Dodd-Frank Act

Shell Energy chief calls for regulatory data confidentiality rules

The confidentiality of energy trading data provided to regulators for market monitoring purposes continues to concern market players and regulators alike, after August leak by senator Sanders

The evolving credit function

The role of the credit function at energy companies is likely to change enormously in the coming months. Are companies ready and how will the changes impact the risk management function? Anna Reitman and Pauline McCallion report

Profile: Cadwalader's Gregory Mocek

Former US CFTC director of enforcement, Gregory Mocek, speaks to Pauline McCallion about the new regulatory environment and his lifelong interest in commodities

Special report: ETRM technology

Our special report for August is on the topic of energy trading and risk management (ETRM) software and technology.

US power bodies call for clarity on Dodd-Frank “swap” definition

More guidance is needed from the CFTC on the definition of a swap, according to Ferc and other industry associations concerned about regulatory overlap

Regulator strengthens enforcement authority

CFTC finalises new Dodd-Frank anti-manipulation rule but energy experts continue to question its value

Q&A – CFTC's Scott O'Malia

CFTC Commissioner Scott O’Malia shares his views with Ned Molloy on, amongst other things, systemic risk, position limits, the use of non-cash collateral and the jurisdictions of the CFTC and FERC

Energy experts eye Dodd-Frank tech benefits

Data reporting systems may be far from Dodd-Frank friendly in the energy sector, but experts say users are likely to benefit once they are up and running

Dodd-Frank ready? Structure's Huxtable

More than 75% of energy companies are in “wait-and-see” mode or still assessing how Dodd-Frank regulation will affect their business, according to The Structure Group's Leonard Huxtable

CFTC to provide Dodd-Frank deadline exemptions today

Dodd-Frank deadline exemptions should limit market disruption, but more clarity on rules and timings needed, says CFTC commissioner Scott O’Malia

Energy Risk USA - 2011 conference highlights

The 2011 Energy Risk USA conference in Houston provided the chance to interact with industry peers and hear about the latest energy market developments.Ned Molloy and Pauline McCallion report

Dodd-Frank: Summary of rule-making progress so far

As regulators approach the end of the Dodd-Frank rule-making period, Energy Risk details the proposals so far and considers what lies ahead for the new regulatory regime. By Peter Madigan with additional reporting by Pauline McCallion

Dodd-Frank puts market manipulation on the radar

Dodd-Frank regulation could usher in more market manipulation cases such as the recent CFTC case against Arcadia Petroleum, Arcadia Energy and Parnon Energy, say market experts

Energy Risk USA: could anti-manipulation rule curb energy activity?

Dodd-Frank manipulation rules could “chill” energy market and boost regulatory infrastructure costs: ER USA panel

Energy companies warned on end-user status

Energy Risk USA speakers concerned about reliance on end-user status; urge energy companies to begin Dodd-Frank compliance planning

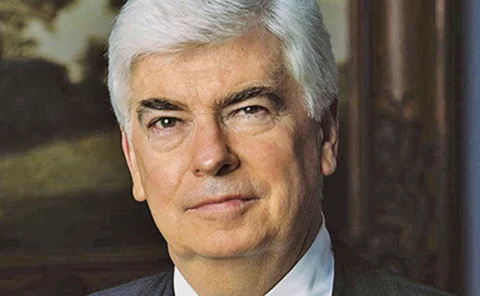

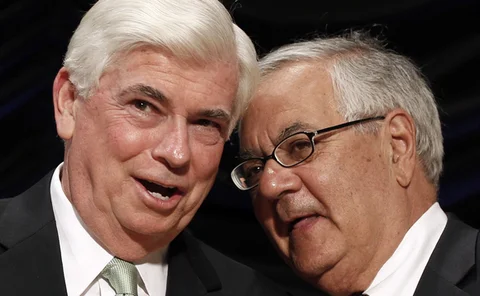

Dodd questions restricting collateral to cash

Co-author of the Dodd-Frank Act shares concerns of energy companies that wish to post non-cash collateral to meet new requirements

Trend towards in-house clearing could increase fees and admin

The LME is the latest exchange considering whether to build its own clearing business. If the trend continues, banks could face more fees and administration

Will ruling create agreement on regulatory jurisdiction?

The FERC’s $30m fine for former a Amaranth trader has set a strong precedent for market manipulation cases, but regulatory overall jurisdiction remains unclear. Pauline McCallion reports

CFTC regulators favour extending Dodd-Frank comment period

CFTC cost and timing concerns continue; FTRs and commodity forwards exempted from swaps definition

Widespread unease over planned position limits rules

Reservations remain among firms involved in commodity trading about a new position limits regime that could be implemented under the Dodd-Frank Wall Street Reform Act, while support continues from anti-speculation campaigners

Position limits deluge continues

Group bombards CFTC with comments on Dodd-Frank position limits; final rule delay expected; quantity unlikely to trump quality says expert

Special report – Weighing up Dodd-Frank

What will impending regulation under the Dodd-Frank Act mean for the energy sector? Our US editor, Pauline McCallion puts the question to leading industry participants