Carbon risk

Merrill Lynch launches carbon certificate

Investment bank Merrill Lynch today launched an index-based investment certificate that offers protected exposure to the stocks of carbon efficient European companies.

Carbon complexities

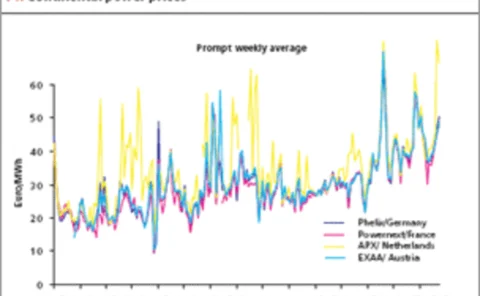

The EU ETS adds price complexity to European energy markets and the trend towards pan-European markets means far more complex models will be needed to model carbon risk, writes Bjorn Brochmann

King coal still fired up

Despite the soaring cost of emissions reduction credits, the EU emissions trading scheme has yet to dampen utilities’ demand for coal. But, finds Oliver Holtaway, it may affect their long-term investment decisions

Swiss Re to launch emissions desk

Global reinsurance firm Swiss Re will set up an emissions desk in within a month, says Chris Walker, New York-based managing director of the greenhouse gas risk solutions team at the company.

US coal trading picks up steam

While the coal market awaits pricing indexes to reinvigorate trading, emissions trading is getting a boost from increased coal burning. Catherine Lacoursière reports

US pushes agreement on carbon storage research

The US government has launched an international research and development programme to reduce power plant emissions by pumping carbon dioxide (CO2) into deep storage.

Carbon across Europe

Pan-European emissions trading is a step closer after agreement of an EU directive. Atle Christiansen and Kristian Tangen of Point Carbon look at the consequences

Between Kyoto and the caribou

Ratification of the Kyoto Protocol on climate change is unlikely to have an effect on the burgeoning Canadian oil and gas sector, as Maria Kielmas discovers

Green risks for the black stuff

The impact of environmental risk on oil companies may be substantial, says a new report by the World Resources Institute. What will the effect be on the oil majors’ stock prices? James Ockenden reviews the report