Regulation

Energy firms face “crunch time” for accounting compliance

Professional services firm PricewaterhouseCoopers (PwC) says time is running out for energy and utility companies to get to grips with the pending implementation of the International Financial Reporting Standards (IFRS).

People swaps

Buchanan appointed Ofgem chief executive UK energy regulator the Office of Gas and Electricity Markets (Ofgem) has appointed Alistair Buchanan as chief executive. Previously head of European utilities research at Dutch bank ABN Amro, Buchanan (pictured)…

Operational and market risks of a regulated power utility

Victor Dvortsov and Ken Dragoon present an analytical method for including market and operational risks when estimating utility portfolio value-at-risk

Measuring the value of clearing

Central clearing houses offer major advantages to the electricity trading industry, says UK Power Exchange’s Paul Danielsen. He sets out a practical example to demonstrate how UK power firms can benefit from clearing

Barrier to entry

Bank of America and UBS are still trying to overcome obstacles that could prevent them entering physical power trading in the US. Federal Energy Regulatory Commission regulations represent the biggest obstacle. Paul Lyon reports

US body calls for electricity reliability organisation

The Edison Electric Institute (EEI) says the creation of an electricity reliability organisation with regulatory oversight is vital for developing and enforcing mandatory reliability rules and standards for US power sector participants.

Water faces rising costs

UK water utilities are expecting rising electricity and environmental costs as they and their regulator prepare for the next five-year price review. Maria Kielmas reports

A hard Act to follow

The final piece of the Sarbanes-Oxley Act – section 404 – falls into place this month, requiring internal control reports. While the Act may go some way to restoring investor confidence, it is costing energy companies dear, finds Kevin Foster

System-ready for Sarbanes-Oxley

Energy companies are not alone in having to review their operations to comply with the Sarbanes-Oxley Act. Energy software suppliers, too, are looking at their systems, although most are confident they are already well prepared, finds Clive Davidson

Deregulation versus re-regulation

While the US authorities are still ironing kinks out of a major electricity market redesign and looking to repeal the utility industry’s most influential Act, US regulators and self regulators are moving to fill the vacuum. Catherine Lacoursière reports

The derivatives burden

Former International Petroleum Exchange official Chris Cook looks at the issues raised at a debate on the future of the European energy markets at the end of London’s Derivatives Week event. The regulatory burden on firms took centre stage

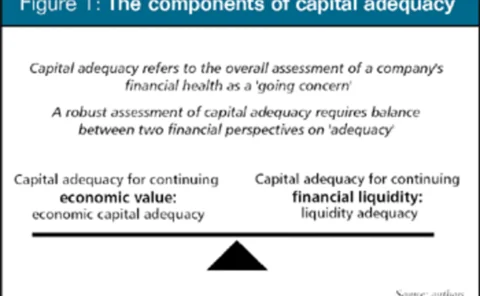

A capital adequacy primer

A summary of the Committee of Chief Risk Officers’ (CCRO) emerging guidelines on capital adequacy, by Cinergy’s Antonio Ligeralde, Kenneth Robinson of El Paso Merchant Energy and CCRO head Michael Smith

Emerging adequacy

The Committee of Chief Risk Officers’ capital adequacy ‘emerging practice’ guidelines will, says the capital adequacy committee chair, evolve into a new regulatory body within a year. James Ockenden reports

Vince Kaminski

Vince Kaminski has returned home – both to his home town of Houston, and to an asset-based energy company – after a year with financial trader Citadel Investments in Chicago.

Ferc’s California clean-up

Sixty energy firms and utilities will have to justify their activities during the California energy crisis, the Federal Energy Regulatory Commission (Ferc) said in its regular bi-weekly meeting on June 25.

Ferc executes already dead Enron

Enron became the first company to face the Federal Energy Regulatory Commission’s (Ferc) “death penalty” in June when the US energy regulator revoked the bankrupt firm’s authority to sell electricity at market-based rates.

Teething problems in Texas

Advocates of retail electricity deregulation cite Texas as evidence that competitioncan succeed. But big risks remain for power marketers, finds Kevin Foster

End of the road for California?

A bill aiming to re-regulate the California energy sector is progressing through the state’s legislature. Does this spell the end for California’s troubled experiment with deregulation? Kevin Foster finds market participants split over the issue

More power to the banks

Banks now have greater freedom to participate in derivatives markets based on physical commodities thanks to two recent ruling by US regulators. As a result, the balance of power looks set to shift from Houston to New York. By Paul Lyon

The cost of deregulation

US electricity deregulation does not necessarily make prices more competitive, as is shown in this study of New England power prices by Logical Information Machines

How to run a market

Former-derivatives-trader-turned-author Frank Partnoy wants to see tougher accounting standards and risk disclosures to deter corporate crooks. But are the regulators listening? Maria Kielmas reports

Seeking an end to manipulation

Renewed allegations of manipulation of natural gas pipeline capacity in the US have been partly blamed on regulatory complacency. How can regulators put an end to the problems dogging the gas markets? Catherine Lacoursière reports

Tough talk on derivatives

The Commodity Futures Trading Commission and Ferc are getting tough in throwing fines around. Is this a ploy to avoid being lumbered with further over-the-counter regulatory responsibilities? Some market participants certainly think so. By Paul Lyon

Wanted: cash for new lines

Can Ferc’s standard market design encourage much-needed investment in the US power grid and develop a merchant model for transmission assets? By Kevin Foster