Operational risk

Asia exchange of the year: SGX

Singapore exchange powers forward in LNG and seals the deal on major freight market acquisition

Asia commodity finance house of the year: Societe Generale

SG CIB makes Asia renewables expansion the cornerstone of its commodity finance business

Energy Risk Asia Awards 2016: The winners

BP takes energy dealer of the year after ramping up third-party and structured business

UK-based energy firms consider fleeing Brexit

Trading units exploring relocation to avoid “years of uncertainty”, says AFM official

Q&A: Dutch watchdog on the pitfalls of Mifid II

Catching the right energy firms – and leaving others untouched – has been tough, says Esma task force member, Jasper Jorritsma

Mifid II impact on energy liquidity sparks fiery debate

Regulators and industry clash over interpretation of Mifid II market-making rules at industry event

EEX futures contract triggers margining spat

Rivals criticise use of lower margins in marketing push

FCA ‘working in background’ on Mifid commodity limits rules

Regulator builds out reporting platform to monitor position limit breaches

Commodity volatility, skew and inverse leverage effect

Two observations have consequences for commodity risk management and stochastic volatility modelling: the first is that the standard leverage effects in commodities are due to a misspecification and are inefficient proxies for the forward slope effect;…

Hedge fund Citadel hires nat gas chief from Hartree

Mercuria hires Morgan Stanley commodities chief; SocGen Asia energy sales head moves to CME; Lindt named Danske CEO; Commonwealth Bank hires head of commodities structuring; Freepoint hires Cofco agriculture heads; Uniper appoints Nordic region GM;…

Coal contracts boom is a sign of desperation

Producers' turn to derivatives may be a last throw of the dice

Carbon life force: derivatives defy coal's bleak future

Coal producers shorting volatility to collect premium, say traders

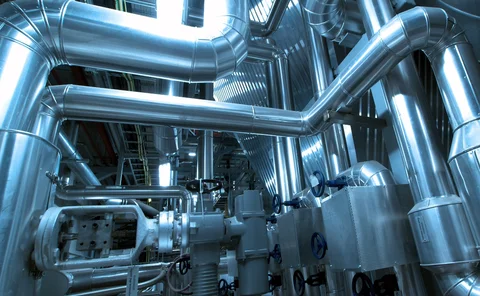

Energy risk teams explore use of KRI metrics

KRIs show particular promise for managing operational risk

Energy firms fear liquidity void if US capital proposals hit banks

Trades ‘wouldn’t be anywhere near making sense’ for banks

Turning uncertainty into innovation in the energy industry

Uncertainty, low commodity prices and squeezed margins are pressing energy companies to look for more innovative and cost-efficient solution

Hidden risks for corporates in renewable energy PPAs

Buyers face load, covariance and basis risks in typical agreements

Position vacant: unpicking energy’s hidden contract risks

Complex, long-term supply deals present job opportunity for risk managers

Enterprise risk management powers up at utilities

There has been a resurgence of interest in enterprise risk management (ERM) recently. What can ERM offer beleaguered utilities?

A profit and loss attribution framework for physical and financial energy portfolios

A profit and loss attribution framework can improve the information available to energy traders and give valuable insight into the health of their portfolios

Plastics hedging rising amid US chemical industry boom

Interest in plastics derivatives is rising as a result of changing market dynamics, but major obstacles still limit its growth potential, finds Stella Farrington

Citi loses senior energy traders

Brookes moves to EDF Trading as head of European gas trading

Disasters can give valuable lessons – Engie Global Markets CRO

Ken Robinson reflects on the ‘good, bad and ugly’ in energy risk management

Exchanges, energy brokers jostle for position ahead of Mifid II

EEX foray into non-MTF platforms sparks outcry from brokers