Credit markets

UK first in Europe to conduct Phase II carbon credit auction

The UK will be the first country in Europe to hold a carbon credit auction under phase II of the European Union Emissions Trading Scheme (EU ETS), the government announced today.

Bank of America buys Merrill Lynch for $50 billion

Bank of America announced today it will acquire Merrill Lynch in a $50 billion all-stock deal, rounding off an explosive weekend on Wall Street.

Bank of America buys Merrill Lynch for $50 billion

Bank of America announced today it will acquire Merrill Lynch in a $50 billion all-stock deal, rounding off an explosive weekend on Wall Street.

RGGI futures competition hots up

As the fledgling US Regional Greenhouse Gas Initiative finds its feet, is there sufficient liquidity for two exchange-traded futures contracts? Katie Holliday finds out. Additional reporting by Roderick Bruce

World Energy to host RGGI carbon allowance auction

US online exchange operator World Energy has signed a contract with RGGI Inc – an administrative subsidiary of the Regional Greenhouse Gas Initiative (RGGI) – to host its first auction for regional carbon dioxide (CO2) allowances.

Utilities seek new credit structures

As US utilities bail out of the auction market, they are turning to enhanced credit structures to refinance bond issues. Catherine Lacoursiere reports

Suppliers fight for green

A shortage of green power in the US has left some states struggling to meet mandatory renewables supply targets. Long-term supply contracts could help producers build new plants, but utilities and competitive suppliers are feuding over who gets to sign…

Evolution expands into global merchant banking

Evolution Markets Financial Services, a subsidiary of environmental market brokerage Evolution Markets, is set to expand its range of activities across global merchant banking within the environmental, energy and clean energy sectors.

Up in the air

Rising wind power prices are encouraging US producers to turn to the short-term and spot electricity markets. Increasingly sophisticated risk management techniques may follow. David Watkins reports

Survey reveals major energy buyers’ views and strategies

A pan-European price forecasting survey of 100 major energy users has revealed that only two fifths of respondents had a risk management policy - seen as essential when developing an energy procurement strategy.

Swiss Re closes European Clean Energy Fund

Global reinsurer Swiss Re has announced the successful close of the European Clean Energy Fund, one of the largest funds of this type in Europe.

Correlation and credit VAR

Navneet Arora and Shisheng Qu show that credit VAR in commodity trading is affected not only by the inherent credit risks of counterparties, but also by various correlations among counterparties and between counterparties and commodity prices

Western congestion

Despite huge strides to improve power transmission efficiency in California since 2001, the region is still flagged a 'critical congestion area' by the US Department of Energy. Neil O'Hara looks at the state of play

Buyout creates largest US independent power transmission co

Michigan Electric Transmission Company has been acquired by ITC Holdings in an $865 million deal which creates the largest independent electricity transmission company in the United States , based on transmission load served.

Credit - Energising credit

Traditional credit instruments can be used to mitigate credit risk in the energy sector, despite the unique risk management challenges, says Chris Coovrey

Refco raises further concerns

As the Refco bankruptcy case rumbles on, investors are wondering if more could have been done to prevent it, and in future, are likely to seek better assurances over the security of funds in segregated customer accounts

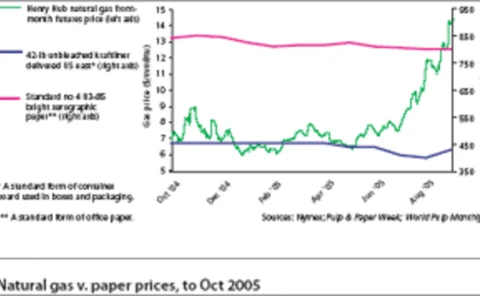

Papering over the cracks

High energy prices are forcing pulp-and-paper makers to take action against falling profits, yet most companies are still shying away from energy price hedging. But that situation may be slowly changing. Joe Marsh reports