Carbon pricing

Auctioning - Carbon under the hammer

As the EU emissions trading scheme gears up for its second phase, countries are deciding how much of their allocations will be auctioned. Oliver Holtaway reports

US emissions - State of play

Point Carbon's Veronique Bugnion takes a look at the scope and timeline for the carbon emission cap-and-trade programmes on the drawing board in the US

Burying a problem

As North American power generators prepare for a carbon-constrained world, new coal plants are being built with the option of installing carbon capture and storage technology. And the economics could be about to improve, finds Catherine Lacoursiere

Knowledge is power

The first year of European carbon trading came to a bumpy end in May. But now the market finally has hard data about emissions, the ride should get smoother. Oliver Holtaway reports

Survey - Positive feedback

Energy Risk's second annual emissions survey charts the development of emissions trading in Europe since the start of the European Union Emissions Trading Scheme a year ago

Price drivers - Policy fears in EU ETS

Developments in 2005 have shown that the EU ETS price has been correlated to relative fuel prices and weather. However, there are still remaining policy issues that could greatly influence prices, writes Henrik Hasselknippe and Kjetil Roine from Point…

The windfall dilemma

Free allocations of emission allowances may keep fossil fuel generators happy, but their customers are not smiling. Tobias Hsieh, credit analyst with ratings agency Standard & Poor's, explains who wins and loses under the trading rules

2005 in review

The energy markets were a dynamic place to be in 2005, with high volatility and an explosion of new players hitting the scene. Inevitably, though, it wasn't all smooth sailing. Energy Risk looks back over the highs and lows of 2005, from the launch of…

Off to a flying start

Aviation is one of the fastest growing sectors in terms of carbon emissions, but a move by the European Commission to include airlines in the EU's Emissions Trading Scheme has alarmed some in the industry

Carbon complexities

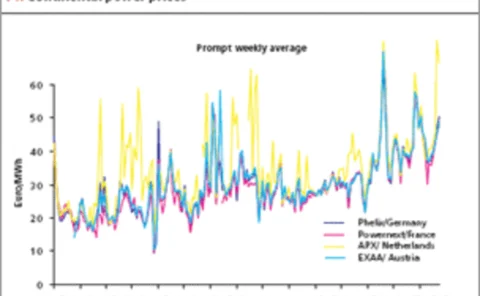

The EU ETS adds price complexity to European energy markets and the trend towards pan-European markets means far more complex models will be needed to model carbon risk, writes Bjorn Brochmann

King coal still fired up

Despite the soaring cost of emissions reduction credits, the EU emissions trading scheme has yet to dampen utilities’ demand for coal. But, finds Oliver Holtaway, it may affect their long-term investment decisions

The cost of power

The market in European Union emissions allowances is taking off, largely thanks to Nord Pool

Barclays Capital in first Leba carbon index trade

Barclays Capital has completed the first financial carbon trade using the new Leba Carbon Index for "a significant volume" of EU emissions allowances.

Carbon copycats

The EU emissions trading scheme, which started in January this year, is already attracting the attention of hedge funds, who see opportunities in this developing and less crowded market, finds Solomon Teague

Clearer signals ahead

Estimating CO2 prices in the first Kyoto budget period of 2008–2012 is now a key risk-management challenge for utility analysts. Abyd Karmali, Sebastian Foot and Nazim Osmancik look at what is likely to drive prices in this period

Signs of the times

A comprehensive Energy Risk survey into emissions trading finds there is widespread confidence in the development of the market, but less conviction that the scheme will tackle global warming. Stella Farrington reports

IPE-ECX carbon futures contract faces fierce competition

London’s International Petroleum Exchange (IPE) and the Amsterdam-based European Climate Exchange (ECX) are set to offer CO 2 futures contracts under the EU Emissions Trading Scheme (ETS).

A shift in perspective

As far as the electricity market is concerned, the EU emissions trading scheme is aimed only at the generation side of the market. But end users also affect carbon emissions levels. This could represent a missed opportunity. Here, Oliver Rix, Phil Grant…

Greenpeace protest at IPE fuels debate on emissions trading

Greenpeace’s invasion of London’s International Petroleum Exchange (IPE) on Wednesday was intended to draw attention to the environmental impact of ‘big oil’ on the day the Kyoto Protocol came into force. However, by attacking an exchange that is about…

UK broker trade group to launch emissions indexes

The London Energy Brokers’ Association (Leba) will launch a series of ‘green indices’, which it says are designed as independent benchmarks for the European emissions market. The association will release both spot and forward indexes, with the aim of…