Energy Risk Software Rankings 2024: IT demands increase amid rising risk

Heightened geopolitical and credit risk increase requirements on commodities software

While most commodity markets last year did not experience the eye-watering price spikes of 2022, it was still a challenging year for risk management teams. Geopolitics and physical supply disruptions caused bursts of volatility, while economic woes and falling prices added to credit concerns.

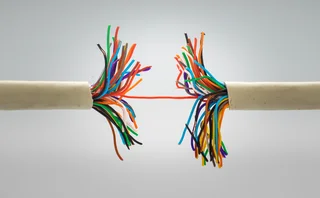

Additionally, the new paradigm of stubborn inflation and higher interest rates meant that tried and tested models needed some major overhauling and new models or components had to be built. This required not only good data and forecasting tools, but systems with excellent integration capabilities.

As commodity prices pinballed between the bullish forces of geopolitical tensions and bearish economic concerns, it was vital for firms to have excellent visibility and understanding of their positions and risk exposures. Having the right tools to manage and mitigate these exposures was essential.

Furthermore, as well as being able to cope with bouts of choppiness, it was important to factor in the impact of secular trends such as climate risk and the advance of artificial intelligence. This potentially requires new thinking around data gathering, analysis and the software systems being used, to ensure firms have the most robust, integrated system for analysing and forecasting risk holistically not just in realtime but years into the future.

Energy Risk’s annual Software Rankings survey indicates which commodities software firms were considered the most proficient across a variety of different areas in the commodities landscape during 2023. In the survey – now in its 19th year – participants voted for their preferred commodities software vendors, data management firms and implementation specialists. The poll covers commodity trading and risk managment software, enterprise risk systems, trading platforms, data firms and technology advisory.

This year included a new section in which respondents indicated which firms they considered best for certain sought-after qualities such as understanding client needs, ease of implementation, integration, creativity and innovation, customer support and market knowledge.

To see the Software Rankings tables in full, click here.

Methodology

The survey went live on November 14, 2023 and closed on February 12, 2024. It received 630 valid responses. To compile the Software Rankings, respondents were asked to vote for their preferred software vendor, data management firm, data provider and technology adviser in a variety of categories. All votes were carefully checked and invalid votes stripped out. Examples of votes considered invalid are people voting for their own firm or using a free internet-based email address, multiple votes from the same person or IP address, and voters who choose the same firm indiscriminately throughout the survey.

Following closure of the poll, the results are subject to an internal review process, which can result in categories being dropped if they do not have enough votes. The outcome of the review is final.

More on Risk management

Energy firms revisit CTRM systems as tech advances

Energy executives mull how to tap into the explosion of new technologies entering the risk space, but systems selection must consider future business needs, writes Yefreed Ditta at Value Creed

CRO interview: Brett Humphreys

Brett Humphreys is head of risk management at environmental markets specialist Karbone. He talks to Energy Risk about the challenges of modelling outcomes in unpredictable times and how he’s approaching the risks at the top of his risk register

How geopolitical risk turned into a systemic stress test

Conflict over resources is reshaping markets in a way that goes beyond occasional risk premia

Energy Risk Debates: the influence of risk culture

The panellists examine different risk cultures and discuss the risk manager’s role and influence in creating a risk culture

Energy Risk reaction: Venezuela and oil sanctions

Energy Risk talks to Rob McLeod at Hartree Partners about the energy risk implications of the US’s control of Venezuelan oil

CRO interview: Shawnie McBride

NRG’s chief risk officer Shawnie McBride discusses the challenges of increasingly interconnected risks, fostering a risk culture and her most useful working habits

Increasingly interconnected risks require unified risk management

Operational risk is on the rise according to a Moody's survey, making unified risk management vital, say Sapna Amlani and Stephen Golliker

Energy Risk Europe Leaders’ Network: geopolitical risk

Energy Risk’s European Leaders’ Network had its first meeting in November to discuss the risks posed to energy firms by recent geopolitical developments