Market risk

Amerex launches consulting service

Amerex Brokers, an over-the-counter energy broker and wholly-owned subsidiary of GFI Group, has formed a fee-based energy risk management and execution consulting division called Amerex Energy Consulting Services (AECS).

“Slow and Painful” recovery for oil industry says Moodys

Ratings agency Moody's expects economic recovery within the global oil industry in 2010 to be 'slow and painful', according to its Industry Outlook for the Global Integrated Oil sector published last week.

Oil & gas sector stung by Obama budget proposals

Tax changes proposed in President Obama's 2010 budget have raised concerns in the US oil & gas industry about supply security and price volatility. Pauline McCallion reports

Power outlet

The 13th annual Energy Risk USA conference brought key industry figures together in Houston to discuss the latest developments in energy markets and risk management

Full marks

Michel Marks, former chairman and board member of Nymex, tells Roderick Bruce about his role in taking the exchange from small potatoes to a cross-commodity powerhouse

Recognising outstanding contributions

To celebrate it's 15th anniversary, Energy Risk is honouring pioneer traders, top women and pioneer quants who've made an outstanding contribution to energy trading and have shaped today's energy markets

The price isn't right

Former Saudi oil minister and head of Opec, His Excellency Sheikh Yamani, speaks to Roderick Bruce about his views on the past, present and future of the global crude oil markets

Staging a transformation

Energy risk management has transformed since the early 1990s. Pauline McCallion speaks to risk managers about the challenges they faced in the early days and how they compare with the issues faced today

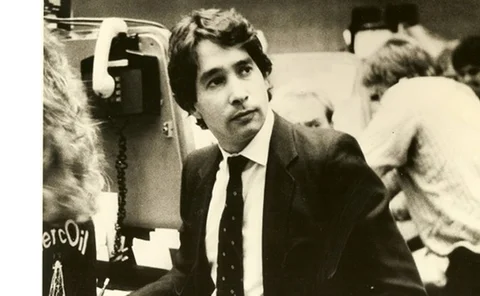

Michael Cosgrove

Our 15th anniversary profile series of key energy industry figures continues as Pauline McCallion talks with with Michael Cosgrove, head of commodities and energy brokerage, North America at GFI

Get-out clause

The economic downturn and fall in commodities prices have left many companies holding contracts that are now unfavourable. Julianne Hughes-Jennett and Alexander Anslow of Lovells discuss when force majeure and other clauses can be used to cancel or…

Rogue PVM oil deals not behind price spike say traders

Unauthorised trading in Brent futures contracts on June 30 by a staff member at oil broker PVM was not the main cause of a spike in oil prices, according to traders.

Model students

Mauro Cesa, Energy Risk's technical editor, talks to quants about how quantitative analysis for energy markets has developed and what they see as the most influential technical publications of the past 15 years

Charting 15 years of prices

David Linton looks back at the long-term trends for oil, gas & power and where prices might go next

15-year Rankings

Energy Risk reveals the top-ranked companies over 15 years of Commodity Rankings

In the beginning...

Some aspects of the energy markets are unrecognisable from 1994, while other issues remain remarkably similar. Stella Farrington looks at the landscape of 15 years ago and how it has moved on