Feature

Taking a health check

When global economic recovery eventually takes place, it is essential energy trading organisations are in a position to capitalise on market changes. Julie Shochat and Ryan Rogers of Enite set out some guidelines

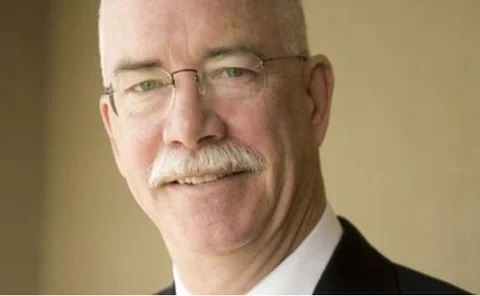

Power adaptor

Alpiq Group was created at the beginning of 2009 as a result of the merger of Swiss utilities Atel and EOS. Peter Heydecker, head of trading and services, talks to Rachel Morison about Alpiq’s culture and presence in European power markets

Too much of a good thing

The price of US natural gas has hit record lows, but with storage fit to burst and demand in the doldrums, any hope of a price pick-up may remain a pipe dream for now, writes Pauline McCallion

Get ready for the revolution

Global events and climate change have fundamentally changed the face of energy procurement. Chris Bowden of Utilyx looks at the issues facing energy-intensive businesses in the UK

Building demand

One year after the collapse of Lehmans, fundamentals for the energy and metals markets continue to evolve, with emerging market demand, especially from China, set to have an increasing impact. Pauline McCallion discusses the outlook with experts

Energy Risk -- New Website Video

Energy Risk editor Stella Farrington discusses the magazine's new online portal, and its benefits for the Energy Risk community.

Realising operational efficiency

Energy trading companies face special challenges in running automated and efficient operations due to the rapid rate of change endemic to markets. David Foti presents principles that can drive efficiency

Bright futures

Hong Kong Mercantile Exchange (HKMEx) aims to become Asia’s leading commodity exchange. Roderick Bruce discusses the new venture with HKMEx president Albert Helmig, a 35-year commodity market veteran.

Umbrella coverage

Pauline McCallion investigates the budding opportunities for managing weather risk in the renewable energy sector.

Green shoots

Will the US Department of Energy's stimulus funding provide the financing required by the renewable energy sector?

Flying into a storm

Extreme volatility in oil markets has caused hundreds of millions of dollars in losses on airline fuel hedges. At the same time, burgeoning margin calls have forced some to get creative with collateral agreements. How is the airline industry adapting? By…

Green skies ahead?

Biofuels could become part of the jet-fuel blend in as little as two years and ready for large-scale use by 2015, say experts. Katie Holliday talks to airlines, biofuels experts and carbon traders about the implications for the jet fuel market.

Steering out of turbulence

In recent months, Germany's national carrier Lufthansa has faced one of the most challenging operating environments in its history. Its fuel hedging team has played an important role in navigating the firm through turbulent markets, finds Roderick Bruce

Dry bulk market's revival

The dry bulk freight market is showing increasing volatility after slumping earlier in the year. Peter Norfolk of SSY looks at the reasons why

Could energy follow finance into meltdown?

Energy companies aspiring to gain Tier I status have long emulated the banking model, in which trading is the repository for pricing and the management of market risk. In light of what has happened to many banks, should energy companies be adopting this…

Optimisation through a component framework

Implementing the most suitable ETRM software for has become increasingly daunting. Paul McLean-Thorne and Tim Hughes investigate

Power plant Greeks

The computation of the price sensitivities - otherwise known as the Greeks - of a power plant is essential for proper hedging and risk management. However, due to the complexity and difficulty involved in the modelling of generation characteristics and…

A seagull's-eye view

US offshore energy could receive a boost from a newly announced US Federal regulatory scheme. Gregory Lawrence, Mustafa Ostrander and Stephen Smith of McDermott Will & Emery outline the programme

Painful mistakes

The use of spreadsheets remains widespread in the energy trading sector, but the risks are high. Pauline McCallion looks at how these traps can be avoided

All for one

The Waxman-Markey Bill brought the US a step closer to establishing a federal mandate for renewable energy generation. Pauline McCallion looks at the implications for renewable energy credits trading