Energy transition

Spectron ventures into LNG

Global brokerage Spectron has added liquefied natural gas (LNG) to its coverage.

Market focus: derivatives - Risky business

Companies that are heavy consumers of energy are particularly susceptible to market volatility. For such end-users, proper use of risk management techniques can mean make or break, says Eric Fishhaut of GlobalView

Evaluating credit & market exposure

Today’s volatile energy prices and the lower creditworthiness of some energy intensive users means energy providers have to assess counterparty risk thoroughly. David Coffman of GDF SUEZ Energy Resources provides some tips for assessing risk in the non…

Power adaptor

Alpiq Group was created at the beginning of 2009 as a result of the merger of Swiss utilities Atel and EOS. Peter Heydecker, head of trading and services, talks to Rachel Morison about Alpiq’s culture and presence in European power markets

Too much of a good thing

The price of US natural gas has hit record lows, but with storage fit to burst and demand in the doldrums, any hope of a price pick-up may remain a pipe dream for now, writes Pauline McCallion

Get ready for the revolution

Global events and climate change have fundamentally changed the face of energy procurement. Chris Bowden of Utilyx looks at the issues facing energy-intensive businesses in the UK

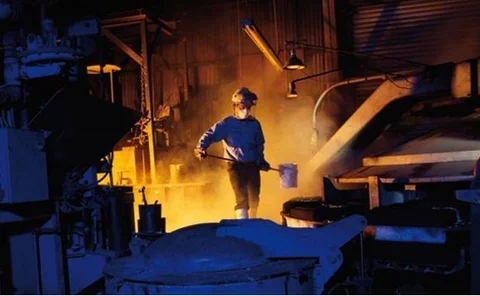

Buying smart

Guy Newsam, general manager at Muntons, a UK-based energy-intensive corporation, talks to Katie Holliday about how the company is addressing its exposure to volatile energy costs and carbon risk

Navigating the energy market

Gary Worby, managing director at EnergyQuote, speaks to Roderick Bruce about increasing energy market complexity and how end-users can achieve optimal energy purchasing

Exchanges disagree over position limits plan

The CME Group has pre-empted long-awaited action from the Commodity Futures Trading Commission (CFTC) to implement position limits for energy trading, publishing its own suggestions for a regime.

US commodity ETFs blow hot and cold

Increasing attention has turned to commodity exchange traded funds (ETF) in the US this month as part of the wider investigation by the CFTC into the need for tighter oversight of energy futures markets. Rachel Morison investigates

Corporate profile: Gazprom Marketing & Trading: energetic expansion

2009 marks 10 years since Gazprom Marketing & Trading was founded in the UK. Following another year of record financial results in 2008, the company’s executive team discusses Gazprom’s expansion into a leading global cross-commodity marketing and…

Canada’s first renewables feed-in tariff launched

The government of Ontario has launched Canada’s first feed-in tariff (Fit) for renewable power under its Green Energy Act. The move is part of a series of incentives designed to create 500,000 jobs in the renewable energy sector over the next five years.

Tarmac enters power-purchase agreement

UK quarrying and construction company Tarmac has signed a £3.5 million power-purchase agreement (PPA). As part of the deal, Tarmac will buy discounted renewable energy from UK renewables firm Nuon Renewables and sell it back to UK energy company npower.

Clean energy fund tops $200 million in first year

A clean-energy infrastructure fund managed by Fortis Investments has attracted €158 million ($232 million) in investment in its first year.

RWE Supply & Trading introduces continental gas financial swap contract

RWE Supply & Trading (RWEST), the trading arm of German power company RWE, has developed a financially settled gas swap contract targeted at non-physical players in the gas markets.

US House Ags Committee reviews Treasury derivatives plan

Members of the US House Agriculture Committee voiced concerns today that government proposals for regulating over-the-counter derivatives would negatively affect end users.

Government ends Royalty-in-Kind programme

US secretary of the interior Ken Salazar this week announced plans to reform management of US energy resources, including the termination of the Minerals Management Service’s (MMS) Royalty-in-Kind programme.