Risk management

Libya and beyond: legal implications of force majeure

Civil unrest in Libya continues to have a major impact on commodity traders with interests in the country. Andrew Ridings and Darren Wall discuss the issues facing traders and examine the legal implications

Energy Risk USA - 2011 conference highlights

The 2011 Energy Risk USA conference in Houston provided the chance to interact with industry peers and hear about the latest energy market developments.Ned Molloy and Pauline McCallion report

Turning points: Duke Energy’s CRO, Swati Daji

Nothing creates a good risk officer like challenging times, says Duke Energy’s CRO, Swati Daji. She talks to Pauline McCallion about managing risks through both the good and the bad

Dodd-Frank puts market manipulation on the radar

Dodd-Frank regulation could usher in more market manipulation cases such as the recent CFTC case against Arcadia Petroleum, Arcadia Energy and Parnon Energy, say market experts

Trend towards in-house clearing could increase fees and admin

The LME is the latest exchange considering whether to build its own clearing business. If the trend continues, banks could face more fees and administration

GDF Suez chooses bank status for new trading arm

European energy giant GDF Suez this week launched a new trading unit, choosing to obtain bank status that prepares it for potentially tougher European regulation of commodity trading

Trading positions - May 2011

Energy Risk catches up with the latest appointments, promotions and departures in global commodity markets

Profile: Diana Higgins, Director Crediten

Assessing counterparty credit can require the skills of a private detective, says Diana Higgins, talking to Stella Farrington about her credit risk career and the changing role of the credit function

Sponsored Q&A: Accenture Risk Management

The Federal Energy Regulatory Commission (FERC) Orders will dictate change in the wholesale electricity markets this year, requiring all regional transmission organisations, independent system operators and participants to respond. Executive Director at…

Sponsored Q&A: LIM

The nature of data delivery has changed in recent years and prompted data management companies to offer more flexible delivery options in order to stay competitive. LIM, a Morningstar company, is developing its technological capabilities to provide a…

Q&A: Tony Hall at Duet Commodities Fund

After turning one of the highest proprietary trading profits in the history of Credit Suisse Commodities in 2009, Tony Hall launched hedge fund Duet Commodities Fund last year. He will be delivering the keynote talk at Energy Risk’s Commodities and…

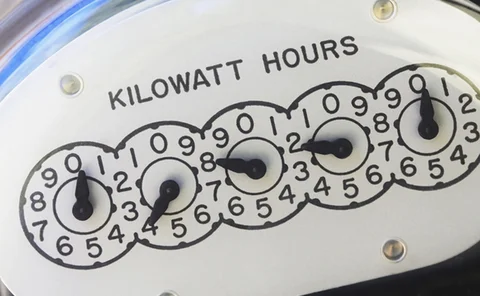

Can electricity demand response replace hedging?

How will greater use of demand response affect risk managers in the power sector? Pauline McCallion asks the experts

Q&A: Derren Geiger, chief operating officer of Caritas Royalty Funds

Derren Geiger, chief operating officer of the energy-focused Caritas Royalty Funds, speaks to Pauline McCallion about managing risks in a rising oil and gas price environment

Valuing non-standard load profile products

Load profile products in the European OTC power markets are attracting increasing attention. However, valuations for these non-standard products can be difficult, as Cregor Janssen and Jan Lueddeke discuss

SMX chief resigns, will stay on advisory board

Thomas McMahon, chief executive of the Singapore Mercantile Exchange (SMX) resigned over the weekend

Commodity prices seen as greatest threat to recovery: poll

Rising commodity prices pose the biggest risk to recovery after the 2008 global financial crisis, according to a risk.net poll

CME Group's Raia joins Goldman Sachs

Joseph Raia today started working at Goldman Sachs, after announcing his resignation as CME Group's managing director for energy and metals marketing at the beginning of the month

E.ON Energy Trading

As a market leader, E.ON Energy Trading optimises and manages commodity risk for Europe’s broadest and most diverse power and gas asset base, and is committed to supporting the development of more open, competitive energy markets

Coal prices rise on back of Japanese disaster and Queensland flooding

Coal prices rise as Latin America and South Africa prepare to export to Asia following the Fukushima disaster and disruptions in supplies from Australia as a result of the Queensland flooding

Slow recovery likely for freight derivatives amid low market rates

An overabundance of dry-bulk vessels ordered before the financial crisis now coming on line is weighing on the freight market and freight rates. Alex Davis looks at how freight derivatives demand will cope during what many expect will be a sustained…

Energy Risk - Rankings reception

Photo highlights from Energy Risk’s Software and Commodity Rankings cocktail reception, held in London on February 24, 2011

Collateral management: Firms face up to regulatory challenge

Collateral management has become an increasingly complex and vital component of credit risk management for the energy sector. With the EU considering reforming commodity derivative regulation, Alex Davis looks at the latest developments and examines…

Q&A: Kaha Kiknavelidze, managing partner at hedge fund Rioni Capital

With the oil & gas industry going through major changes from pricing to regulation, Lianna Brinded talks to Kaha Kiknavelidze of Rioni Capital about oil & gas opportunities