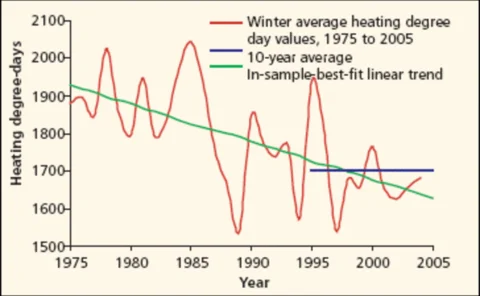

Following the trend

The analysis of historical meterological data is vital for structuring weatherderivatives. But how should weather traders deal with the trends that may existsin the data? Steve Jewson and JeremyPenzer investigate

Weather wrap-up

Energy Risk’s inaugural weather derivatives survey shows that traders and end-users appearto be confident about the state of their business, despite high-profile exitsfrom the industry in recent years. Paul Lyon analyses the results

Accepting responsibility

Alex Schippers heads ABN Amro’s weather team – arguably one of the most innovative desks in Europe. Here he talks to Paul Lyon about the state of the global weather risk market

Vertical take-off

As UK supplier Centrica narrows its focus to fund an asset acquisition spree, James Ockenden finds the ‘asset-light’ utility model has finallybeen buried and a move towards ‘vertical integration’ is now thestrategy of choice

Nymex and Tiffe consider weather derivatives

Both the New York Mercantile Exchange (Nymex) and The Tokyo International Financial Futures Exchange (Tiffe) are considering launching weather contracts.

Wolverine to be market maker for Japanese weather futures

Wolverine Trading, the Chicago-based energy trading company, will be the lead market maker for Japanese weather futures soon to be offered by the Chicago Mercantile Exchange (CME).

Energy Risk launches weather derivatives survey

Energy Risk , the leading publication for energy trading and finance professionals, today launched its first annual weather derivatives survey.