Operational risk

Energy Risk Asia awards dinner

Energy Risk honoured success at the annual Asia awards dinner held in Singapore on September 26 following our Asia conference. We showcase the winners

Energy Risk Europe: The challenge ahead

A tough economic environment, sluggish trading activity and regulatory reform all left their mark on Energy Risk Europe this year, where market participants discussed the many threats looming over the industry and how to overcome these challenges…

Energy market focuses on counterparty risk

The critical importance of counterparty risk management was demonstrated by the bankruptcy of Lehman Brothers in September 2008. In response, banks and other energy market participants have been trying hard to improve their game. Gillian Carr reports

Special report: Oil

Energy Risk focuses on the world's most actively traded commodity

Uncleared margin rules threaten E&P hedging

Exploration and production companies can find it difficult to satisfy collateral demands when looking to hedge their output using derivatives. Now, Dodd-Frank threatens to make this even harder with margin requirements for uncleared trades. Alexander…

The uncertain impact of an SPR release

During September, speculation about a possible withdrawal from the US Strategic Petroleum Reserve hit boiling point. Although such a release now appears to be unlikely, Jay Maroo investigates the impact any future withdrawal might have on oil traders and…

People moves in energy markets

Energy Risk catches up with the latest appointments, promotions and departures in global commodity markets

Commodity position limits cause Mifid II confusion

Mifid II is set to impose position limits for commodity derivatives, but recent drafts are sowing confusion over who will be responsible for setting them, writes Jay Maroo

Lawsuit threats cloud California cap-and-trade scheme

California is set to launch the world’s second-largest carbon market, but threats of litigation have kept many potential market participants sitting on the sidelines

Natural gas producers step up hedging

Hedging by North American natural gas producers increases as prices rebound

Banks retreat from commodity derivatives

Increasing capital requirements and other regulatory constraints are cutting the headcount and risk-taking ability of banks in commodity and energy derivatives. Might this diminished role pave the way for less regulated participants to take their place?…

The unreliability of oil price forecasting

Oil price forecasts are notoriously unreliable, making life difficult for energy market participants attempting to manage their risks. Alexander Osipovich explores the reasons why analysts struggle to predict future prices

Using credit valuation adjustment to set limits

In their previous article, Carlos Blanco and Michael Pierce introduced the concept of credit valuation adjustment (CVA). In this next instalment, they explore CVA allocation methods and discuss alternative structures using CVA to set limits, credit…

Banks cut commodity VAR as regulatory reform bites

Basel capital rules and regulatory reform stymie risk appetite of major banks in commodities

CFTC offers last-minute Dodd-Frank relief

Agency eases compliance burden for commodity and energy firms

Oil price reporting agencies' principles won't deter manipulation, say critics

International Organization of Securities Commissions principles for oil price reporting agencies fail to silence critics

Basis trading to emerge in European gas

Natural gas basis swaps increasingly used in over-the-counter market and could eventually trade on exchanges

As banks retreat who will dominate US power trading?

Squeezed by the Volcker rule and Basel III, banks have been pulling back from US electricity markets. Who will become the new power-trading champions, and should hedgers be worried about liquidity? Alexander Osipovich reports

Corporate statement: BroadPeak Partners

BroadPeak Partners and consultancy Baringa Partners put the operational cost of a single lost or mis-booked trade at more than $600. But the cost in terms of risk miscalculation and compliance is often much higher

Trading positions: October 2012

Energy Risk catches up with the latest appointments, promotions and departures in global commodity markets

QE3: The next big driver for oil prices?

Quantitative easing has been touted as the next big driver of oil prices. However, analysing and predicting the market behaviour it actually generates is difficult. Jay Maroo talks to experts about what they expect from QE and how this might impact risk…

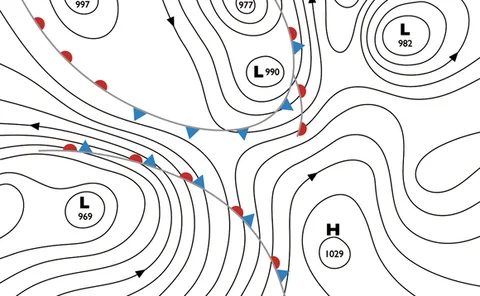

Energy firms tune in to weather forecasts

As weather forecasting becomes more accurate, utilities and banks are increasingly turning to it – not only to predict power and gas demand – but also to find arbitrage opportunities, writes Gillian Carr

Lack of critical mass in biomass

Growth in the use of biomass has led clearing houses to list derivatives referencing the organic fuel source, while some experimentation has also taken place within the over-the-counter markets. But these efforts are yet to yield substantial success. Jay…