Market risk

Banks welcome FCA focus on commodity trading houses

UK regulator right to question risk posed by commodity trading houses, bankers argue

More US oil producers hedging with non-WTI crudes

Increased volatility pushes oil producers to hedge with LLS, WCS and other regional crudes

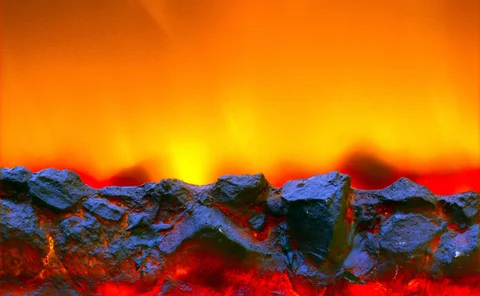

Coal derivatives market fosters burning ambition

Increased attention from both traders and hedgers is providing a boost to the coal derivatives market, say participants, fuelling the success of the API 8 index linked to Chinese coal imports and stimulating further product development efforts elsewhere…

Coal derivatives market fired up by new participants

Commodity traders and physical producers move into coal derivatives as major banks retreat

Commodities investing is still fundamentally sound

Commodity investors may have had a bad year, but putting money into commodities of finite supply continues to makes sense

Global Advisors’ Masters looks ahead to commodity rebound

Daniel Masters, the former head of energy trading at JP Morgan and co-founder of hedge fund Global Advisors, has seen his share of ups and downs. Alexander Osipovich reports

Off-the-shelf ETRM software taking off, survey reveals

Off-the-shelf energy trading and risk management (ETRM) systems are more popular than ever before, according to Energy Risk’s annual software survey. However, companies say they still require significant customisation and rarely meet all their ETRM needs…

Enforcement director nominated for Ferc chair

Centrica hires Hess market risk director; Vattenfall names trading head; Gazprom recruits BAML power trader; Baltic Exchange names Singapore head; Mitsubishi UFJ in commodity retreat

Trade reporting special report

Derivatives trade reporting is mandatory in the US and Europe under Dodd-Frank and Emir rules. Energy Risk presents a special report

Platts shifts focus away from price reporting code

Price reporting agency says it intends to concentrate on complying with Iosco rules, leaving future of IPRO code in doubt

Fed probes catastrophic risks in bank physical commodity trading

The US Federal Reserve has moved to tighten the rules on physical commodity trading by banks, citing fears they might suffer huge losses as a result of an environmental disaster. How valid are such concerns and what steps is the Fed likely to take?…

Oil benchmarks need reform, says Vitol's Taylor

Oil industry needs to make issue of dwindling benchmark production a top priority, says Vitol chief

A can-do attitude

Axpo Trading & Sales aims to optimise the production of Switzerland-based utility Axpo, but is increasingly offering the same service to external clients, including renewable generators. Energy Risk talks to Domenico De Luca, head of international…

Emir reporting date sparks 'mad rush' in energy derivatives market

A requirement to report trades under the European Market Infrastructure Regulation kicked in on February 12, creating a rush to comply among energy derivatives market participants. Some firms have struggled with the rules, and say a lack of support from…

Commodities investing down but not out, Masters says

Global Advisors co-founder believes short-term woes will give way to long-term rally

Energy firms' systems not ready for regulation, survey finds

ETRM systems are ill-prepared for financial and energy market regulation, according to Energy Risk survey

Emir reporting deadline causes alarm among commodity traders

Commodity derivatives end-users hit hard by Emir reporting rules, say industry sources, especially smaller firms

CFTC has ‘turned the corner’ on swap data mess, says O’Malia

New CFTC working group will iron out inconsistencies between SDRs and address end-user concerns, commissioner vows

Centrica hires ex-Hess market risk director

John Wengler joins Centrica Energy as UK-based midstream risk director

Europe should unite or die, says Lowe

NWE market coupling delays highlight need for robust EU energy regulator, says former EC director general

US energy firms facing Dodd-Frank trade reporting ‘nightmare’

Differing approaches of swap data repositories haunt energy companies trying to reconcile trades

Risk & Energy Risk Commodity Rankings 2014 – energy

The past 12 months proved tough for energy dealers, with low volatility, poor liquidity and sluggish levels of client activity. Given this, some banks decided to scale back their commitment to the market – a trend that is reflected in this year’s results…

Risk & Energy Risk Commodity Rankings 2014 – metals

For metals, the past 12 months were marked by plummeting gold prices, directionless markets in base metals and heated rows over the London Metal Exchange’s warehousing system. Despite this, the top dealers and brokers in this year’s rankings are largely…

Looking back: Regulators try to slow down OTC juggernaut

Today, regulation is a fact of life for OTC commodity derivatives traders. But in April 1994, it was somewhat novel, as Energy Risk reported at the time