New York Mercantile Exchange (Nymex)

Iran sets out mixed energy plan 2010/2011

Iran’s national budget for 2010/2011 will be less reliant on oil revenues but will still reveal "good news" on oil production of 20% enriched fuel in February this year, says Iranian president Mahmoud Ahmadinejad, in a move aimed at making the state less…

EIA: World will be more dependent on Opec oil

The world will become more dependent on Organization of the Petroleum Exporting Countries (Opec) oil by the start of 2011, following sustained surplus production capacity and a forecasted decline in growth from countries outside the producer group, says…

Russia/Belarus crisis not expected to affect oil market in the longer term

Russia’s halt in crude oil supplies to Belarus, which is providing some support to the oil complex today (January 4), is not expected to have a big impact on the global market, say analysts.

UPDATED: Nymex follows Saudi sour crude endorsement with new contracts

Nymex is to launch two sour crude oil contracts after Saudi Aramco’s announcement this week that it will use the Argus Sour Crude Index (ASCI) as a benchmark for US sales from January 2010.

Movers & shakers

As part of our 15th Anniversary, Energy Risk rounds up 15 of the most influential and innovative companies currently active in the traded energy markets and profiles their achievements

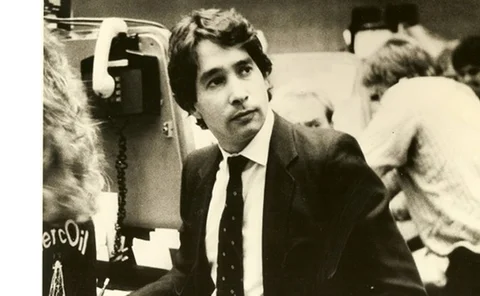

Full marks

Michel Marks, former chairman and board member of Nymex, tells Roderick Bruce about his role in taking the exchange from small potatoes to a cross-commodity powerhouse

Making markets

In the first of two articles tracing the beginnings of energy derivatives, Roderick Bruce talks to oil trading pioneers about the market’s formative years

All Clear?

Despite a recent large increase in volumes, clearing for commodities remains a contentious issue, with little agreement on what the best business model should be, and insufficient standardisation, say market participants. Rachel Morison investigates

Refiners feel the squeeze

While crude oil prices have undergone a 70% decline since July, gasoline has dropped by 75%, taking the crack spread into negative territory. Eric Fishhaut of GlobalView Software looks at this unusual phenomenon

A dark futurefor clearing

Clearing was the energy buzz word of early 2003. But as Clearing Bank Hannover goes into liquidation and the future of EnergyClear’s business remains uncertain, it seems energy clearing has lost its appeal. By Paul Lyon

Refining systems for oil trading

The increasing complexity of the crude oil business – on both the physical and financial side – means companies in the sector need fast-changingand flexible software to manage their operations. CliveDavidson reports

Profiting from gas prices

Rachel Jacobson of energy information and software provider Fame looks at how natural gas prices are likely to rise and what firms can do to protect against them

Eyeing the pricing

US energy regulators are keeping an ever-more-watchful eye on gas and power price reporting – but are they finally flexing their muscles appropriately? Paul Lyon reports

The great gas price divide

US natural gas prices may be volatile, but is there a real need to worry? Some participants blame the New York Mercantile Exchange for price spikes and worry about the future, while others see no problem with the market’s health. By Paul Lyon

Online clearing: the shape of energy markets to come

The energy trading market is moving towards a structure in which participants achieve market presence through a dedicated market network, rather than having to use local or regional exchanges, says strategic consultant Chris Cook

Playing a waiting game

With energy – and particularly natural gas – costs on the rise, are end-users finally coming to terms with the importance of hedging or are they still waiting to get burned before they enter the hedging market? Kevin Foster reports

US energy prices: in line for a fall?

A combination of concerns in the second half of January 2003 has boosted US oil and natural gas prices to levels not seen since the winter of 2000/2001. Will the higher prices stick? Logical Information Machines examines cause and effect

Blurring the lines

A turf war between Atlanta’s IntercontinentalExchange and the New York Mercantile Exchange reveals a shift in the traditional role of over-the-counter brokers and exchanges, finds Catherine Lacoursière

Crude oil takes a double hit

Mark Powell of GlobalView Software looks at how crude prices are being affected by the impending war with Iraq and the general strike in Venezuela

US gas market challenges

A new report from the investigative office of the Federal Energy Regulatory Commission finds that competitive natural gas markets in the US are robust, but warns of challenges ahead. Kevin Foster reports

Exchanging blows

Conflict in the US and growth in Europe marked another turbulent year for energy exchanges. Kevin Foster casts an eye back over 2002

Standardising electricity contracts

Electricity contracts have come and gone, but a new trio of financially settled futures contracts aims to widen the electricity market, reports James Ockenden