Energy transition

Energy Risk Europe 2010

Energy Risk's 2010 annual Europe conference brought leading chief risk officers, quantitative analysts and regulators to London to discuss key risk management issues

London conference report

Energy risk managers met in London in October for Energy Risk’s Europe 2010 conference to discuss the latest developments and prospects for the energy and commodities markets as the economic recovery takes root amid sweeping regulatory changes. Katie…

Singapore conference report

Energy risk managers, end-users and producers from across Asia gathered for Energy Risk’s annual conference in Singapore in September to discuss how energy and commodities markets will evolve and face the challenges that lay ahead. Lianna Brinded reports

Australia’s power market

Australian power is a hot topic among hedge funds and international investment banks in the energy trading space. Katie Holliday looks at the secret behind the attraction

Nuclear industry weighs short-term pain for long-term gains

With increased use of nuclear energy currently the EU’s most likely route to ensuing both security of supply and low carbon emissions, Alex Davis examines the impact such a policy could have for energy risk managers

Europe – Threat to long term oil supplies

European domestic reserves of crude oil are declining at a rapid pace and with European energy demand set to pick up, the region could be exposed to additional security of supply risks, reports Katie Holliday

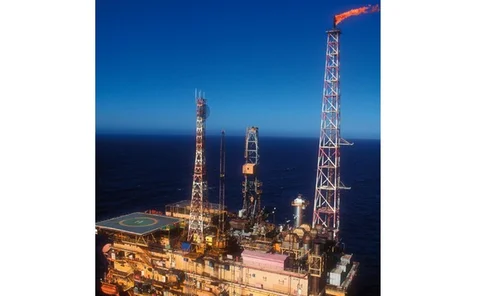

Oil report: US toughens up after BP oil spill

Pauline McCallion speaks to industry experts about the outlook for US offshore E&P and how risk management strategies are changing in the wake of the BP spill last April

Oil price outlook

Despite oil prices staying tightly within range over the past year, Lianna Brinded finds out that most analysts see prices becoming more closely correlated to supply and demand fundamentals and edging higher, with $100/bbl expected for 2012

EU proposals leave energy firms cold

September saw the first draft proposals on new EU financial markets regulation. With these running parallel to the energy market’s regulatory changes long in the pipeline, Alex Davis examines the worries for the industry

Trading positions - November 2010

Energy Risk catches up with the latest appointments, promotions and departures in the global commodity markets

Petrobras raises the stake for unconventional oil

The Petrobras share sale at the end of September set a world record, with $70 billion raised. Alex Davis examines how this is a good omen for risk appetite in deep-water drilling

Data aggregation is largest daily risk issue for energy and commodities

Data aggregation is the most difficult energy trading risk management issue an energy firm deals with on a daily basis, says Centrica Energy’s risk reporting manager when speaking to Lianna Brinded at the Energy Risk Europe conference in London

Fuel hedging can put you at more risk: Austrian Airlines's Henle

Jet fuel hedging is the most common misconception for mitigating risk, says Austrian Airline’s head risk manager

Optimising and hedging power generation assets

The head of risk at Spanish utility company Endesa speaks to Lianna Brinded about the co-ordination of optimisation and hedging of power generation assets.

EDF’s head of credit risk: misconceptions of assessing credit

EDF Trading North America’s head of credit risk talks to Lianna Brinded exclusively about the misconceptions of assessing credit risk in the energy and commodities market

Analyst: unified framework is better for energy risk management

Building a unified framework for consistent modelling of energy spots, forwards and swaps is better for energy risk management, says Verbund Austrian Power Trading’s principal quantitative analyst

Special video report: regulatory strategies from chief risk officers

With regulatory changes and new markets impacting the energy and commodities markets, Lianna Brinded files this exclusive special video report showcasing the views of leading risk managers and quantitative analysts on how to tackle these challenges

New dynamic risk measure launched

Tool can capture the time evolution of market risk for energy and commodity-linked positions

Energy Risk Asia 2010 conference

With global regulation changes causing market concern and businesses tipped to move to Asia seen by analysts as a beacon of supply and demand growth, this year's Energy Risk Asia conference in Singapore couldn’t have come at a better time

Upturn predicted for physical energy trading

Trade flow likely to move to physical markets due to new derivatives rules, experts say

Video: Trayport MD on OTC markets moving to Asia

Elliott Piggott, managing director at technology provider Trayport, speaks to Lianna Brinded about why he sees the over-the-counter derivatives market moving to Asia

Energy markets are top EU priority says EC's Lowe

As Europe's energy risk managers outline their regulatory risk concerns, the European Commission's Philip Lowe looks to reassure the market